- United States

- /

- Energy Services

- /

- NYSE:VAL

Valaris (VAL): Assessing Valuation After Strong Q3 Earnings Jump and Major Share Buyback Completion

Reviewed by Simply Wall St

Valaris (VAL) just posted third-quarter earnings that saw net income climb substantially compared to a year ago, even as revenue slipped. At the same time, the company wrapped up a major phase of its share repurchase program.

See our latest analysis for Valaris.

Valaris has been on a roll lately, gaining positive momentum after its robust third-quarter results and high-profile share buybacks. Investors have taken notice, with the share price up 17.7% over the past month and 29.4% year-to-date. The total shareholder return for the last year sits at a solid 17.6%. Recent insider selling and mixed analyst sentiment have given the market pause, but the company’s earnings surge and aggressive repurchases appear to have reignited optimism for the longer term.

Curious about what other companies are showing strong momentum and leadership? Broaden your horizons and discover fast growing stocks with high insider ownership

With the stock posting strong gains and profit growth, the question now is whether Valaris is trading at an attractive valuation, or if the market has already factored in its future prospects. Is there still an opportunity here, or is everything priced in?

Most Popular Narrative: 8% Overvalued

With Valaris shares closing recently at $58.20, the most widely followed narrative puts fair value at $53.70. This suggests the stock is currently trading at a noticeable premium. This sets the stage for a deeper dive into the business’s drivers and potential catalysts influencing analyst sentiment.

"The company's $4.7 billion contract backlog, its highest of the decade, reflects continued success in winning attractive, multi-year contracts for its high-specification fleet, supported by robust global offshore activity and rising demand for deepwater projects. This strong backlog visibility points to increasing future revenue and earnings stability."

What’s quietly powering that fair value? This narrative is betting on backlog strength and future margin upgrades, but the details behind the numbers might surprise you. Ready to see what analysts think will really drive Valaris’s next move? Click through for the projections that have everyone talking.

Result: Fair Value of $53.70 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating environmental regulation or unexpected offshore drilling slowdowns could quickly shift sentiment. These factors pose real risks to Valaris’s earnings momentum.

Find out about the key risks to this Valaris narrative.

Another View: Is the Market Missing Something?

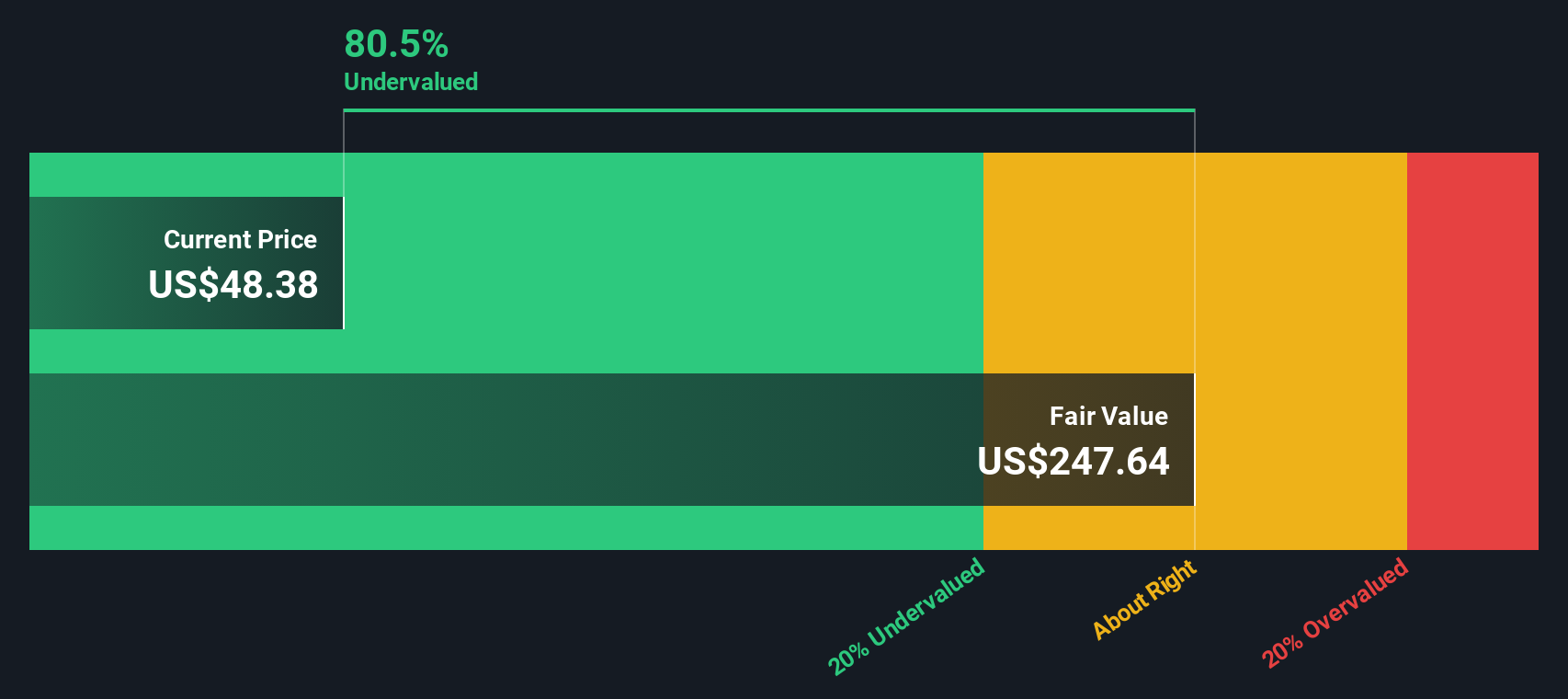

While analyst fair value points to Valaris being overvalued, our SWS DCF model takes a much more bullish view. It suggests the shares are trading at a significant discount to their true worth, flagging a potential undervalued opportunity that the market might be overlooking. Which story should investors believe?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Valaris Narrative

If you see the story differently or want to dig into the numbers yourself, shaping your own take is quick and easy. You can Do it your way

A great starting point for your Valaris research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means staying ahead of the crowd. Don’t settle for ordinary; you can tap into groundbreaking trends and tomorrow’s winners with just a few clicks.

- Capture opportunities with rising market stars by checking out these 3572 penny stocks with strong financials, which are driving big moves as their momentum accelerates.

- Boost your portfolio’s potential and track income opportunities with these 15 dividend stocks with yields > 3%, bringing yields above 3% to the table.

- Tap into the future of medicine and uncover growth stories among these 32 healthcare AI stocks, transforming healthcare through artificial intelligence and innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAL

Valaris

Provides offshore contract drilling services in Brazil, the United Kingdom, U.S.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives