- United States

- /

- Oil and Gas

- /

- NYSE:SM

Could SM Energy’s (SM) ESOP Share Offering Signal a Shift in Ownership Priorities?

Reviewed by Simply Wall St

- SM Energy Company has recently filed a shelf registration to offer 4,492,289 shares of common stock worth US$123.13 million for an employee stock ownership program (ESOP) related offering.

- This move signals a potential shift in share count and employee alignment, which could influence investor sentiment regarding future ownership structure and company priorities.

- We'll explore how the ESOP-related share offering could impact SM Energy’s investment narrative and future balance sheet decisions.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

SM Energy Investment Narrative Recap

To own SM Energy, you need to believe that disciplined balance sheet management, production from the Uinta Basin, and operational improvements will outweigh the persistent pressure from weak oil prices and higher operating costs. The recent ESOP-related share offering is not likely to materially affect the key short-term catalyst, growing and efficiently integrating Uinta Basin assets, nor does it appear to amplify the immediate risk of further margin compression tied to commodity price swings.

Among SM Energy’s recent updates, the company’s Q2 production and LOE guidance stands out, especially as lease operating expenses tick up. While production growth remains on track, higher operating costs continue to be a risk worth watching, even as SM focuses on supporting employee ownership and long-term alignment through its new stock offering.

In contrast, any sustained weakness in commodity prices could still challenge SM’s ability to maintain its leverage targets and planned cash returns to shareholders, something investors should be aware of...

Read the full narrative on SM Energy (it's free!)

SM Energy's outlook anticipates $3.5 billion in revenue and $583.5 million in earnings by 2028. This is based on a projected annual revenue growth rate of 7.3%, but implies an earnings decline of $237.9 million from current earnings of $821.4 million.

Uncover how SM Energy's forecasts yield a $39.08 fair value, a 36% upside to its current price.

Exploring Other Perspectives

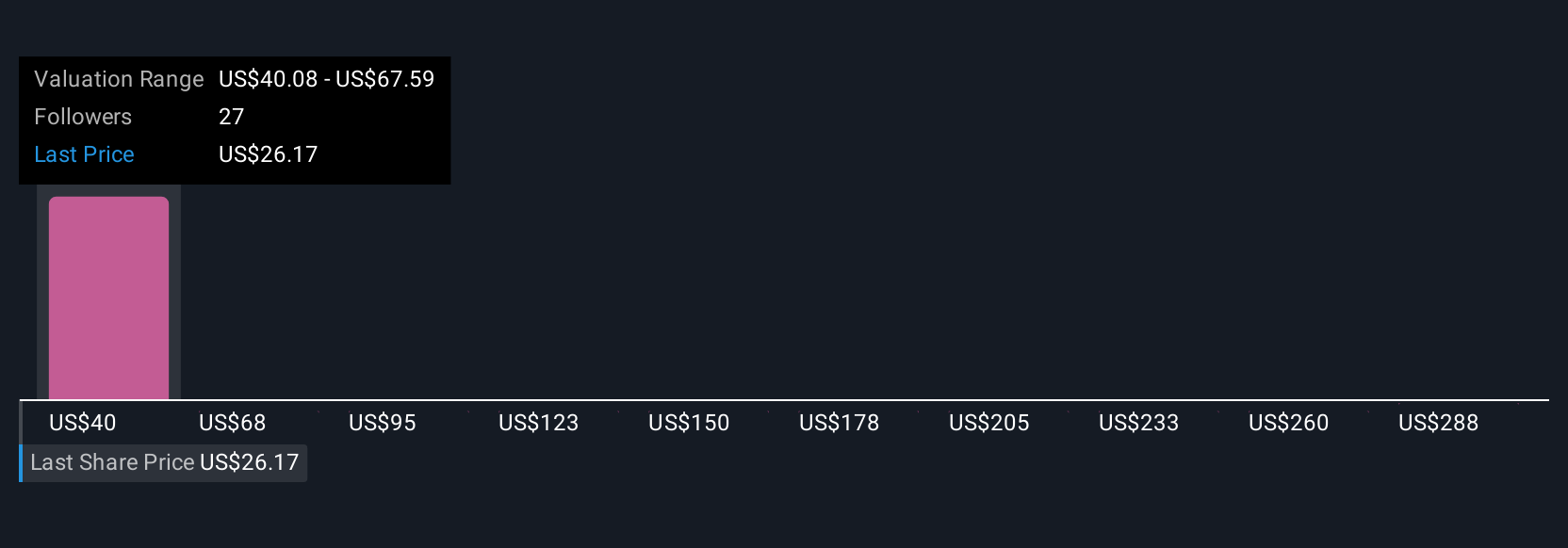

Fair value estimates from three Simply Wall St Community members span from US$39.08 to US$315.24 per share. Against this backdrop, the company’s exposure to fluctuating oil prices remains a central issue so your view on future industry volatility may shape your own outlook.

Explore 3 other fair value estimates on SM Energy - why the stock might be worth over 10x more than the current price!

Build Your Own SM Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SM Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free SM Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SM Energy's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SM

SM Energy

An independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives