- United States

- /

- Oil and Gas

- /

- NYSE:MPLX

Oneok-MPLX Texas Export Terminal Project Might Change The Case For Investing In MPLX (MPLX)

Reviewed by Sasha Jovanovic

- Earlier this week, Oneok and MPLX jointly announced a US$1.75 billion investment in a new Texas City export terminal and connecting pipeline, marking a significant addition to the Houston area’s midstream energy infrastructure.

- This collaboration highlights growing momentum behind U.S. export infrastructure development, with both companies seeking to expand their reach in a key energy hub.

- We'll assess how MPLX's expanded export capacity through this joint project may influence its long-term growth and capital return outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

MPLX Investment Narrative Recap

MPLX shareholders must believe in the enduring demand for U.S. energy infrastructure and the company's ability to capitalize on export growth from key regions like Houston and the Permian Basin. The recent partnership with Oneok to develop a US$1.75 billion Texas City export terminal expands MPLX’s export capacity, but does not meaningfully reduce near-term risks tied to market or regulatory headwinds that can impact return on new investments.

Among recent announcements, the 12.5% increase in MPLX’s quarterly dividend stands out. A strengthened distribution underscores management’s confidence in cash flow durability, an important point, given the sizable capital commitments like the new Houston project that will test MPLX’s ability to deliver long-term returns and sustain payout growth.

In contrast, investors should also keep a close eye on how expanding capital expenditures might magnify balance sheet and refinancing risks if...

Read the full narrative on MPLX (it's free!)

MPLX's narrative projects $14.0 billion in revenue and $5.3 billion in earnings by 2028. This requires 6.8% yearly revenue growth and a $1.0 billion increase in earnings from the current $4.3 billion.

Uncover how MPLX's forecasts yield a $57.29 fair value, a 5% upside to its current price.

Exploring Other Perspectives

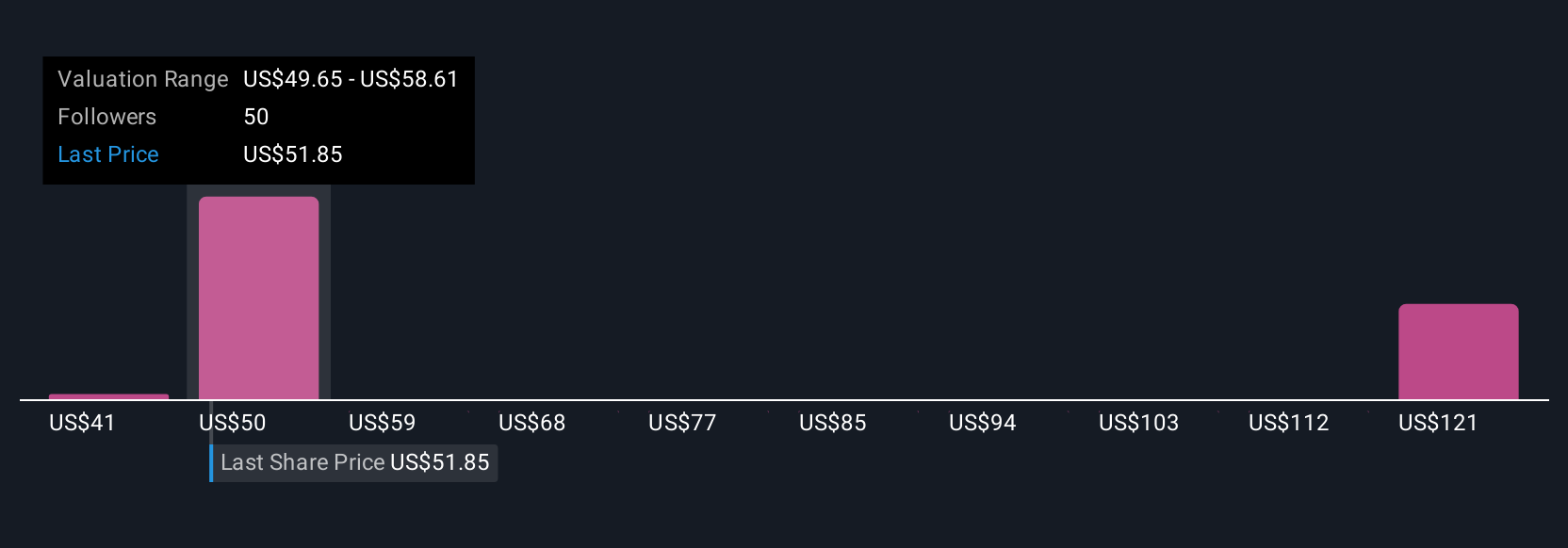

Simply Wall St Community contributors value MPLX between US$41.26 and US$123.25, with seven different perspectives represented. While many see catalysts in export and pipeline growth, the potential for overbuilding or pressured returns could weigh on market outcomes, explore the full spectrum of investor viewpoints for deeper insight.

Explore 7 other fair value estimates on MPLX - why the stock might be worth 24% less than the current price!

Build Your Own MPLX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MPLX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MPLX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MPLX's overall financial health at a glance.

No Opportunity In MPLX?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPLX

MPLX

Owns and operates midstream energy infrastructure and logistics assets primarily in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026