- United States

- /

- Oil and Gas

- /

- NYSE:OKE

ONEOK (OKE): Weighing Valuation After a Recent Share Price Rebound

Reviewed by Simply Wall St

ONEOK (OKE) has quietly outperformed the broader energy space over the past month, with the stock up about 12% and roughly 7% in the past 3 months, despite a weak year to date.

See our latest analysis for ONEOK.

That recent strength sits against a tougher backdrop, with the share price at $76.34 after a weak year to date share price return but still supported by a solid multi year total shareholder return, suggesting momentum in sentiment may be turning upward again.

If ONEOK’s rebound has you thinking about what else might surprise to the upside, this is a good moment to explore fast growing stocks with high insider ownership.

With shares still down sharply for the year but trading at a hefty intrinsic discount and below analyst targets, are investors being offered a mispriced midstream cash machine, or is the market already factoring in the next leg of growth?

Most Popular Narrative Narrative: 14.5% Undervalued

With ONEOK last closing at $76.34 against a narrative fair value near $89, the storyline leans toward upside as cash flows compound.

Persistent growth in global demand for U.S. natural gas and NGLs, driven by increasing international energy needs and continued coal-to-gas switching, supports long-term volume throughput and higher utilization rates across ONEOK's midstream and export infrastructure. This directly underpins future revenue and EBITDA growth. Ongoing expansions and capital investments in key areas like the Permian and Delaware Basins (for example, new processing plants and pipeline connections) position ONEOK to capture incremental fee-based volumes and benefit from robust U.S. shale production, leading to higher top-line growth and enhanced earnings stability.

Want to see the math behind this upside case? The narrative leans on firm volume growth, richer margins, and a future earnings multiple few midstream names command. Curious which assumptions really move the fair value line?

Result: Fair Value of $89.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, earnings remain vulnerable to narrower commodity spreads and elevated post acquisition leverage, which could delay synergy capture and put pressure on the upside case.

Find out about the key risks to this ONEOK narrative.

Another Lens on Value

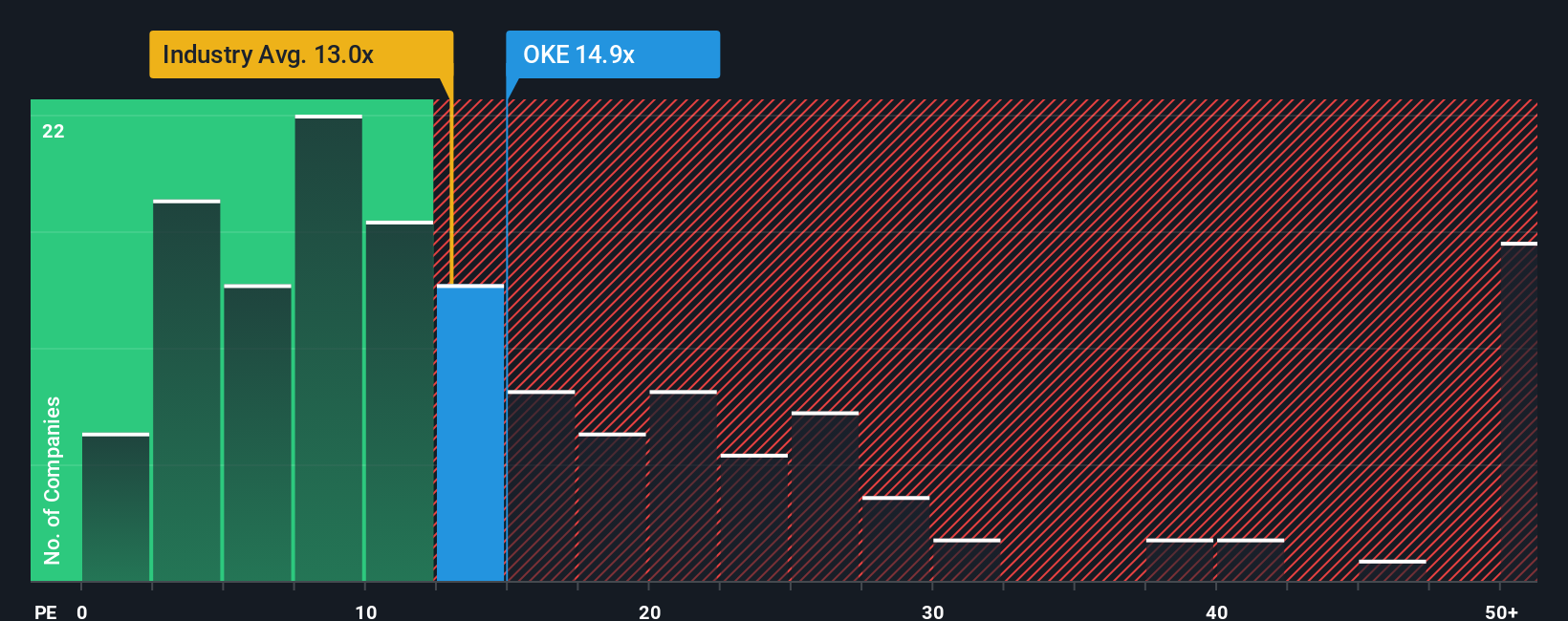

On earnings, ONEOK looks far cheaper than the narrative suggests. At 14.4 times earnings it trades below peers at 15.4 times, yet well under a 20 times fair ratio, which points to meaningful re rating potential if sentiment normalizes and execution stays on track. Is the market mispricing this cash generator?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ONEOK Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in under three minutes: Do it your way.

A great starting point for your ONEOK research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready For Your Next Move?

Do not stop with ONEOK alone. Sharpen your edge by scanning fresh opportunities others overlook, before the crowd catches on and prices move away.

- Capitalize on Wall Street missteps by targeting potential bargains through these 907 undervalued stocks based on cash flows that flag companies trading below their cash flow potential.

- Ride powerful structural trends by focusing on innovation driven businesses using these 26 AI penny stocks that could reshape entire industries.

- Strengthen your income strategy with these 15 dividend stocks with yields > 3% that spotlight companies offering yields above 3% without ignoring financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026