- United States

- /

- Oil and Gas

- /

- NYSE:TPL

How Texas Pacific Land’s New $500 Million Credit Facility Could Shape Growth Plans for TPL Investors

Reviewed by Sasha Jovanovic

- On October 23, 2025, Texas Pacific Land Corporation entered into a new revolving credit facility agreement with Wells Fargo Bank and other lenders, providing access to up to US$500 million with potential increases of up to US$250 million and a maturity date of October 23, 2029.

- This revolving credit facility enhances the company's financial flexibility, supporting its ability to fund capital expenditures, acquisitions, and general business purposes as opportunities arise.

- We'll examine how this enhanced access to undrawn credit could influence Texas Pacific Land's ability to execute on growth and diversification plans.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Texas Pacific Land Investment Narrative Recap

For shareholders, the core belief is in Texas Pacific Land’s ability to generate strong cash flows from oil and gas royalties and its growing water services business, despite ongoing shifts in energy markets. The newly secured US$500 million revolving credit facility could increase flexibility for acquisitions and growth, though it does not materially alter the most significant near-term catalyst, the company’s ability to convert Permian production into sustained royalty growth, or reduce the ongoing risk of regulatory or commodity-driven revenue pressures.

Among recent developments, TPL’s US$286 million acquisition of additional Permian mineral and royalty interests in October is particularly relevant, as it signals continued expansion of core assets that underpin royalty income. Such transactions, supported by the new credit facility, feed directly into the company’s main revenue drivers and will remain closely watched as investors assess future cash flow resilience and potential long-term production challenges.

However, investors should note that while added financial flexibility sounds reassuring, persistent risks around Permian regulatory or environmental changes could...

Read the full narrative on Texas Pacific Land (it's free!)

Texas Pacific Land's narrative projects $895.3 million revenue and $610.3 million earnings by 2028. This requires 7.2% yearly revenue growth and a $150 million earnings increase from $460.2 million today.

Uncover how Texas Pacific Land's forecasts yield a $921.93 fair value, in line with its current price.

Exploring Other Perspectives

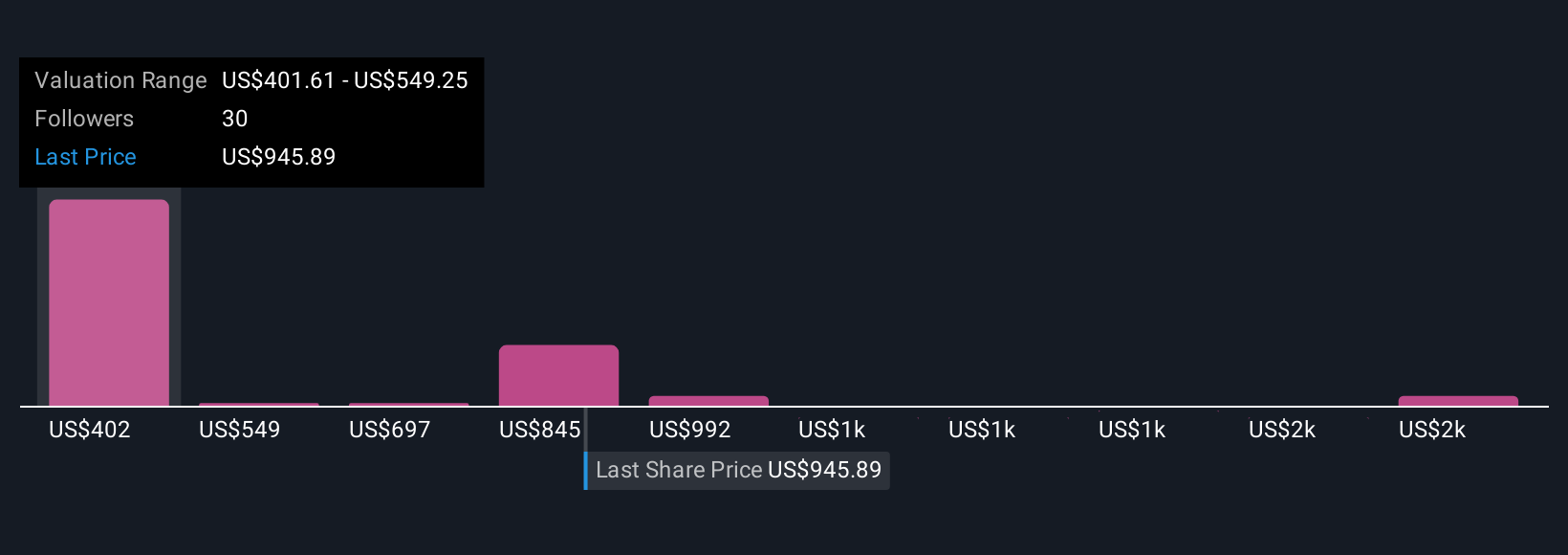

Thirteen individual fair value estimates from the Simply Wall St Community span US$401.61 to US$1,790.78 per share. While opinions vary widely, sustained Permian activity remains a central factor shaping future performance outcomes, encouraging you to examine other contrasting viewpoints.

Explore 13 other fair value estimates on Texas Pacific Land - why the stock might be worth less than half the current price!

Build Your Own Texas Pacific Land Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Pacific Land research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Texas Pacific Land research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Pacific Land's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Pacific Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPL

Texas Pacific Land

Engages in the land and resource management, and water services and operations businesses.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives