- United States

- /

- Energy Services

- /

- NYSE:RIG

Does Transocean’s Recent 13% Rally Signal a Fresh Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

- Wondering if Transocean could be an undervalued opportunity, or if the market is getting ahead of itself? You're not alone, and the answer depends on how we look at value.

- The stock just posted a 7.4% bounce over the past week and has gained 13.3% in the last month, signaling shifting sentiment and fresh curiosity from investors despite being down 1.4% for the year.

- Fueling these moves, headlines have zeroed in on renewed interest in offshore drilling and strategic contract wins for Transocean. Some observers believe these developments may position the company to capitalize on rising energy demand and a tight rig market. Meanwhile, industry chatter about regulatory changes has sparked additional debate about the long-term outlook.

- If you check the numbers, Transocean scores 2 out of 6 on our valuation check. Next, we will dive into what traditional measures say and explore why the most powerful insights may come from looking beneath the surface at the bigger valuation story.

Transocean scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Transocean Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their present value. This helps investors determine what the company is worth today based on expectations for future performance.

For Transocean, analysts estimate current Free Cash Flow at $141.5 million. Over the next several years, this figure is forecast to rise substantially. By 2027, projected Free Cash Flow reaches $680 million, with extrapolated ten-year figures suggesting a consistent climb to $739.5 million by 2035. These projections highlight analysts' belief in the company's capacity for stable cash generation, with longer-term numbers representing a blend of forecast growth and modest adjustments by Simply Wall St.

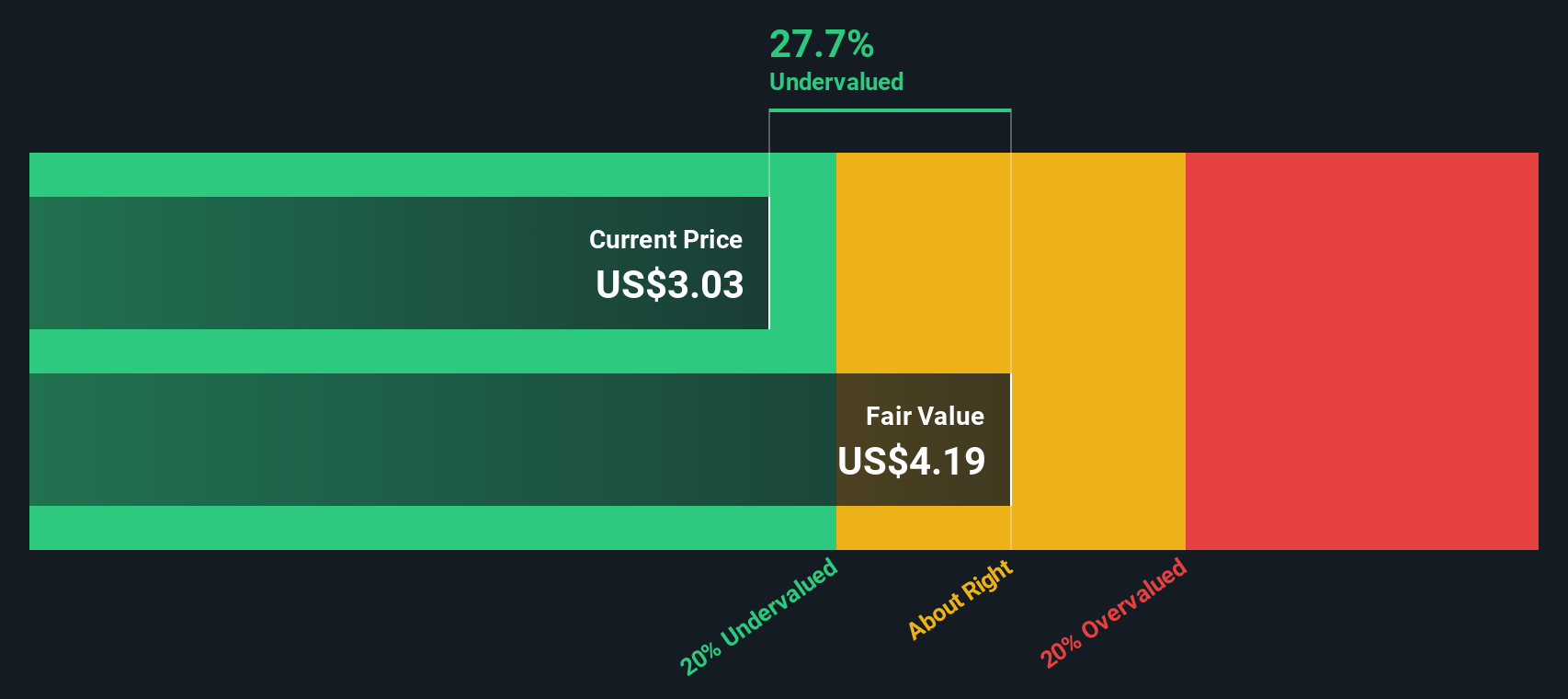

The DCF model values Transocean at $9.23 per share. The share price is currently trading over 50% below this intrinsic estimate, so the model implies the stock is 52.9% undervalued. This result identifies a notable gap between Transocean's market price and its projected cash-generating potential based on this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Transocean is undervalued by 52.9%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

Approach 2: Transocean Price vs Sales

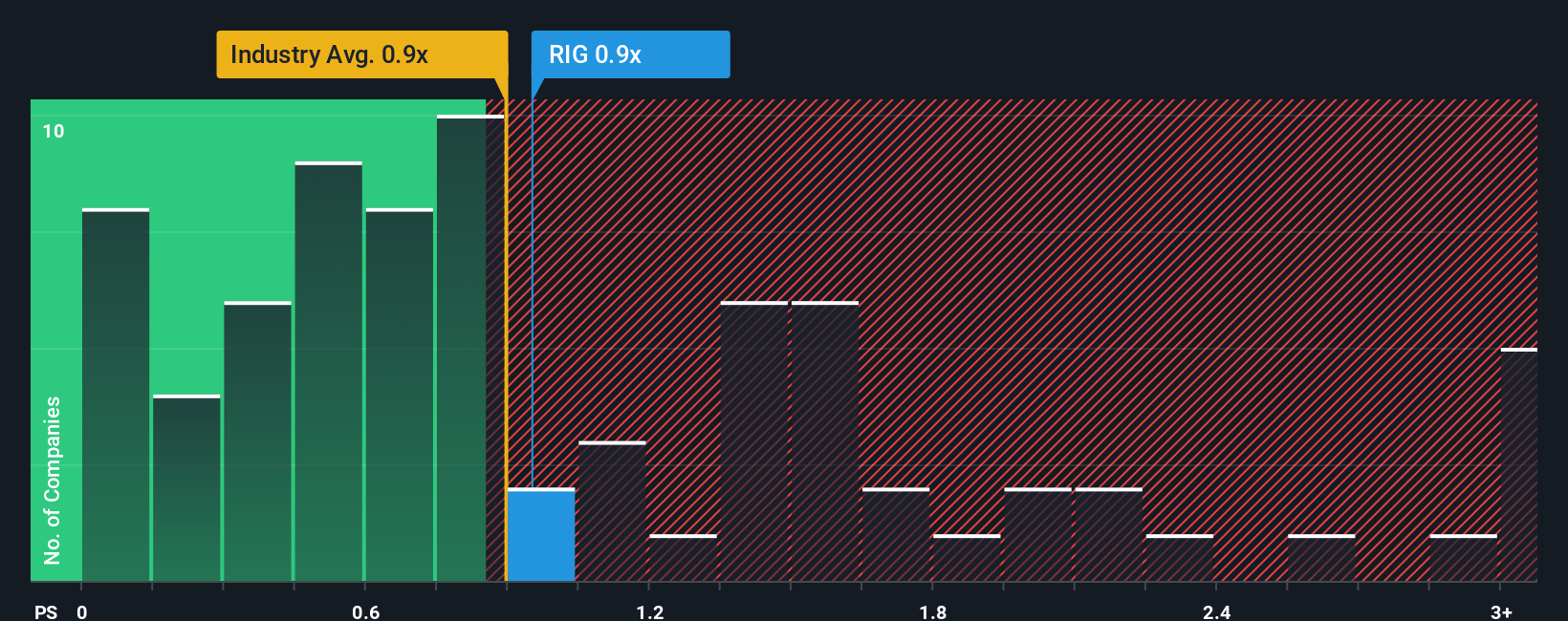

For many companies in the energy services sector, the Price-to-Sales (P/S) ratio is a preferred valuation metric, especially when profitability is volatile or negative. The P/S ratio offers a straightforward way to compare how investors are valuing each dollar of a company’s sales, making it a relevant choice for Transocean at this stage of its financial cycle.

Growth expectations and perceived risks play major roles in determining what a fair or typical P/S ratio should be. Higher expected growth or lower risk usually supports a higher ratio, while companies with slower growth or greater uncertainties tend to trade at lower multiples.

Transocean currently trades on a P/S ratio of 1.24x. This is slightly above the Energy Services industry average of 1.01x and also marginally higher than the average for its closest peers at 1.10x. However, Simply Wall St’s proprietary Fair Ratio, which incorporates important factors such as revenue growth, profit margins, risk profile, market capitalization, and industry context, suggests a fair value multiple for Transocean of 1.02x.

The Fair Ratio often delivers a more individualized benchmark than industry averages because it takes into account the company’s specific dynamics and future prospects, not just broad sector trends.

With Transocean’s actual P/S ratio only 0.22x above its Fair Ratio, the valuation looks balanced in this context, neither notably undervalued nor excessively stretched.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Transocean Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your story behind a company—how you connect headlines, forecasts, and your own views to specific financial estimates, like expected revenue or profit margins, and ultimately to what you see as fair value.

Narratives help you move beyond just numbers by weaving together your assumptions with a company's unique journey. This might include how you interpret recent contract wins, shifts in the rig market, or future industry changes. On Simply Wall St's Community page, millions of investors use Narratives as an easy, accessible way to clarify their investment thinking and instantly see how their outlook compares to others.

With Narratives, you can track whether you would buy, hold, or sell by directly comparing your Fair Value (based on your story) to the latest Price. The tool automatically updates when new news, contracts, or results come out. For example, one Transocean investor may see high-margin contracts and a tightening rig market as reasons for a bullish Narrative, driving a Fair Value of $5.50. Another, more cautious investor may focus on debt and crude price risks, resulting in a Fair Value as low as $2.50.

Do you think there's more to the story for Transocean? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RIG

Transocean

Provides offshore contract drilling services for oil and gas wells in Switzerland and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026