- United States

- /

- Oil and Gas

- /

- NYSE:RRC

Range Resources (RRC): Evaluating Valuation After Strong Q3 Earnings and Share Buybacks

Reviewed by Simply Wall St

Range Resources (RRC) just released its third quarter and nine-month results, showing a clear jump in both revenue and net income compared to last year. Investors are also noting steady production growth along with ongoing share repurchases.

See our latest analysis for Range Resources.

With a strong earnings beat and ongoing buybacks, Range Resources is getting fresh attention from investors. The past week’s 5.9% share price return follows well-received Q3 and updated production guidance. The one-year total shareholder return of 14% continues to highlight steady long-term momentum.

If you're interested in broadening your search beyond energy, now’s a great moment to discover fast growing stocks with high insider ownership.

Yet even after such a strong quarter and ongoing buybacks, does Range Resources stock still have room to run? Or are investors already pricing in the company’s brighter outlook and market-leading gains?

Most Popular Narrative: 11.3% Undervalued

Range Resources is trading below what the most widely followed narrative considers fair value. The fair value outpaces the last close by a notable margin, signaling strong upside potential if the core assumptions prove accurate.

Ongoing efficiency gains in drilling and completions and sustained reductions in per-unit well costs are enabling Range to increase production guidance and lower capital spending. This directly expands margins and delivers stronger free cash flow even in a flatter commodity environment.

Craving the details that make this fair value so bullish? The narrative is built on projected gains in earnings and margins, plus bold growth expectations for the company’s top and bottom line. Want to see which forecasts turn these assumptions into that striking valuation? Don’t miss what’s driving this story upward.

Result: Fair Value of $41.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity headwinds or regulatory delays in Appalachia could present challenges to Range Resources’ optimistic outlook and may slow future growth momentum.

Find out about the key risks to this Range Resources narrative.

Another View: Market-Based Valuation Tells a Different Story

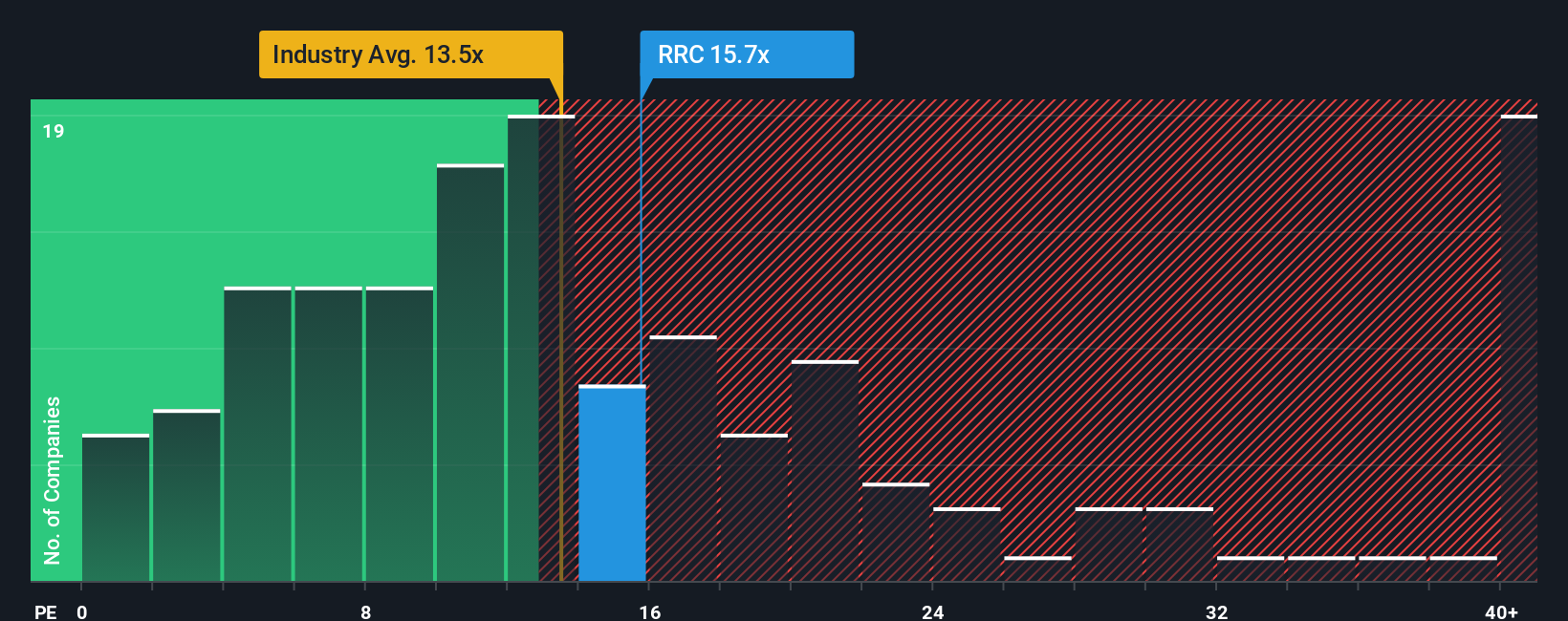

Now, let’s look at what market ratios reveal. Range Resources trades at a price-to-earnings ratio of 15.3x, which is higher than the average for both its peers (13.9x) and the broader US Oil and Gas sector (12.7x). However, our fair ratio estimate sits at 17.9x, so the market could shift its view upward or see continued downside risk if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Range Resources Narrative

If you see the story differently or have your own view, dive into the data and shape a personalized take in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Range Resources.

Looking for More Investment Ideas?

Move beyond the obvious and supercharge your portfolio with handpicked stock opportunities. Don’t let these high-potential trends pass you by. Start your search now:

- Unlock opportunities for steady income by targeting these 20 dividend stocks with yields > 3% that offer strong yields above 3% and a track record of reliable payouts.

- Access the next wave of market disruptors by jumping into these 26 AI penny stocks transforming entire industries with artificial intelligence and automation breakthroughs.

- Capitalize on tomorrow’s winners by scanning these 843 undervalued stocks based on cash flows that stand out for attractive value based on cash flows and real potential for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRC

Range Resources

Operates as an independent natural gas, natural gas liquids (NGLs), and oil company in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives