- United States

- /

- Oil and Gas

- /

- NYSE:MGY

Magnolia Oil & Gas (MGY): Margin Compression Counters Bullish Narratives Despite Solid Long-Term Profitability

Reviewed by Simply Wall St

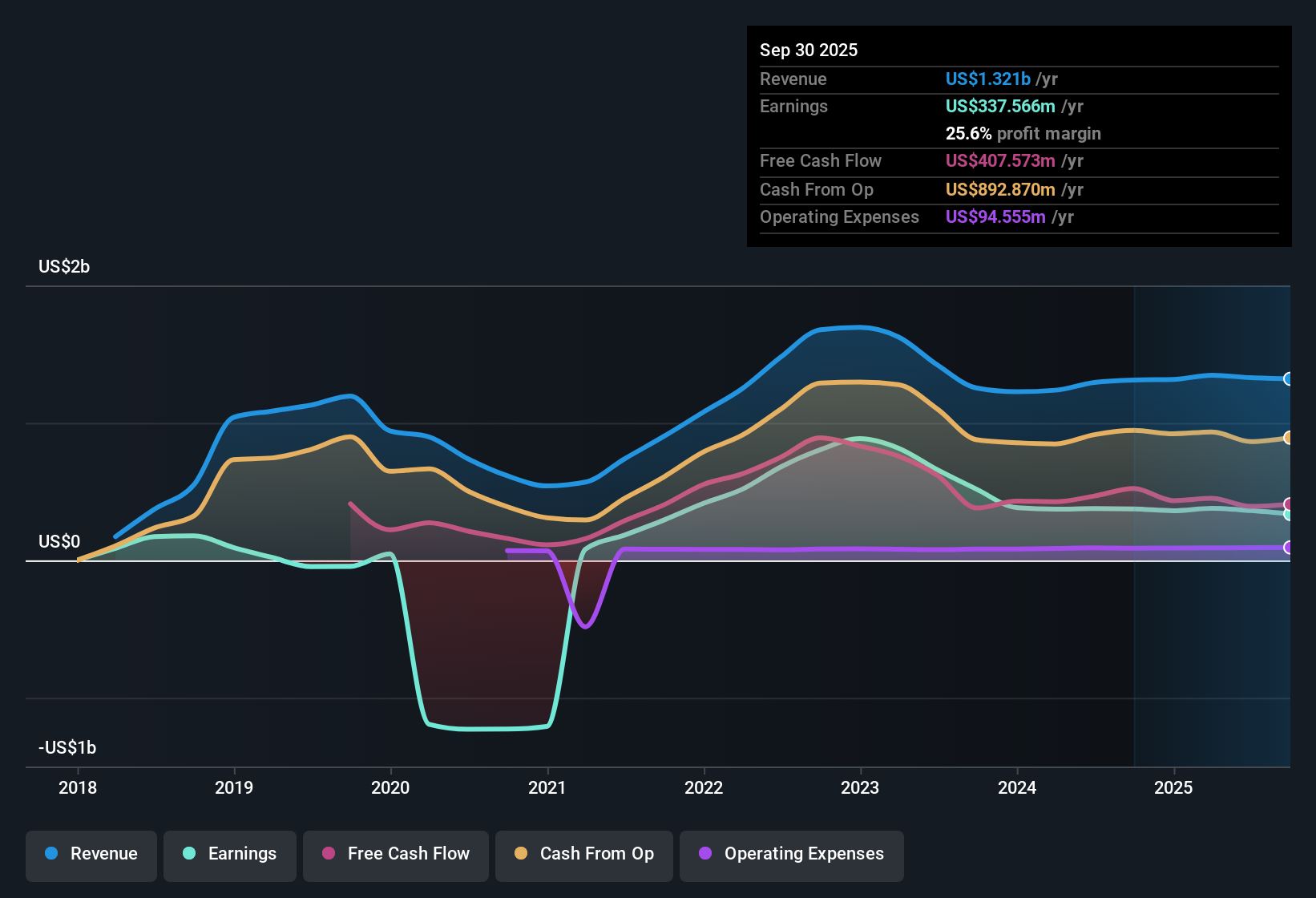

Magnolia Oil & Gas (MGY) is forecast to grow earnings by 8.2% per year, while revenue is expected to increase at an annual rate of 5.3%. The company’s current profit margin stands at 25.6%, down from 28.5% last year. Over the past five years, Magnolia has transitioned to profitability with annual earnings growth of 30.5%. Investors are likely taking note, as the stock trades at $22.41 per share, a Price-to-Earnings ratio of 12.3x, and high earnings quality even though recent earnings growth has not been positive.

See our full analysis for Magnolia Oil & Gas.Now, it’s time to see how these headline numbers stack up against the most widely held narratives about Magnolia Oil & Gas. This is where expectations meet reality.

See what the community is saying about Magnolia Oil & Gas

Margins Stabilize Despite Pullback

- Magnolia's current profit margin is 25.6%, slightly lower than last year’s 28.5%, but still robust for the sector.

- Analysts' consensus view highlights that strong operational performance and premium asset quality are driving reliable long-term profitability. This is demonstrated by the company’s ability to maintain margins in a volatile price environment.

- Consistent operational outperformance, including better-than-modeled well results and resilient production growth, supports the case for stable net margins and returns on capital above industry averages.

- Sustained capital discipline and a lower reinvestment rate have improved the operating cost structure. This reinforces per-share earnings even as commodity prices fluctuate.

Consensus narrative suggests the durability of these profit margins may set Magnolia apart from peers in the sector. 📊 Read the full Magnolia Oil & Gas Consensus Narrative.

Buybacks Set to Accelerate Per-Share Growth

- Analysts expect the number of shares outstanding to decline by 3.01% per year over the next three years, magnifying future earnings per share growth for existing shareholders.

- Analysts' consensus view points out that disciplined capital management and ongoing buybacks directly boost shareholder returns.

- Below-guidance reinvestment rates are freeing up cash for buybacks and dividends. This helps deliver more value to shareholders even as revenue grows at a measured pace.

- Strong free cash flow from high-return core acreage positions Magnolia to both fund growth and return capital, increasing per-share earnings even in a volatile market.

DCF Fair Value Implies Substantial Upside

- The current share price of $22.41 trades at a steep discount not only to peer averages but also to the DCF fair value estimate of $85.38, indicating the potential for significant upside if revenue and margin assumptions are met.

- Analysts' consensus view notes that while the Price-to-Earnings ratio of 12.3x is slightly below the US oil and gas industry average, investors remain focused on Magnolia’s stable profitability and measured forward growth.

- The consensus analyst price target of $26.88 is 13% higher than today’s share price, signaling broad market belief in the company’s long-term prospects.

- Sustained operational performance alongside successful acquisitions and stable profit margins are seen as catalysts for eventually closing the gap towards fair value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Magnolia Oil & Gas on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Put your view in motion and craft a unique narrative for Magnolia Oil & Gas in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Magnolia Oil & Gas.

See What Else Is Out There

Magnolia’s margins have slipped from last year, and recent earnings growth has stalled. This raises questions about the company’s ability to deliver consistently over time.

If you want stable performers instead, use our stable growth stocks screener (2113 results) to spot companies that maintain steady earnings and revenue growth through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MGY

Magnolia Oil & Gas

An independent oil and natural gas company, engages in the acquisition, development, exploration, and production of oil, natural gas, and natural gas liquids reserves in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives