- United States

- /

- Oil and Gas

- /

- NYSE:WES

How Western Midstream’s Rising Gas Throughput and Earnings May Impact WES Investors

Reviewed by Sasha Jovanovic

- Western Midstream Partners, LP recently announced its third-quarter 2025 results, reporting natural-gas throughput of 5.4 Bcf/d, a 2% sequential increase, with quarterly revenue of US$952.48 million and net income of US$331.73 million, both higher than a year ago.

- An interesting detail is that while natural-gas throughput increased, crude-oil and NGLs throughput fell 4% and produced-water volumes remained flat, indicating shifting operational dynamics within the company's core business segments.

- We'll explore how Western Midstream’s quarterly revenue and net income growth may shape its investment outlook going forward.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Western Midstream Partners Investment Narrative Recap

To invest in Western Midstream Partners, you have to believe in the ongoing strength of US energy infrastructure and the company’s ability to turn expanding natural gas volumes into sustainable earnings. The latest results, highlighting revenue and net income growth, provide reassurance on short-term performance, though the sequential drop in crude oil and NGLs throughput presents a minor signal rather than a material catalyst or risk shift at this stage.

The company’s decision to maintain its quarterly distribution at US$0.910 per unit, consistent with prior periods, stands out because it suggests management is prioritizing stability for unitholders during a period of mixed throughput trends, offering no direct change to either growth catalysts or risks based on these operating results.

However, for investors, it is important to keep in mind that significant capital expenditure commitments for projects like Pathfinder and North Loving II could challenge returns if...

Read the full narrative on Western Midstream Partners (it's free!)

Western Midstream Partners' outlook anticipates $4.5 billion in revenue and $1.7 billion in earnings by 2028. This reflects a projected annual revenue growth rate of 7.1% and an earnings increase of $0.5 billion from the current $1.2 billion.

Uncover how Western Midstream Partners' forecasts yield a $40.83 fair value, a 6% upside to its current price.

Exploring Other Perspectives

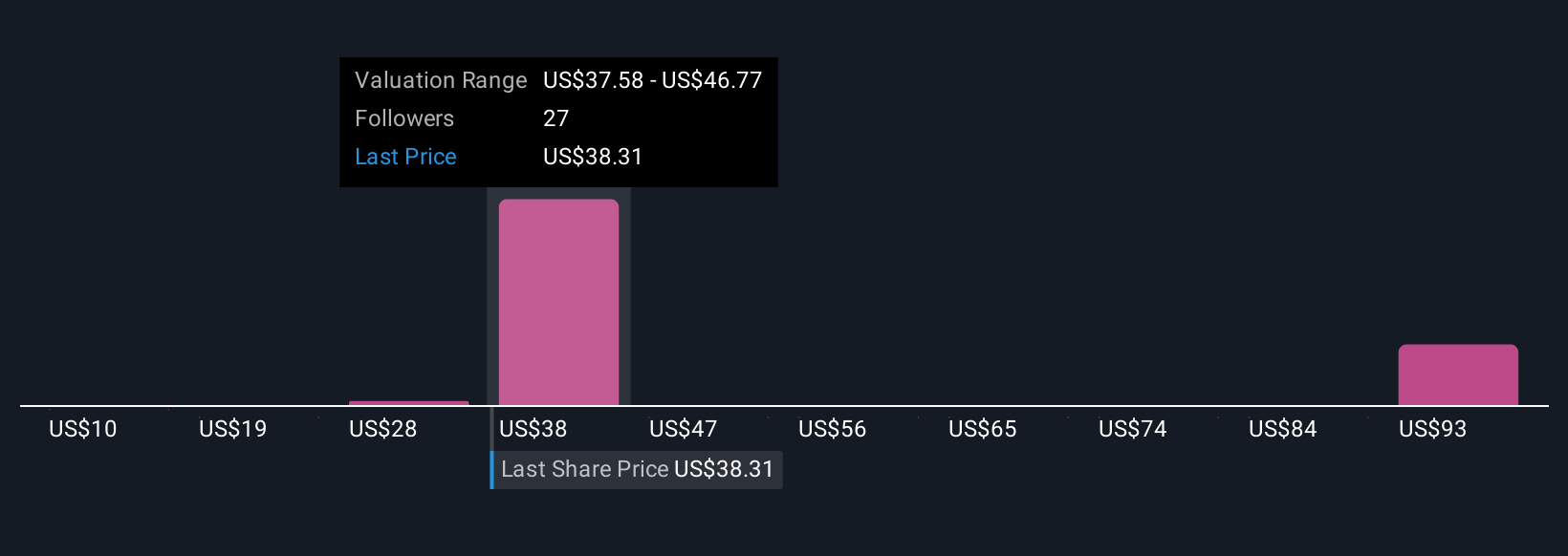

Five fair value estimates from the Simply Wall St Community range from US$10 to US$112.68 per unit, showing dramatically different views. While some see strong long-term growth tied to US energy demand, others highlight that Western Midstream's heavy capital investments may elevate future financial risk if hydrocarbon demand falters.

Explore 5 other fair value estimates on Western Midstream Partners - why the stock might be worth over 2x more than the current price!

Build Your Own Western Midstream Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Midstream Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Western Midstream Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Midstream Partners' overall financial health at a glance.

No Opportunity In Western Midstream Partners?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Midstream Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WES

Western Midstream Partners

Operates as a midstream energy company primarily in the United States.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives