- United States

- /

- Oil and Gas

- /

- NYSE:RRC

A Fresh Look at Range Resources (RRC) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Range Resources.

Range Resources has quietly built momentum, delivering an 11.7% 90-day share price return and a 9.1% total shareholder return over the past year, as investors respond to improving results and a strong year for energy stocks. While price moves have been steady rather than dramatic, the company’s three-year total shareholder return of 37.4% shows that the longer-term trend is still positive.

If you’re interested in expanding your investing lens, now is the perfect time to discover fast growing stocks with high insider ownership.

With shares still trading at a discount to analyst price targets and solid financial growth on the books, the question now becomes whether Range Resources is truly undervalued, or if the market has already factored in its next phase of growth.

Most Popular Narrative: 8% Undervalued

The common narrative sets Range Resources' fair value at $41.79, above the last close of $38.46. This suggests there may be room for upside based on future projections.

"Ongoing efficiency gains in drilling and completions and sustained reductions in per-unit well costs are enabling Range to increase production guidance and lower capital spending. This directly expands margins and delivers stronger free cash flow even in a flatter commodity environment."

Curious what happens when analysts run the numbers on revenue growth, profits, and margins? There is a bold plan behind this valuation target. Want a look at the core forecasts and the assumptions informing that fair value? Unlock the full forecast details that could influence this company's outlook.

Result: Fair Value of $41.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity headwinds and oversupply in the gas market could limit near-term cash flow. This may challenge the case for a rebound in valuations.

Find out about the key risks to this Range Resources narrative.

Another View: Multiples Paint a Different Picture

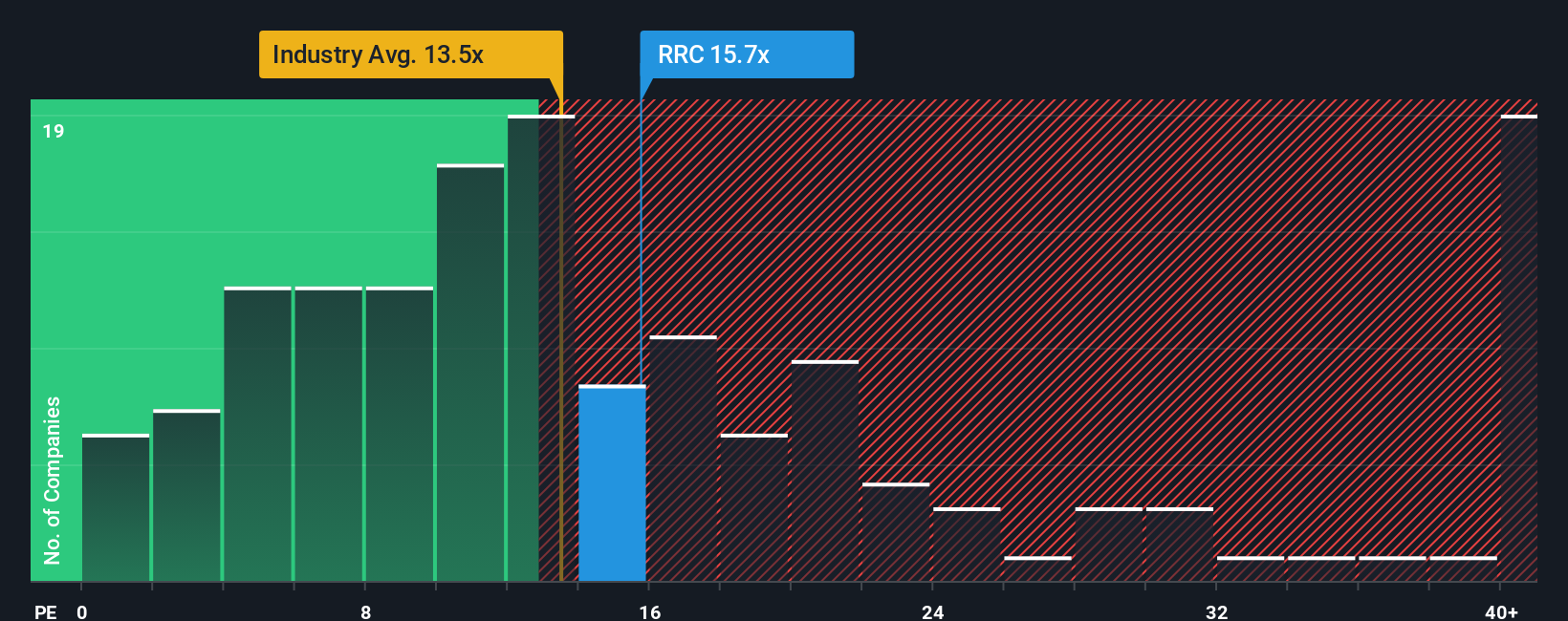

Taking a step away from forecasts, current price-to-earnings ratios offer a fresh angle. Range Resources trades at 15.9x, which is above the US Oil and Gas industry average of 13.1x. Against its peers, however, it looks cheaper. The peer average stands at a high 47.5x, while the fair ratio sits at 17.9x.

In practical terms, this means the stock is somewhat pricey compared to the industry, but more favorably valued when compared to direct peers or possible future market norms. Could the premium to industry averages turn into risk, or does peer pricing hint at overlooked upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Range Resources Narrative

Feel free to dig into the data and shape your own investment narrative. Putting together your own take can be done in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Range Resources.

Looking for More Smart Investment Moves?

Smart investors always keep their options open. Before you make your next move, check out these top opportunities that could shape your portfolio’s future.

- Capitalize on tomorrow’s leaders by taking a closer look at these 3581 penny stocks with strong financials. These show powerful momentum and financial resilience in emerging markets.

- Maximize your search for reliable passive income with these 15 dividend stocks with yields > 3%, which offers attractive yields above 3% and stable payout records.

- Seize the rise of AI transformation by targeting these 25 AI penny stocks to catch the next wave of innovation fueling growth across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRC

Range Resources

Operates as an independent natural gas, natural gas liquids (NGLs), and oil company in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026