- United States

- /

- Energy Services

- /

- NYSE:TTI

TETRA Technologies (TTI) Is Up 7.1% After Profit Rebound and CFO Transition—What's Changed?

Reviewed by Sasha Jovanovic

- TETRA Technologies reported third-quarter 2025 financial results with revenue of US$153.24 million and net income of US$4.15 million, reversing a net loss from the previous year.

- The company simultaneously announced CFO Elijio Serrano’s planned March 2026 retirement, with EVP Matt Sanderson named as his successor, highlighting ongoing leadership continuity amid improving earnings performance.

- We'll explore how TETRA's return to profitability and growth in quarterly revenue impacts its long-term investment outlook and risk factors.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

TETRA Technologies Investment Narrative Recap

Shareholders in TETRA Technologies generally need to believe in the sustainability of robust deepwater completions activity and heightened demand for industrial chemicals and battery-grade bromine. The recent return to profitability and solid revenue growth for the third quarter signals progress, but these developments do not materially change the fact that near-term earnings remain heavily tied to cyclical end-markets, where any downturn or project disruption continues to present the biggest risk to results. Short-term catalysts and risks remain fundamentally unchanged by the headline numbers.

Among the latest news, the announced retirement of CFO Elijio Serrano and the clear succession plan with Matt Sanderson’s planned promotion stand out. This transition, mapped well ahead of execution, provides reassurance of management continuity during a period when the company is targeting expansion in specialty chemicals and energy storage applications, both major growth levers amid sector volatility.

However, despite this positive leadership update, investors should be aware that if demand for deepwater fluids or electrolytes underperforms, the extensive capital tied up in the Arkansas facility may remain underutilized...

Read the full narrative on TETRA Technologies (it's free!)

TETRA Technologies' outlook projects $661.4 million in revenue and $1.8 million in earnings by 2028. This reflects a 2.9% annual revenue growth rate but a steep earnings decrease of $118.6 million from the current $120.4 million.

Uncover how TETRA Technologies' forecasts yield a $8.17 fair value, a 8% upside to its current price.

Exploring Other Perspectives

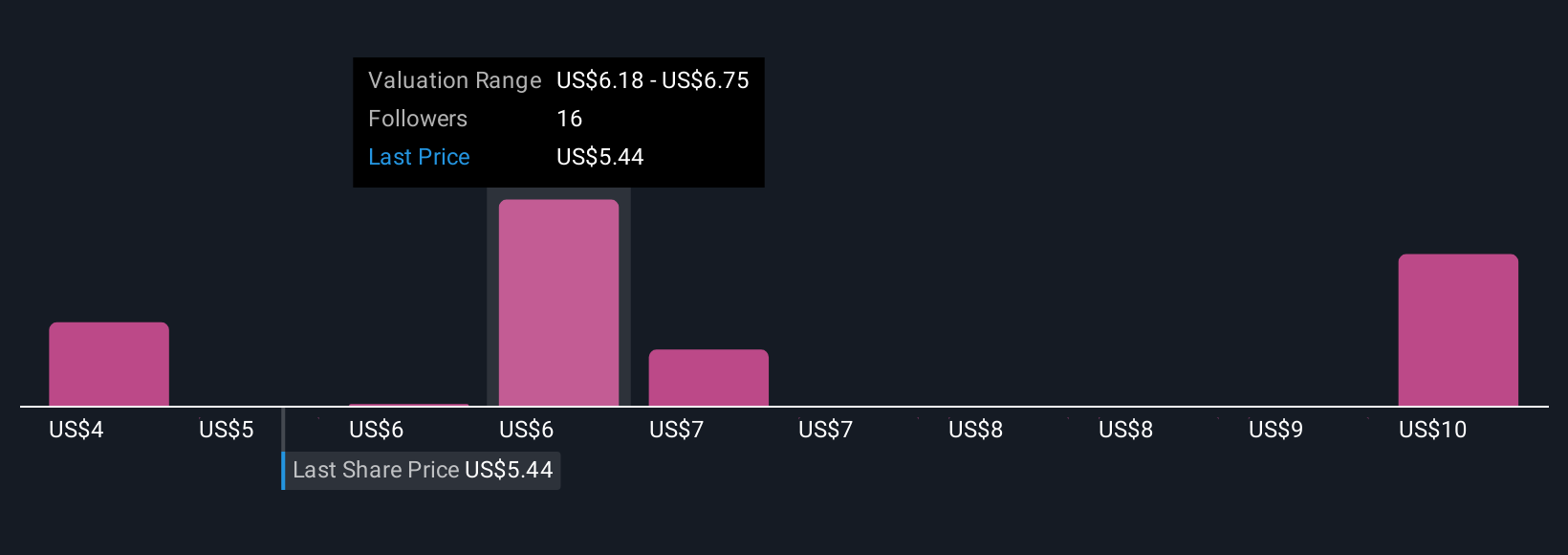

Six members of the Simply Wall St Community assessed fair value for TETRA Technologies, with estimates stretching from US$4.45 to US$22.23 per share. While investors express a wide range of forecasts, the reliance on deepwater and commodity demand could continue to drive significant volatility in results, so consider several perspectives before drawing conclusions.

Explore 6 other fair value estimates on TETRA Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own TETRA Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TETRA Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TETRA Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TETRA Technologies' overall financial health at a glance.

No Opportunity In TETRA Technologies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TETRA Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TTI

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives