- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Valero Energy (VLO): Assessing the Stock’s Valuation After a Strong Run

Reviewed by Simply Wall St

Valero Energy (VLO) stock is coming off a remarkable stretch, with shares rising around 16% over the past three months and nearly 35% in the past year. Investors are taking notice of recent gains and are evaluating how these gains compare to the company’s fundamentals.

See our latest analysis for Valero Energy.

After a steady run across the year, Valero Energy’s momentum has picked up sharply. Recent share price gains are catching investors’ attention, and its one-year total shareholder return of 35% reveals notable outperformance that is fueling optimism about both near-term and longer-term prospects.

If you’re interested in what else might be fueling investor excitement this quarter, it’s a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With such strong performance in recent months, the critical question now is whether Valero Energy remains undervalued at current prices or if the market has already accounted for future growth, which could leave little room for upside.

Most Popular Narrative: 2.8% Undervalued

With Valero Energy's fair value calculated at $185.83, slightly above the last closing price of $180.54, attention is now on whether continued operating momentum and capital return strength support further gains.

Bullish analysts highlight Valero's highly complex refineries, which can process less expensive crude oils and efficiently convert them into premium products such as diesel and jet fuel. This contributes to growth in operating margins and earnings per share.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple typically associated with technology leaders. Interested in which bold financial projections support that price target? Explore further to see the noteworthy figures behind this fair value calculation.

Result: Fair Value of $185.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, operational cost pressures and regulatory uncertainties could undermine margin improvements and challenge Valero’s positive outlook in the coming quarters.

Find out about the key risks to this Valero Energy narrative.

Another View: Is Valero Overpriced by This Metric?

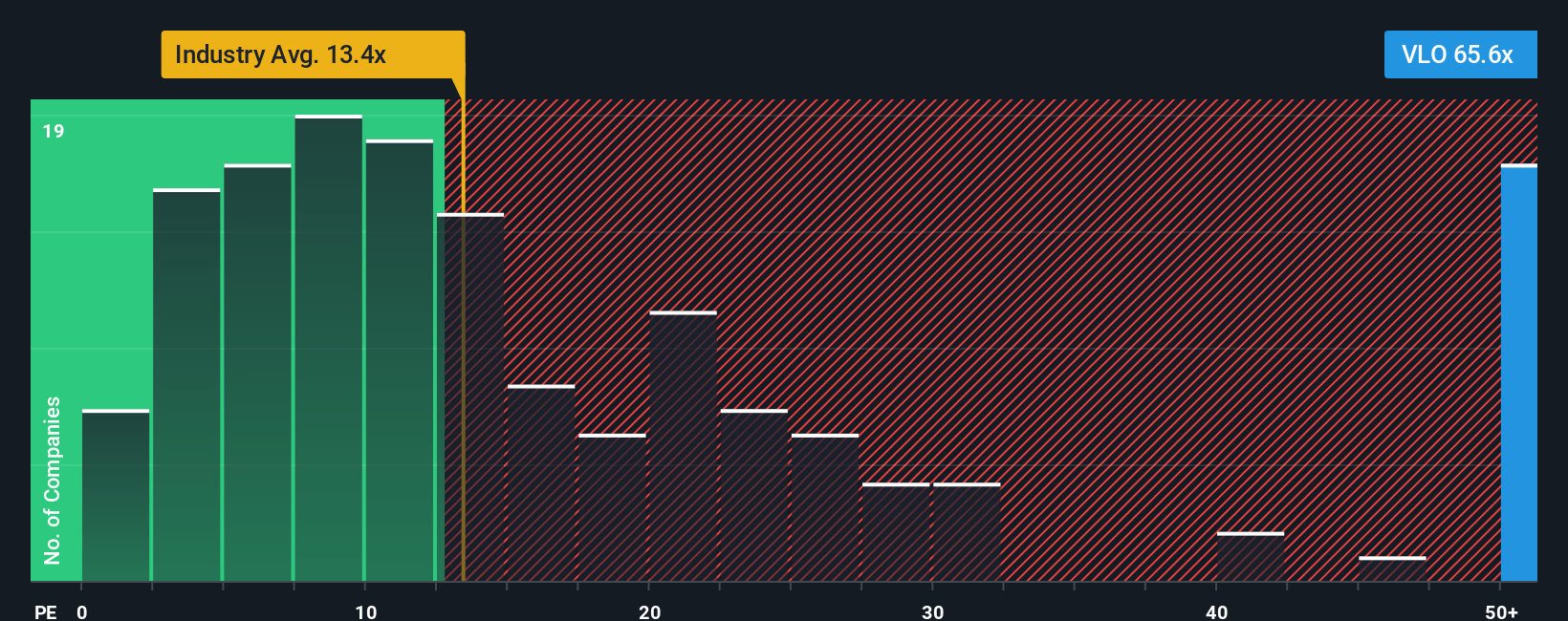

While the fair value calculation points to Valero Energy being slightly undervalued, our market-based comparison reveals a different story. The company’s price-to-earnings ratio of 36.9x is much higher than both the US Oil and Gas industry average of 13.6x and the fair ratio of 23.1x. This raises the risk that Valero’s shares could see a pullback if the market adjusts for these elevated multiples. Which view will the market follow next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valero Energy Narrative

If you have a different take on Valero’s outlook, or want to dig into the numbers on your own terms, you can quickly create your own perspective in just a few minutes. Do it your way

A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next winning strategy by searching outside the obvious. Some of the market’s best opportunities often fly under the radar. Don’t miss the chance to find standout stocks with qualities that match your goals and risk profile.

- Spot hidden bargains that the market has overlooked and seize potential upside through these 923 undervalued stocks based on cash flows.

- Power up your portfolio with future-defining breakthroughs by checking out these 27 quantum computing stocks, where innovation is just getting started.

- Reach for steady income and reliability by evaluating these 14 dividend stocks with yields > 3% offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026