- United States

- /

- Oil and Gas

- /

- NYSE:TNK

Teekay Tankers Ltd. (NYSE:TNK) Surges 26% Yet Its Low P/E Is No Reason For Excitement

Teekay Tankers Ltd. (NYSE:TNK) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 23% over that time.

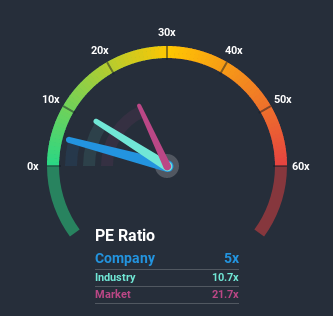

In spite of the firm bounce in price, Teekay Tankers may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5x, since almost half of all companies in the United States have P/E ratios greater than 22x and even P/E's higher than 43x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Teekay Tankers certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Teekay Tankers

What Are Growth Metrics Telling Us About The Low P/E?

Teekay Tankers' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 105%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 154% as estimated by the four analysts watching the company. With the market predicted to deliver 20% growth , that's a disappointing outcome.

In light of this, it's understandable that Teekay Tankers' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Teekay Tankers' P/E

Even after such a strong price move, Teekay Tankers' P/E still trails the rest of the market significantly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Teekay Tankers maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Teekay Tankers is showing 2 warning signs in our investment analysis, and 1 of those is significant.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you decide to trade Teekay Tankers, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:TNK

Teekay Tankers

Provides crude oil and other marine transportation services to oil industries in Bermuda and internationally.

Very undervalued with flawless balance sheet and pays a dividend.