- United States

- /

- Oil and Gas

- /

- NYSE:OVV

NuVista Acquisition And New Coverage Could Be A Game Changer For Ovintiv (OVV)

Reviewed by Sasha Jovanovic

- In recent days, William Blair began covering Ovintiv Inc. with an Outperform rating, highlighting the company’s completed acquisition of NuVista and its projected 2026 production contribution of 100,000 barrels of oil equivalent per day.

- The firm also pointed to Ovintiv’s established infrastructure in the Montney and Permian basins and potential asset sales as key levers for delivering shareholder returns via dividends and buybacks.

- We’ll now assess how William Blair’s upbeat initiation, especially its focus on the NuVista acquisition, reshapes Ovintiv’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ovintiv Investment Narrative Recap

To own Ovintiv, you generally need to believe in the value of scale and infrastructure in North American shale and the company’s ability to turn that into durable free cash flow, despite recent earnings pressure and high leverage. William Blair’s upbeat initiation around the NuVista acquisition reinforces the production growth side of the story, but does not materially change the near term risk that weaker margins and high capital needs could constrain how much cash reaches shareholders.

Among recent announcements, Ovintiv’s ongoing US$0.30 per share quarterly dividend and active buyback program, including repurchasing about US$304.0 million of stock since late 2024, are most directly connected to William Blair’s thesis around dividends and buybacks as key return levers. These actions underline that capital returns are already a live catalyst, but they also put a sharper spotlight on whether future production and pricing can consistently support them.

Yet behind the NuVista growth story, investors should be aware of how concentrated exposure to North American shale could...

Read the full narrative on Ovintiv (it's free!)

Ovintiv’s narrative projects $8.6 billion revenue and $2.3 billion earnings by 2028.

Uncover how Ovintiv's forecasts yield a $51.82 fair value, a 23% upside to its current price.

Exploring Other Perspectives

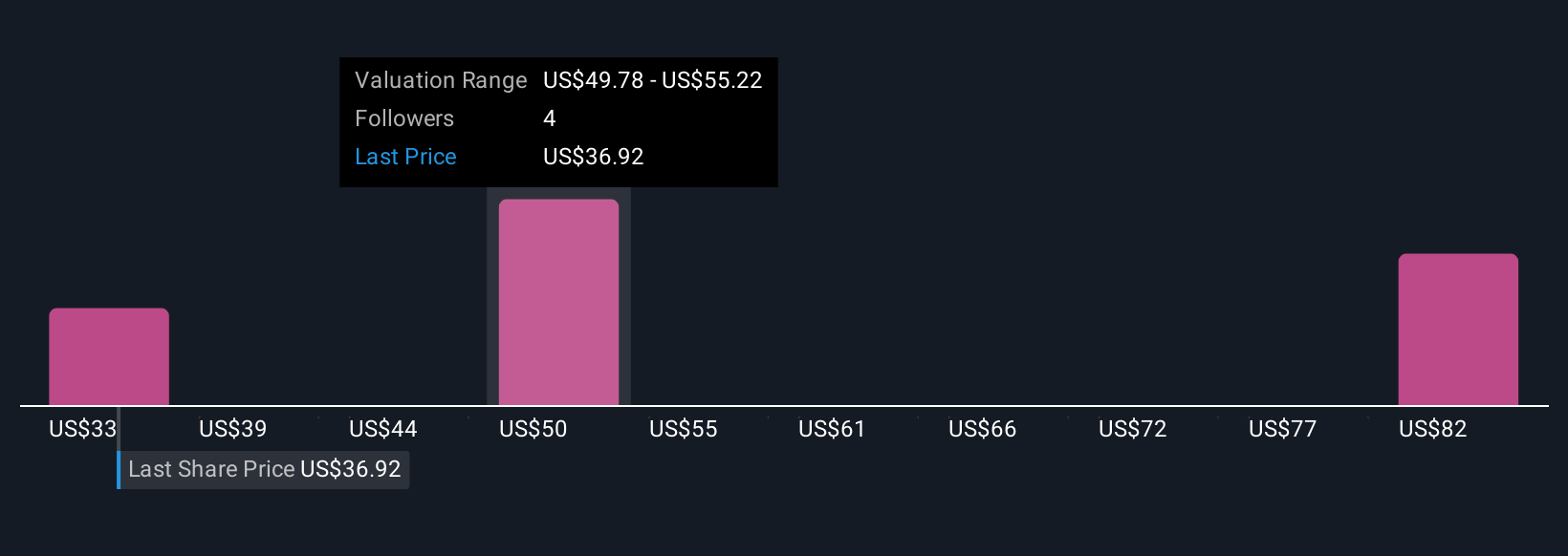

Five members of the Simply Wall St Community currently value Ovintiv anywhere between about US$33 and US$223 per share, with estimates spread across the entire range. When you set these views against the company’s reliance on North American shale and the risk of basin specific downturns, it becomes clear that you should compare several perspectives before forming a view on Ovintiv’s potential performance.

Explore 5 other fair value estimates on Ovintiv - why the stock might be worth 21% less than the current price!

Build Your Own Ovintiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ovintiv research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Ovintiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ovintiv's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OVV

Ovintiv

Explores, develops, produces, and markets natural gas, oil, and natural gas liquids in North America.

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026