- United States

- /

- Oil and Gas

- /

- NYSE:GEL

Genesis Energy (GEL): Evaluating Valuation After Third Quarter Profit Return and Recent Share Price Surge

Reviewed by Simply Wall St

Genesis Energy (GEL) just released its third quarter earnings, moving from a net loss last year to a modest net income. The company also reported revenue growth for the quarter. Still, it faces a significant year-to-date net loss.

See our latest analysis for Genesis Energy.

Genesis Energy’s share price has surged 53% year to date, with much of that strength coming in recent weeks as traders responded to the company’s jump back to quarterly profitability. While the short-term trend is positive, the long-term total shareholder return of over 270% in five years shows how momentum has shifted in this turnaround story.

If you’re looking to broaden your search after Genesis Energy’s latest earnings swing, now is the perfect moment to check out fast growing stocks with high insider ownership.

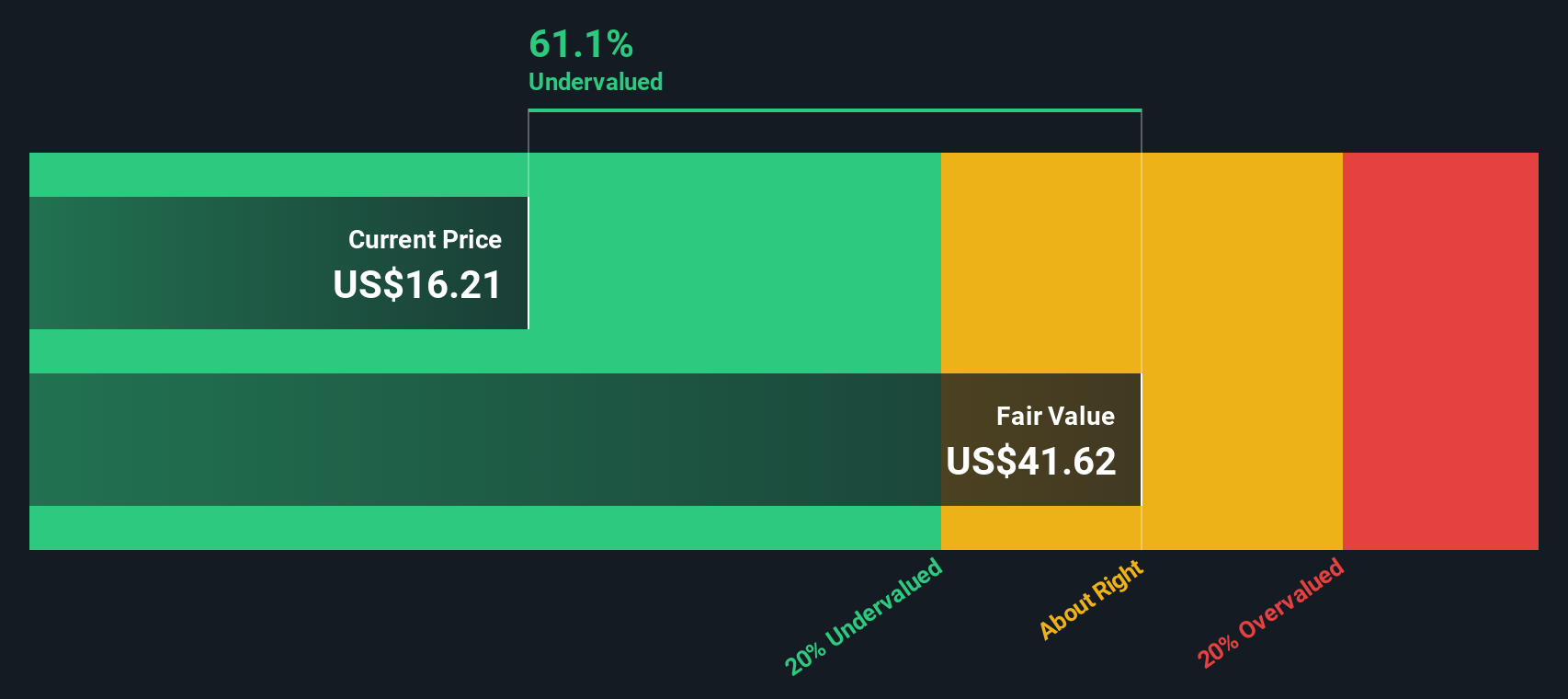

After such a sharp rebound in share price and a swing back to profitability this quarter, investors are left debating whether Genesis Energy remains undervalued or if the market is already pricing in future growth. Could there still be a buying opportunity here?

Price-to-Sales Ratio of 0.7x: Is it justified?

Genesis Energy’s stock currently trades at a price-to-sales (P/S) ratio of 0.7x, marking it as inexpensive compared to both industry peers and broader market multiples. The last close price sits at $16.11, reflecting consensus that the shares trade below typical valuations for this sector.

The price-to-sales ratio compares a company’s market capitalization directly to its annual revenues, providing a straightforward metric for investors to assess how much they are paying for every dollar of sales. For energy companies like Genesis Energy, this multiple is relevant because earnings can be volatile. Revenue provides a more stable picture of the business’s scale and pricing by the market.

Genesis Energy trades at a P/S multiple far below industry averages and its peer group. Its 0.7x multiple is well under the US Oil and Gas industry average of 1.4x and the peer group average of 2.2x. However, it is notably above the calculated fair P/S ratio of just 0.2x, indicating that while the share price looks attractive relative to peers, there could still be room for downward adjustment if sentiment were to shift toward a fair-value benchmark.

Explore the SWS fair ratio for Genesis Energy

Result: Preferred multiple of Price-to-Sales 0.7x (UNDERVALUED)

However, the company's negative annual revenue growth and ongoing net loss could quickly shift sentiment if improvements do not materialize in the coming quarters.

Find out about the key risks to this Genesis Energy narrative.

Another View: Our DCF Model Agrees

Looking at Genesis Energy through the lens of our DCF model tells a similar story. The SWS DCF model estimates fair value at $48.51, which is much higher than the current share price of $16.11. This suggests the company is significantly undervalued according to projected cash flows. Does this second valuation give investors extra reason to pay attention, or could risks undermine the optimistic view?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Genesis Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Genesis Energy Narrative

If you want to dig deeper or follow your own path, you can easily build a personalized analysis of Genesis Energy in just a few minutes. Do it your way

A great starting point for your Genesis Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities go fast. Don’t let your next big winner slip away when you could be watching the latest trends unfold right now.

- Unlock the potential of tomorrow’s markets by scanning these 28 quantum computing stocks for companies that are pioneering advances in next-generation computing and transformative technology.

- Grow your passive income stream by seeking out these 16 dividend stocks with yields > 3% that offer robust yields and the financial strength to sustain regular payouts.

- Capitalize on exponential tech growth by targeting these 24 AI penny stocks that are building the infrastructure and tools powering the artificial intelligence revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEL

Genesis Energy

Engages in the midstream segment of the crude oil and natural gas industry in the United States.

Undervalued with very low risk.

Similar Companies

Market Insights

Community Narratives