- United States

- /

- Energy Services

- /

- NYSE:VAL

The Bull Case For Valaris (VAL) Could Change Following Major Contract Wins and Rising Institutional Interest

Reviewed by Sasha Jovanovic

- Institutional investors have significantly increased their holdings in Valaris, following the company's announcement of securing over US$1.0 billion in new contract backlog and expanding its partnership with Saudi Aramco through ARO Drilling.

- Notably, Valaris now has a contract backlog of approximately US$4.7 billion and stands out among peers with elevated short interest compared to industry averages.

- We'll explore how strengthened institutional confidence and major contract wins could reshape Valaris's longer-term investment narrative and growth outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Valaris Investment Narrative Recap

To be a Valaris shareholder, you have to believe that robust global demand for offshore drilling and recent contract wins can offset sector challenges like overcapacity and day rate pressure. The largest recent news, namely the jump in institutional ownership after Valaris secured over US$1.0 billion in backlog, may support near-term investor confidence but does not fundamentally remove the industry's overcapacity risk, which remains a pivotal short-term catalyst and concern for earnings stability. Among the company's recent updates, the US$760 million in new long-term contracts for the VALARIS DS-16 and DS-18 drillships directly supports backlog growth and increases revenue visibility. This announcement is relevant for backing the company's efforts to secure higher utilization rates and protect margins, reinforcing the primary investment catalyst of strong multiyear backlog and global rig demand. However, investors should also be alert, as heightened customer concentration means earnings could still swing abruptly if major clients shift priorities or defer projects...

Read the full narrative on Valaris (it's free!)

Valaris is projected to reach $2.4 billion in revenue and $453.7 million in earnings by 2028. This outlook assumes a 1.2% annual decline in revenue and a $178.2 million increase in earnings from the current level of $275.5 million.

Uncover how Valaris' forecasts yield a $55.10 fair value, in line with its current price.

Exploring Other Perspectives

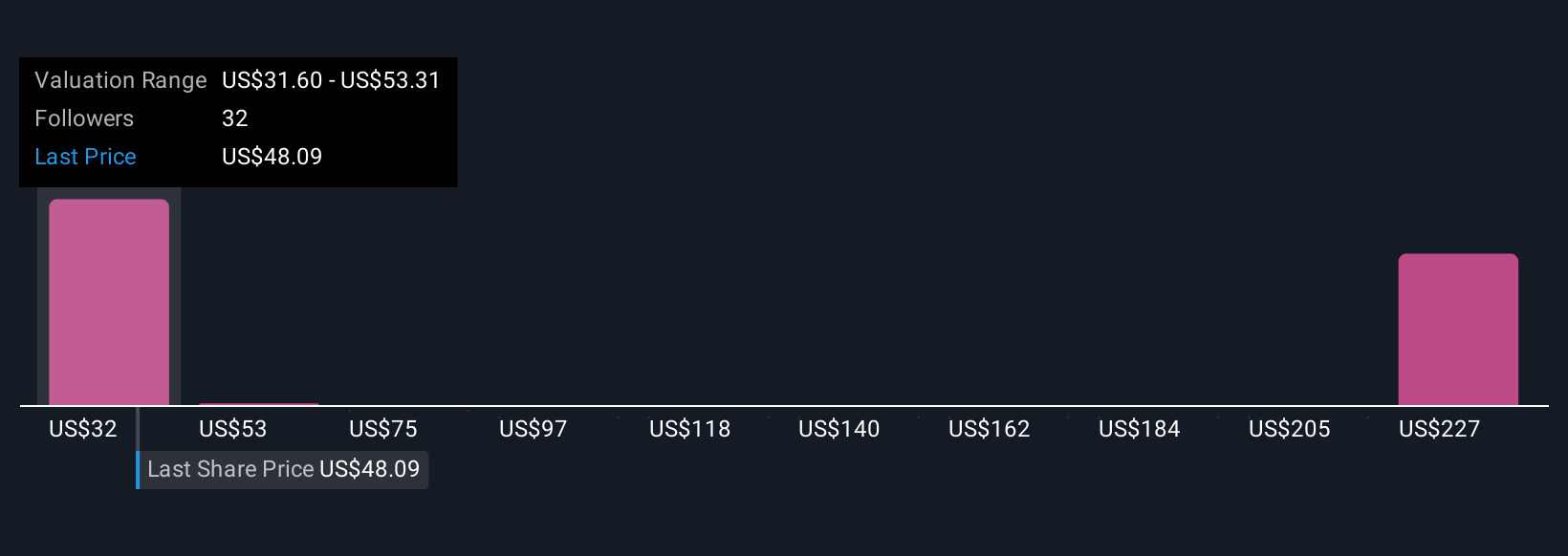

Eight Simply Wall St Community members estimate Valaris’s fair value from US$31.60 to US$338.05 per share, reflecting a broad range of expectations. Continued industry rig oversupply remains closely watched and could challenge the company’s ability to fully realize its backlog potential.

Explore 8 other fair value estimates on Valaris - why the stock might be worth 44% less than the current price!

Build Your Own Valaris Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valaris research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Valaris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valaris' overall financial health at a glance.

No Opportunity In Valaris?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAL

Valaris

Provides offshore contract drilling services in Brazil, the United Kingdom, U.S.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success