- United States

- /

- Oil and Gas

- /

- NYSE:RRC

The Bull Case for Range Resources (RRC) Could Change Following Dividend Hike and Kopernik’s Stake Increase

Reviewed by Sasha Jovanovic

- Range Resources Corporation’s Board of Directors declared a quarterly cash dividend of US$0.09 per share for the fourth quarter of 2025, payable on December 26, 2025, to stockholders of record on December 12, 2025.

- Kopernik Global Investors recently expanded its stake in Range Resources by over 1.61 million shares, making the company the second-largest disclosed position in its portfolio and highlighting growing institutional interest.

- With the Board’s continued commitment to shareholder returns through steady dividends, we’ll explore how this development could influence Range Resources’ investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Range Resources Investment Narrative Recap

To be a shareholder in Range Resources, one needs to believe in the sustained expansion of US natural gas demand and the company’s ability to generate strong cash flows from its Appalachian asset base. The recent dividend affirmation reflects healthy free cash flow and management's focus on steady shareholder returns, although this announcement alone does not materially affect short-term catalysts like production growth or key risks such as regulatory headwinds for pipeline development.

Of the recent announcements, the Q3 2025 earnings result stands out: Range exceeded earnings estimates, raised production guidance, and highlighted improved operating efficiency. These updates point to operational execution supporting immediate catalysts, but do not fully mitigate long-term risks around regional market access and evolving regulatory requirements.

However, investors should be aware that despite dividend consistency, the regulatory risks tied to pipeline and infrastructure permitting in Appalachia remain a key challenge for Range Resources…

Read the full narrative on Range Resources (it's free!)

Range Resources' narrative projects $4.1 billion in revenue and $804.1 million in earnings by 2028. This requires 13.7% annual revenue growth and a $325.4 million increase in earnings from the current $478.7 million.

Uncover how Range Resources' forecasts yield a $41.79 fair value, a 6% upside to its current price.

Exploring Other Perspectives

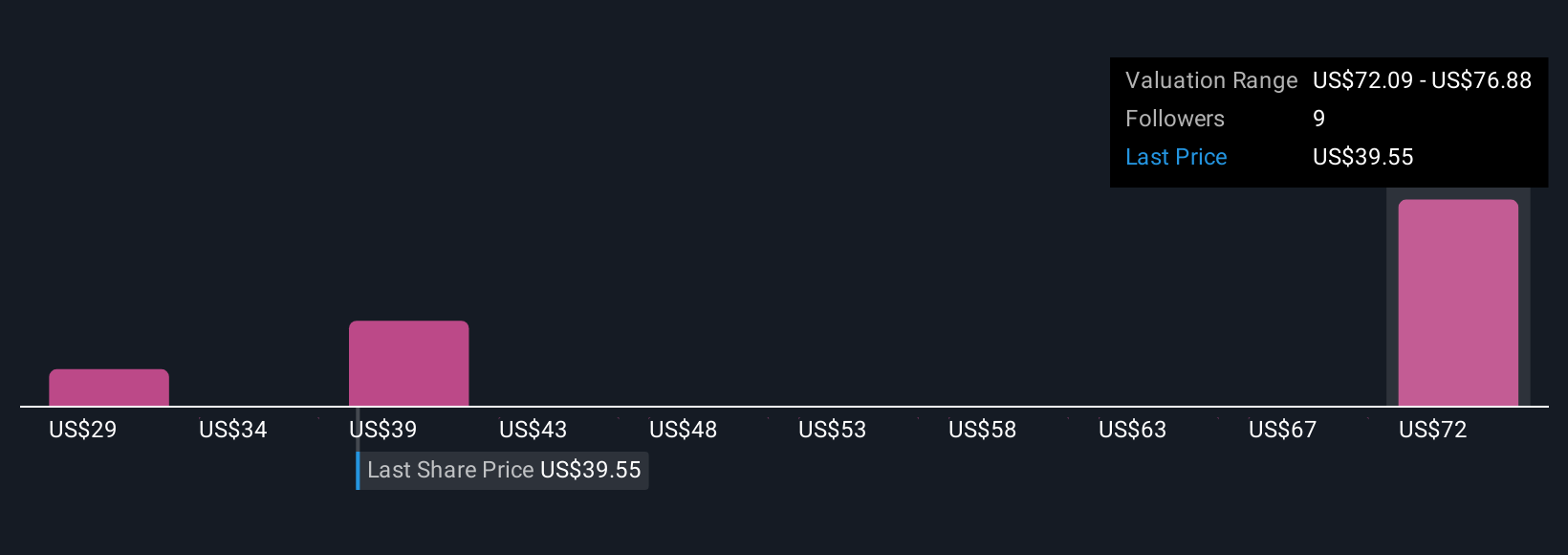

Five fair value estimates from the Simply Wall St Community for Range Resources range from US$29 to US$77.43 per share, suggesting unusually wide uncertainty among individual forecasts. While several community members see significant upside, ongoing regulatory scrutiny around Appalachian infrastructure could test the company’s ability to capture new market opportunities. Consider these varied outlooks as you explore more perspectives.

Explore 5 other fair value estimates on Range Resources - why the stock might be worth as much as 96% more than the current price!

Build Your Own Range Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Range Resources research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Range Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Range Resources' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRC

Range Resources

Operates as an independent natural gas, natural gas liquids (NGLs), and oil company in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.