- United States

- /

- Oil and Gas

- /

- NYSE:INSW

Will Lowered Analyst Estimates Reshape International Seaways’ (INSW) Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- International Seaways recently saw analysts revise their consensus earnings estimates downward for the September 2025 quarter, citing weaker expected revenues and changing business conditions.

- This latest shift in analyst sentiment comes despite the company's historical tendency to surpass earnings forecasts in previous quarters.

- We’ll examine how analysts’ more negative earnings outlook now influences International Seaways’ overall investment narrative and future prospects.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

International Seaways Investment Narrative Recap

To be a shareholder of International Seaways, you need confidence in the longevity of seaborne crude and product transport, especially as trade route complexity and fleet renewal could drive future utilization. The latest downward revisions in analyst earnings estimates for September 2025 do point to immediate headwinds, but they do not fundamentally change the primary catalyst for the stock, potential upside from extended shipping routes fueled by shifts in global refining capacity. The most substantial short-term risk remains exposure to volatile tanker spot markets, especially if demand softens. Among recent company developments, the September 2025 issuance of US$250 million in senior unsecured bonds stands out. This move was intended to fund the repurchase of six VLCCs and support general corporate purposes. While not directly related to analysts’ revised earnings outlook, the bond issuance helps ensure financial flexibility and continued fleet modernization, key to capturing future trade route opportunities. In contrast, with spot market dependence still a major risk, investors should be aware of...

Read the full narrative on International Seaways (it's free!)

International Seaways' narrative projects $848.0 million revenue and $288.7 million earnings by 2028. This requires 2.0% yearly revenue growth and an increase of $50.1 million in earnings from $238.6 million today.

Uncover how International Seaways' forecasts yield a $56.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

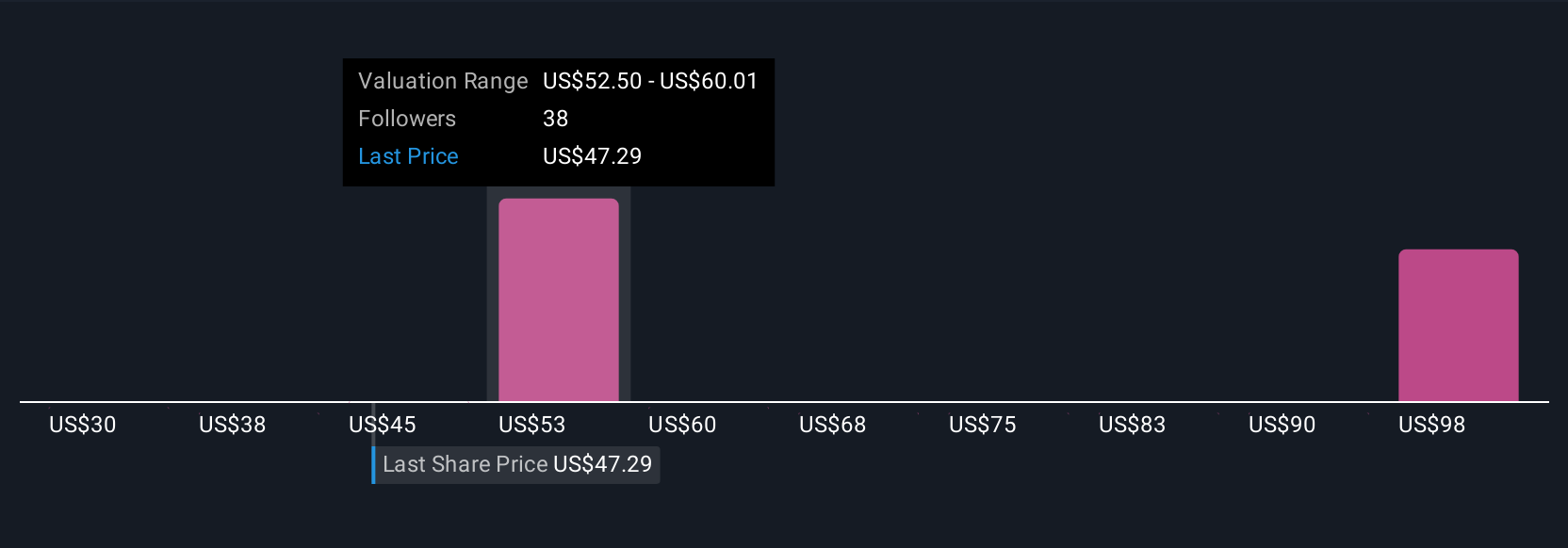

Six fair value estimates from the Simply Wall St Community range widely, from US$30 to US$107.46. Against this backdrop of diverging opinions, consider that reliance on the volatile spot market remains a near-term risk to stability and future returns.

Explore 6 other fair value estimates on International Seaways - why the stock might be worth over 2x more than the current price!

Build Your Own International Seaways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Seaways research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free International Seaways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Seaways' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSW

International Seaways

Owns and operates a fleet of oceangoing vessels for the transportation of crude oil and petroleum products in the international flag trade.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026