- United States

- /

- Oil and Gas

- /

- NYSE:MPC

How Investors May Respond To Marathon Petroleum (MPC) Higher Q3 Earnings, Buyback, and Leadership Change

Reviewed by Sasha Jovanovic

- Marathon Petroleum recently reported its third quarter 2025 results, highlighted by a significant increase in net income to US$1.37 billion and basic earnings per share rising to US$4.51, alongside the completion of a US$650 million share repurchase tranche and an upcoming leadership transition with Maryann T. Mannen appointed as future chairman of the board.

- These developments showcase both strengthened operational performance and ongoing commitment to capital returns, while marking a leadership succession that may influence future company direction.

- As the company posts higher quarterly earnings and finalizes a substantial buyback, we’ll explore what these events mean for its investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Marathon Petroleum Investment Narrative Recap

To be a Marathon Petroleum shareholder today, you need to believe that strong, sustained demand for refined products and the company’s continued focus on shareholder returns will outweigh long-term challenges from industry decarbonization and shifting energy policy. The latest quarterly earnings beat and buyback completion reinforce both near-term momentum and capital strength, but do not materially shift the biggest short-term catalyst, ongoing robust US fuel demand, or the key risk of demand erosion from electrification and renewables.

Among recent updates, the US$650 million share repurchase stands out for its relevance to the company's returns-focused strategy. Regular buybacks have helped support earnings per share, which remains a main driver of shareholder value, especially as capital allocation discipline becomes an increasingly important catalyst amid uncertain industry growth rates.

By contrast, investors should be aware of the risk that even consistently strong capital returns may not offset structurally declining fuel demand if electrification continues to accelerate...

Read the full narrative on Marathon Petroleum (it's free!)

Marathon Petroleum's narrative projects $123.8 billion in revenue and $4.2 billion in earnings by 2028. This assumes a 2.6% annual revenue decline and an increase of $2.1 billion in earnings from the current $2.1 billion.

Uncover how Marathon Petroleum's forecasts yield a $197.50 fair value, in line with its current price.

Exploring Other Perspectives

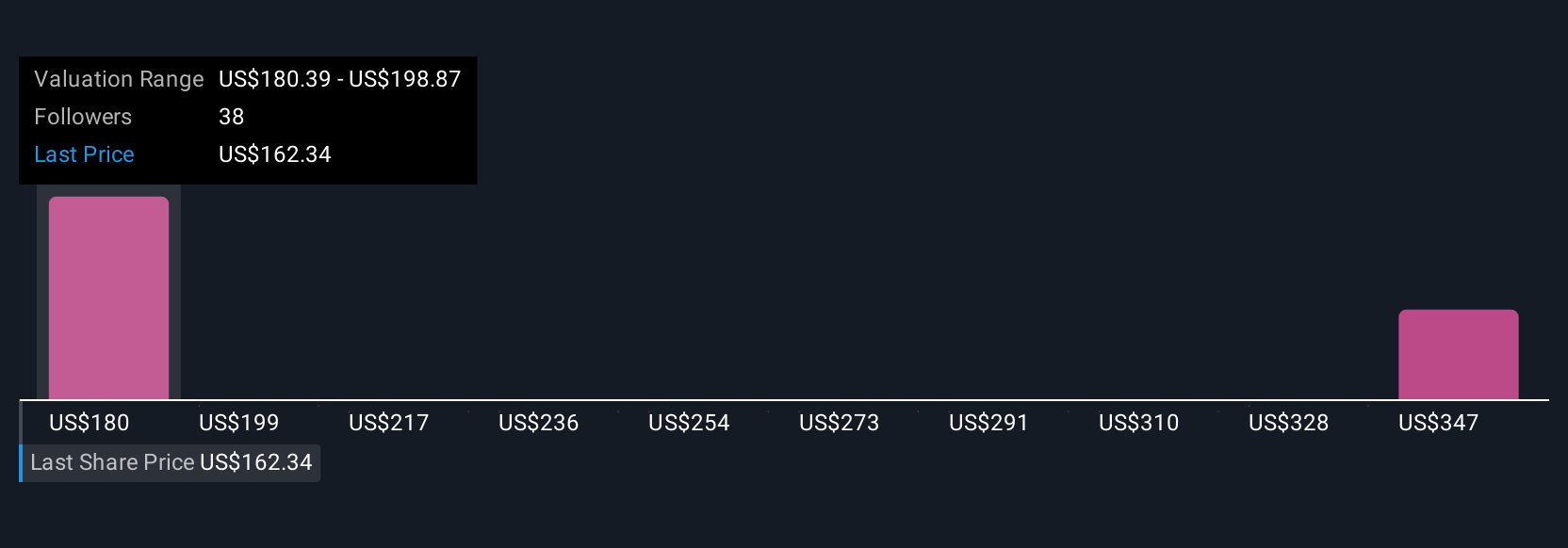

Four private investors from the Simply Wall St Community estimate Marathon Petroleum’s fair value between US$197.50 and US$566.45 per share. This spectrum sits against the backdrop of consistent buybacks supporting earnings per share, offering plenty of room for you to explore contrasting opinions.

Explore 4 other fair value estimates on Marathon Petroleum - why the stock might be worth over 2x more than the current price!

Build Your Own Marathon Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marathon Petroleum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Marathon Petroleum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marathon Petroleum's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives