- United States

- /

- Energy Services

- /

- NYSE:TDW

Tidewater (TDW): Examining Valuation After Recent 10% One-Month Share Price Gain

Reviewed by Simply Wall St

See our latest analysis for Tidewater.

While Tidewater’s short-term moves have grabbed headlines, the company’s year-long track record is equally noteworthy. The past 12 months saw a total shareholder return of 3.1%, and the recent 10% one-month share price gain suggests momentum may be picking up again after a quieter stretch.

If you're curious to see what else is gaining traction right now, it might be the perfect moment to expand your search and discover fast growing stocks with high insider ownership

With Tidewater shares still trading below analyst price targets as profits grow, the big question for investors remains: is the recent uptick just the beginning of a bigger move, or has the market already accounted for the company’s future growth prospects?

Most Popular Narrative: 8.7% Undervalued

Compared to the recent closing price, the narrative’s fair value calculation puts Tidewater shares at nearly 9% below what analysts expect long term. This gap signals room for optimism among those who see fundamental drivers in play.

Multi-year offshore project pipeline, particularly in deepwater regions such as Africa, Brazil, the Caribbean, and Asia Pacific, remains robust. This is underpinned by the world's rising energy demand and depletion of onshore reserves, supporting increased demand for Tidewater's fleet and driving top-line and cash flow growth from 2026 onward.

Want to know the formula for these high hopes? This narrative rests on stronger profitability and a future share count shrink. There is a bold case for earnings and margins baked in here. Ready to uncover what numbers are fueling this price target? Click through to see the full breakdown and the assumptions powering the fair value estimate.

Result: Fair Value of $60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as persistent offshore market softness or integration challenges in acquisitions could quickly shift momentum away from this optimistic narrative.

Find out about the key risks to this Tidewater narrative.

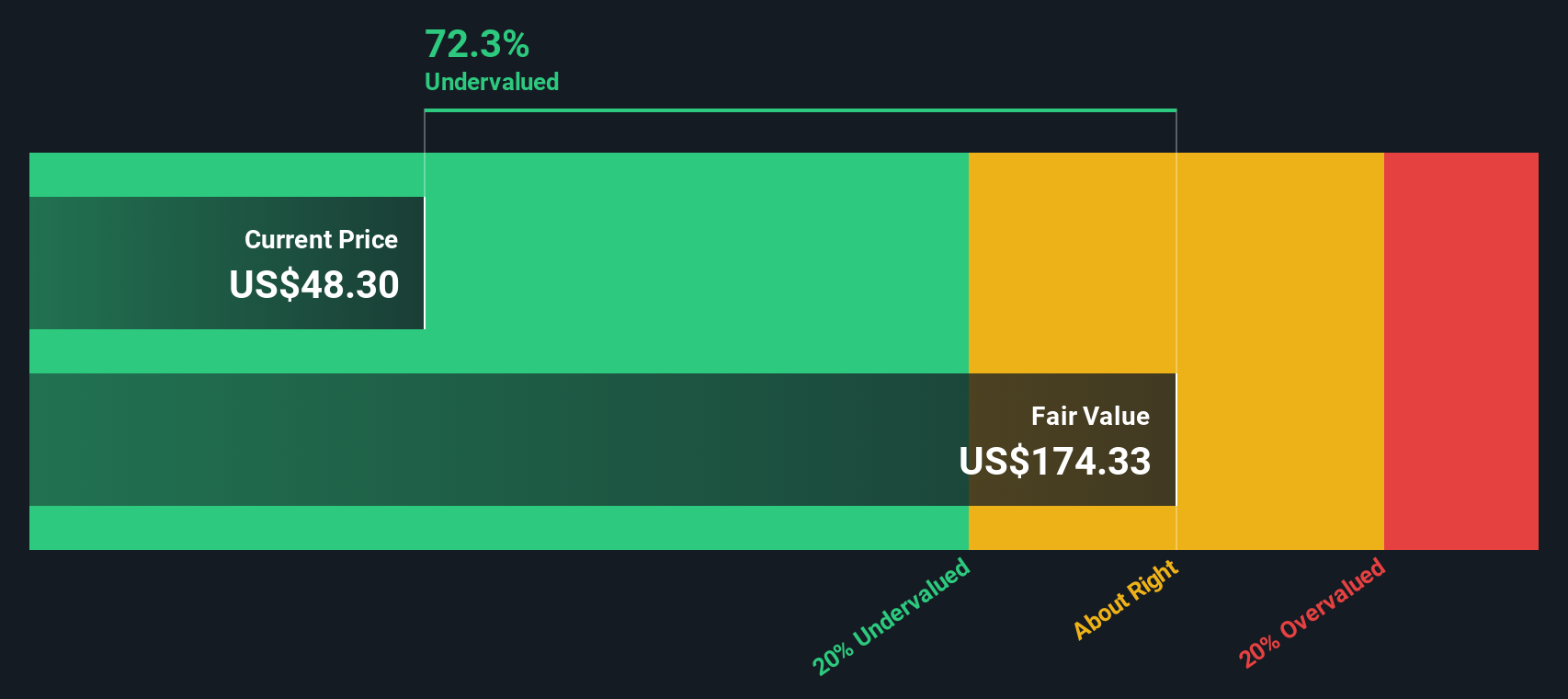

Another View: SWS DCF Model Puts Shares Deeply Undervalued

Taking a different approach, our SWS DCF model estimates Tidewater's fair value at $178.63, which is far above the current price. This suggests the market may be overlooking long-term cash flow potential, even as other valuation methods see more limited upside. Will the market catch on?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Tidewater Narrative

If you’d rather dig into the numbers yourself and see things from a fresh perspective, taking a few minutes is all it takes to craft your own outlook. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tidewater.

Looking for more investment ideas?

Why settle for just one opportunity when there is a whole world of promising stocks waiting for you? Use the Simply Wall Street Screener now to catch the trends shaping tomorrow’s portfolios before the crowd does.

- Unlock the potential of tech-driven portfolios by exploring these 25 AI penny stocks, which are powering groundbreaking advancements in artificial intelligence.

- Boost your income by selecting from these 15 dividend stocks with yields > 3%, which deliver reliable yields and enhance portfolio stability with steady cash flow.

- Position yourself at the forefront of financial innovation with these 82 cryptocurrency and blockchain stocks, leveraging the momentum behind blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tidewater might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TDW

Tidewater

Provides offshore support vessels and marine support services to the offshore energy industry through the operation of a fleet of offshore marine service vessels worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives