- United States

- /

- Energy Services

- /

- NYSE:RIG

Transocean (RIG) Losses Worsen, Challenging Bullish Turnaround and Value Narratives

Reviewed by Simply Wall St

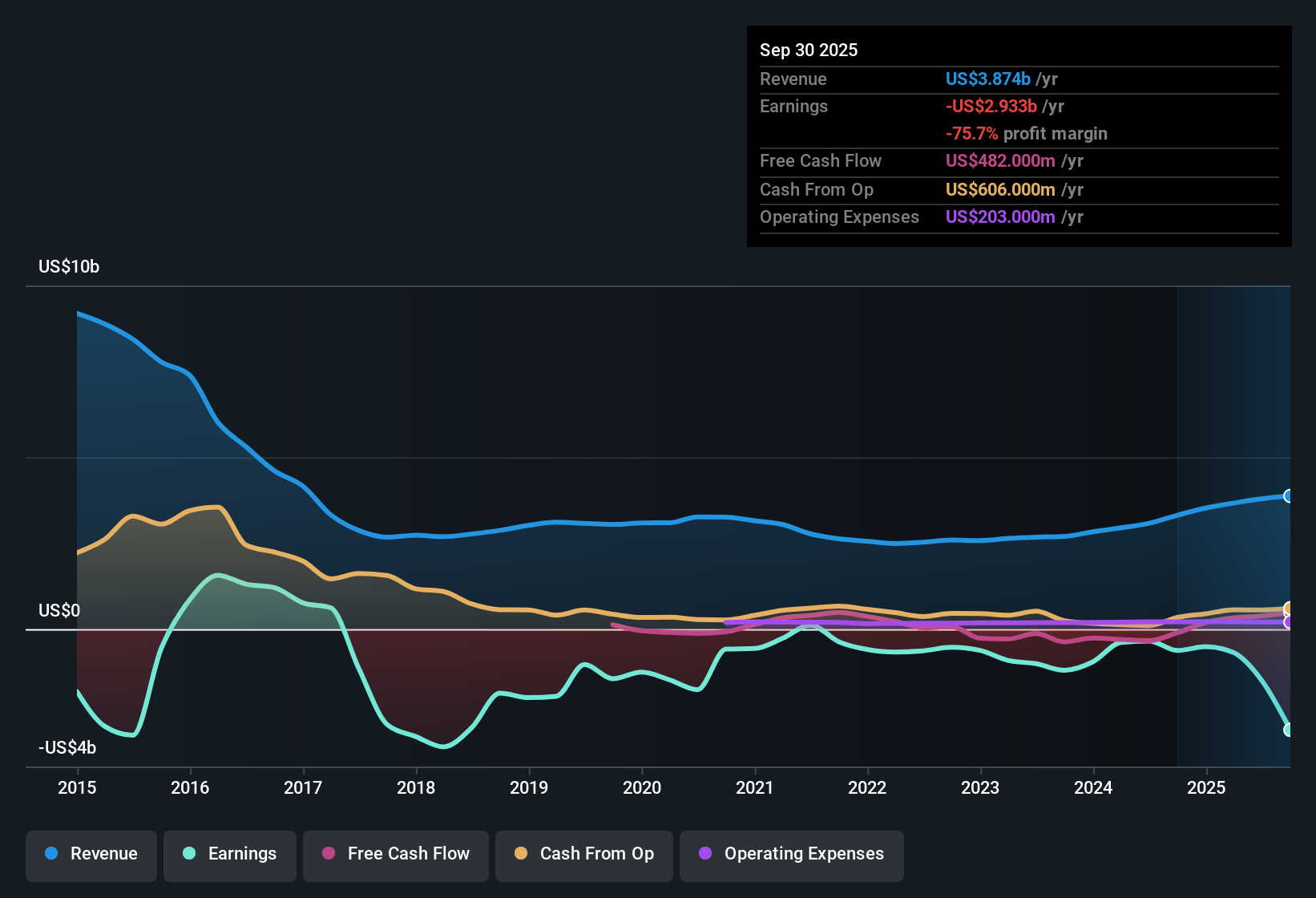

Transocean (NYSE:RIG) remains unprofitable, with net losses increasing at a rate of 28.3% per year over the past five years. While revenue is expected to decline at an annual rate of 1.3% over the next three years, earnings are forecast to rebound sharply with expectations of a 132% annual growth rate and a return to profitability within that period. Investors are weighing the company’s attractive valuation and strong anticipated earnings growth as Transocean works to reverse ongoing revenue declines and achieve profitability.

See our full analysis for Transocean.Next, we will look at how these results compare with the most widely followed narratives among investors and analysts to see what holds up and what gets challenged.

See what the community is saying about Transocean

Backlog of $7 Billion Fuels Margin Hopes

- Transocean's industry-leading backlog sits at approximately $7 billion, which provides strong revenue visibility and cash flow stability over the next several years.

- Analysts' consensus view highlights how a contracted pipeline with major exploration and production clients is seen as enabling efficient conversion of backlog into revenue, supporting margin expansion and helping accelerate debt reduction.

- Revenue certainty from this backlog is expected to directly support higher profit margins, projected to rise from -39.6% now to 4.6% within three years as contracts are fulfilled.

- Consensus narrative also points to sector tailwinds such as tighter rig supply and disciplined capital allocation, which could allow Transocean to lock in premium dayrates through 2027, boosting both utilization and profitability.

Consensus narrative notes Transocean’s multi-billion backlog and margin upside as catalysts for a turnaround. See what the full analyst narrative says, including how these expectations stack up with industry trends. 📊 Read the full Transocean Consensus Narrative.

Share Dilution and Debt Remain Key Risks

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next three years, reflecting potential dilution as the company juggles high debt and seeks to fund operations.

- Consensus narrative weighs these factors heavily, pointing to concerns around Transocean’s substantial debt load and ongoing refinancing needs.

- Bears argue sustained high debt and interest expense could offset margin gains, especially if dayrate recovery underwhelms or contract wins slow in a volatile energy market.

- Customer concentration and rig oversupply are also flagged as vulnerabilities that could undermine revenue stability, giving critics reason to watch share count and leverage closely.

Valuation Gap: Discount to DCF Fair Value and Peers

- At a current share price of $3.91, Transocean trades not only about 25% below its DCF fair value estimate of $5.20, but its price-to-sales ratio of 1.1x aligns with peers and sits just above the US energy services industry average of 1.0x.

- According to the consensus narrative, this discount reflects both optimism about strong forecasted earnings growth and skepticism around the company's return to profitability.

- Analyst consensus price target of $3.88 is only 0.8% lower than the current price, highlighting uncertainty around whether expected profit recovery and backlog conversion can justify a materially higher valuation.

- Bulls argue the valuation gap gives upside if dayrates and margins rebound as projected, but bears see risk if revenue slips or debt pressures persist.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Transocean on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data in another way? Put your perspective to work and shape your own view in just a few minutes. Do it your way

A great starting point for your Transocean research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Transocean’s ongoing high debt levels, persistent share dilution, and refinancing pressures could put pressure on margins and slow the path to sustainable profitability.

If those financial risks give you pause, check out solid balance sheet and fundamentals stocks screener (1984 results) for stronger companies with more resilient balance sheets that can weather market swings with confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RIG

Transocean

Provides offshore contract drilling services for oil and gas wells in Switzerland and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives