- United States

- /

- Oil and Gas

- /

- NYSE:NAT

Nordic American Tankers (NAT): Profit Margin Falls to 0.6%, Challenging Bullish Dividend Narrative

Reviewed by Simply Wall St

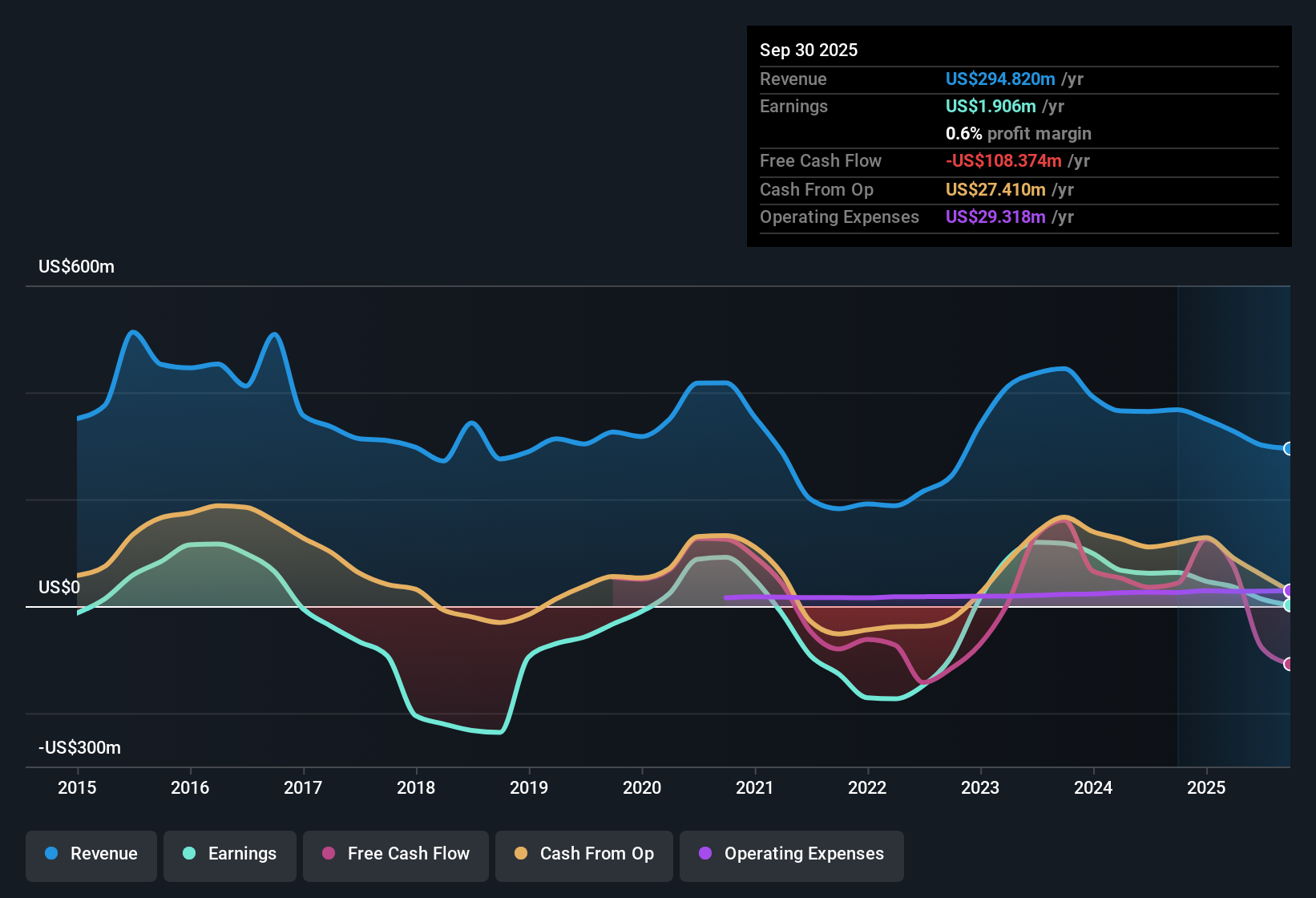

Nordic American Tankers (NAT) just posted its Q3 2025 results, reporting revenue of $45.7 million and a basic EPS of -$0.013. The company has seen revenue fluctuate over recent quarters, moving from $52.0 million in Q3 2024 to $40.2 million in Q2 2025 before rebounding in the latest quarter. Margins remain under pressure, and investors will be watching closely to see if improving EPS forecasts can counter the recent softness in profitability.

See our full analysis for Nordic American Tankers.Now, we stack these earnings numbers against the prevailing market narratives to see where reality meets expectations and where opinions might shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Drops to 0.6%

- Trailing twelve-month net profit margin slid sharply, ending at just 0.6% compared to 17.1% the previous year, with the latest net income totaling $1.91 million.

- The prevailing market view spotlights the dramatic margin drop, tying it to a material one-off gain of $16.6 million that inflated results for the period.

- Analysts expect NAT's earnings per share to grow at 80.7% per year going forward. However, consensus notes this optimism is undercut by tighter margins and an outlook for revenue to decline at -1.3% per year.

- Questions are also swirling around the durability of profitability, as net income fell despite rising quarter-on-quarter revenue.

To see what’s behind the margin pressure and where analysts see value despite it, browse the latest detailed consensus view. 📊 Read the full Nordic American Tankers Consensus Narrative.

Dividend Coverage Remains Thin

- The current dividend yield stands high at 9.34%, but reported earnings and free cash flow are not covering payouts. Current earnings and free cash flows are insufficient relative to the dividend commitment.

- Narrative commentary highlights ongoing financial sustainability concerns, as interest payments are not well covered by current earnings and the payout ratio is stretched.

- Consensus expectation for strong future earnings growth is at direct odds with today's thin coverage, leading some to worry about longer-term dividend reliability unless profit margins improve.

- This tension is amplified by signs that NAT is prioritizing yield even as net profit margins fall to multi-year lows, increasing reliance on improved future earnings that are not yet visible in trailing data.

Trading Above Fair Value

- NAT’s share price of $3.64 is currently above its DCF fair value of $2.31, and its price-to-sales ratio is higher than the broader US oil and gas industry but lower than its closest peers.

- Consensus market analysis points out that despite the richer valuation, NAT still stands out for relative value among direct peers. Investors are weighing up high earnings growth forecasts against headwinds in current margins and dividend coverage.

- Trading above fair value may limit near-term upside unless margin or growth surprises materialize. This is a central narrative stance given sector volatility and NAT’s cyclical business environment.

- While stronger EPS growth is expected, the stock’s premium pricing could make it vulnerable if future results do not deliver on the optimism baked into the market price.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Nordic American Tankers's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

NAT is struggling with overstretched dividend payouts and thin coverage. This raises serious questions about its ability to sustain returns at current levels.

If reliable income matters most, uncover opportunities with stronger payout security by checking out these 1929 dividend stocks with yields > 3% to find stocks consistently supporting healthy dividends with robust earnings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordic American Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NAT

Nordic American Tankers

A tanker company, owns, operates, and charters double-hull tankers in Bermuda and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026