- United States

- /

- Oil and Gas

- /

- NYSE:OKE

ONEOK (OKE) Expands Joint Venture With Eiger Express Pipeline Project Launch

Reviewed by Simply Wall St

ONEOK (OKE) recently announced a joint venture with WhiteWater, MPLX, and Enbridge to construct the Eiger Express Pipeline, enhancing its strategic initiatives in natural gas transportation. Over the past week, the company's stock price moved 2.5%, which aligns with a generally mixed market performance, as major indexes were mixed with slight declines or gains. While the overall market had a flat week, ONEOK's involvement in this pipeline project and potential benefits from increased transport capacity could have provided some support to its stock movement, balancing broader market trends including Nvidia's earnings focus and broader economic signals.

We've discovered 1 possible red flag for ONEOK that you should be aware of before investing here.

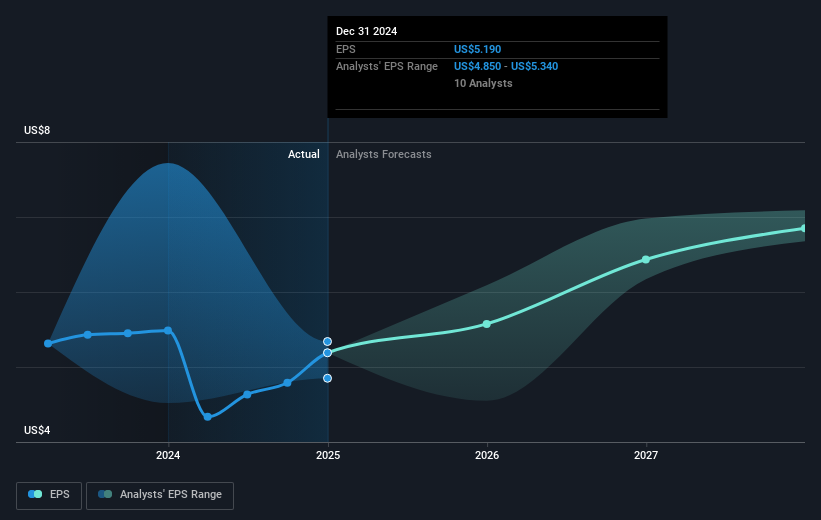

The collaboration to construct the Eiger Express Pipeline could significantly influence ONEOK's narrative, especially in enhancing its natural gas transport capacity. This expansion aligns with the company's broader initiatives of capturing growing U.S. and global energy demand. The project's success may bolster ONEOK's revenue and earnings forecasts, supporting its stable revenue and improved margins narrative. This development, if realized as expected, reinforces the long-term strategic positioning of ONEOK in the energy sector, potentially translating into better shareholder returns in the coming years.

Over the longer term, ONEOK’s total shareholder returns were very large at 270.27% over five years, reflecting its growth and effective capital allocation strategies. This strong performance starkly contrasts with its one-year return, where it underperformed the U.S. market which returned 15.9%, and the U.S. oil and gas industry, which returned 1% decline. Despite this, the company's past five-year performance suggests strong fundamental growth, underpinning its competitive positioning in the industry.

Regarding its current share price of $74.84, the company's stock has a consensus analyst price target of $98.5, indicating a 31.61% potential upside. This substantial potential gain, if realized, underscores the market's optimistic outlook towards ONEOK's growth prospects and profitability, despite current valuation challenges. The anticipated revenue and earnings growth expectations, alongside this collaborative pipeline project, may further cement investor confidence in achieving these targets.

Understand ONEOK's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026