- United States

- /

- Oil and Gas

- /

- NYSE:PARR

Par Pacific (PARR): Loss Reduction Rate of 41.2% Challenges Persistent Bearish Narratives

Reviewed by Simply Wall St

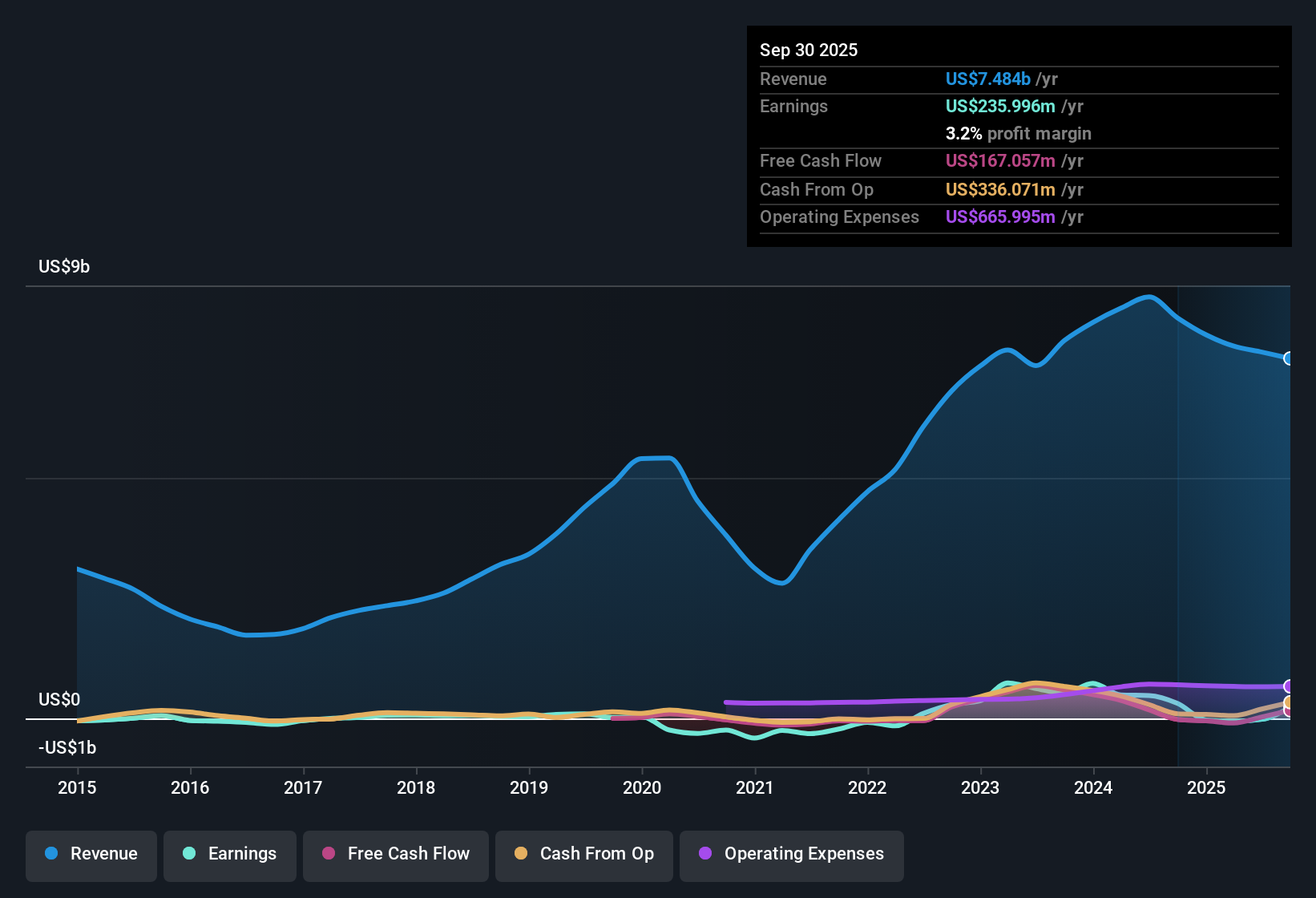

Par Pacific Holdings (PARR) remains unprofitable, but has managed to cut its losses at an impressive clip of 41.2% per year over the past five years. Investors are eyeing a projected 0.4% annual revenue decline over the next three years and continue to grapple with both negative net profit margins and ongoing poor earnings quality, as the company shows no signs of recent profitability to benchmark against previous years. With margins under pressure, the latest results set the stage for a key debate around value versus performance in this earnings cycle.

See our full analysis for Par Pacific Holdings.Next up, we’re stacking these headline results against the top investor narratives for Par Pacific to highlight where market stories meet and where they collide.

See what the community is saying about Par Pacific Holdings

Margins Projected to Swing Positive

- Analysts expect Par Pacific's profit margin to rise from -0.3% to 6.3% over the next three years, marking a material turnaround from current negative earnings quality.

- Consensus narrative suggests that operational improvements and growing demand, especially from tight US West Coast markets, are supporting stable margins and could enable this profit margin jump.

- Near-record throughput in Hawaii and strategic partnerships in renewables are highlighted as key factors underpinning this margin recovery.

- Ongoing regulatory incentives and supply constraints are also seen as contributors to sustained margin improvement according to analysts’ consensus view.

- Strong regional demand and efficiency gains may finally deliver long-awaited margin stability. Get the full data-driven story in the consensus narrative. 📊 Read the full Par Pacific Holdings Consensus Narrative.

Analyst Price Target and Share Count Trends Diverge

- Analysts set a price target of $40.75, almost matching the current share price of $37.63, while projecting the number of shares outstanding to decline by 7.0% annually over the next three years.

- Consensus narrative points out a split among analysts, where the small gap between price and target suggests muted upside, but buybacks and share count reduction could boost per-share metrics.

- The current price-to-earnings trajectory assumes a rebound from -85.6x PE to 4.0x by 2028 if earnings fully materialize.

- This possible PE normalization would land Par Pacific well below the sector average of 13.2x, raising questions about whether the current price already reflects most of the anticipated improvements.

DCF Suggests Deep Discount to Fair Value

- Par Pacific trades at a share price of $37.63, which is well below its DCF fair value estimate of $58.65, a discount of more than 35 percent, while its price-to-sales ratio of 0.3x remains below industry and peer averages.

- Consensus narrative highlights that while analysts’ price targets are far more conservative than the DCF model, the combination of low valuation multiples alongside expected earnings recovery keeps alive the debate on how much discount is actually warranted.

- Analysts view Par Pacific’s good relative and overall value as a bright spot, tempered by ongoing profitability challenges and sector transition risks.

- Bears argue that structural headwinds, like high leverage and uncertainty around refinery assets, justify a larger discount, even if headline valuation looks appealing by the numbers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Par Pacific Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the results? Share your perspective and build your own narrative with just a few clicks: Do it your way

A great starting point for your Par Pacific Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite valuation optimism and planned margin recovery, Par Pacific’s profitability remains under pressure because of persistent negative earnings, high leverage, and sector headwinds.

If you want to avoid companies weighed down by debt and financial instability, use our solid balance sheet and fundamentals stocks screener (1979 results) to target businesses with stronger balance sheets and a healthier outlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PARR

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives