- United States

- /

- Oil and Gas

- /

- NYSE:DKL

Evaluating Delek Logistics Partners (DKL) After Mixed Q3 Results and Insider Sale

Reviewed by Simply Wall St

Delek Logistics Partners (DKL) is back in focus after a mixed third quarter, with earnings per share missing expectations even as revenue topped forecasts, along with a small insider sale from Executive Vice President Reuven Spiegel.

See our latest analysis for Delek Logistics Partners.

The mixed third quarter and modest insider selling come as Delek Logistics Partners trades around $45.73, with a 30 day share price return of 2.40 percent and year to date share price return of 8.70 percent. Its 1 year total shareholder return of 30.40 percent and 5 year total shareholder return of 142.72 percent suggest that long term momentum remains firmly intact despite near term wobbles.

If this kind of steady compounding appeals to you, it could be a good moment to look beyond midstream and explore fast growing stocks with high insider ownership for other potential opportunities.

With units trading slightly above analyst targets, yet boasting robust multi year returns and solid earnings and revenue growth, are investors overlooking lingering risks or underestimating how much future expansion is already priced in?

Most Popular Narrative: 4.5% Overvalued

With the most followed narrative placing fair value slightly below the recent 45 dollar plus trading level, the gap between expectations and price looks narrow but meaningful.

The full commissioning and expected ramp to capacity of the new Libby 2 gas plant in the Delaware Basin, along with associated investments (amine unit and AGI wells), positions Delek Logistics to capitalize on rising energy demand and stable domestic energy infrastructure needs, likely boosting gathering and processing volumes, EBITDA, and revenue growth. Delek Logistics' unique, vertically integrated offerings in the Permian, including handling of crude, gas, and water, plus advanced sour gas solutions, provide a competitive advantage as supply chain resilience and U.S. energy security remain priorities, supporting high utilization of existing assets and margin improvement.

Curious how steady, mid single digit top line growth, fatter margins and a lower future earnings multiple can still justify today’s price? The narrative lays out a detailed earnings roadmap, a deliberate valuation reset and a bold view on long term infrastructure demand, but keeps one crucial assumption hidden in plain sight. You will need to read on to see which forecasted shift actually drives the fair value call.

Result: Fair Value of $43.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated leverage and heavy fossil fuel exposure mean that weaker demand or stricter regulation could quickly undermine the growth and margin story.

Find out about the key risks to this Delek Logistics Partners narrative.

Another View on Value

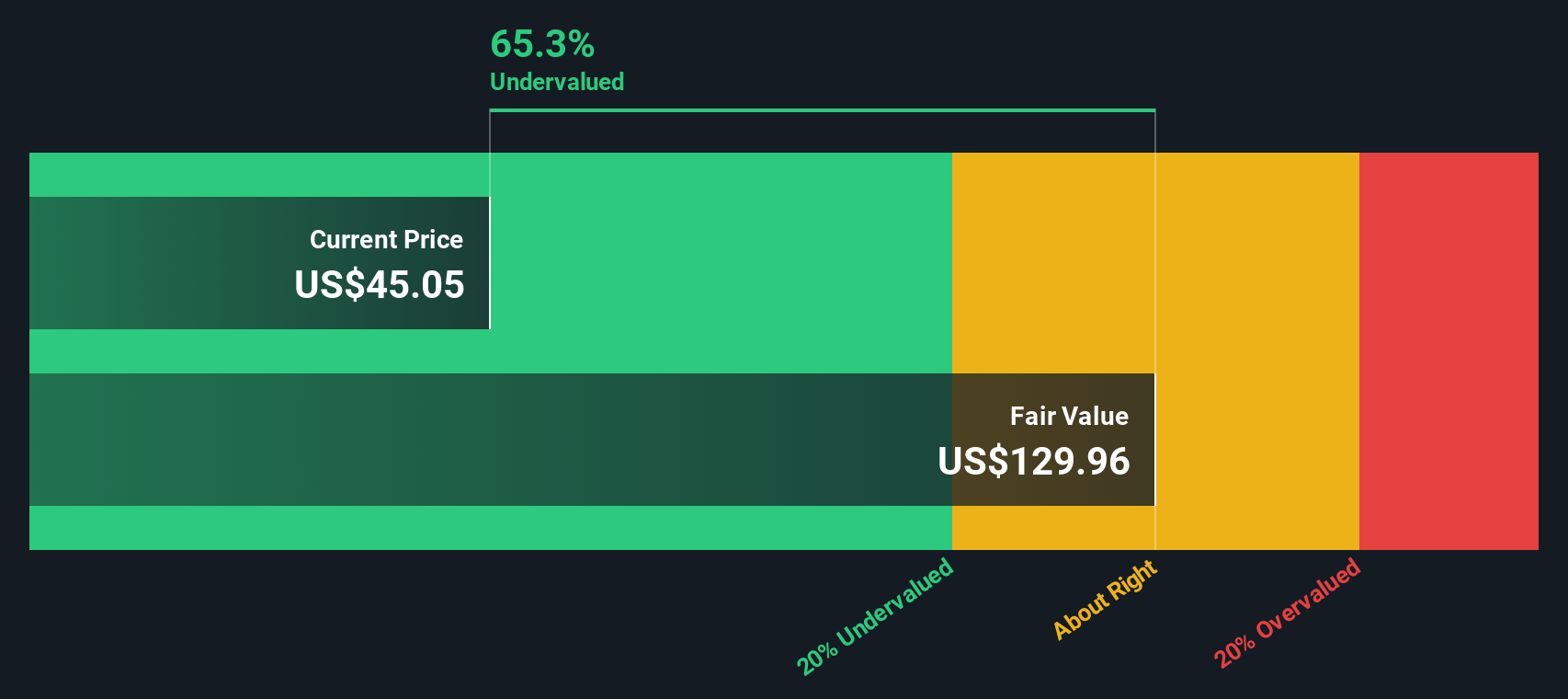

While analysts see Delek Logistics Partners as about 4.5 percent overvalued at $43.75, our DCF model paints a very different picture. It implies fair value near $162.89, or roughly 72 percent above today’s price. Is the market too cautious on long term cash flows, or is the model too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Delek Logistics Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Delek Logistics Partners Narrative

If you want to stress test these assumptions or rely on your own research, you can craft a personalized view of Delek Logistics in just a few minutes: Do it your way

A great starting point for your Delek Logistics Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next steps by scanning a few focused opportunities that could sharpen your portfolio and uncover what others are missing.

- Capture potential mispricings by reviewing these 909 undervalued stocks based on cash flows that may offer stronger cash flow upside than the market currently expects.

- Position yourself ahead of the next digital wave by checking out these 81 cryptocurrency and blockchain stocks tied to blockchain, payments, and financial infrastructure innovation.

- Strengthen your income stream by targeting these 15 dividend stocks with yields > 3% that combine attractive yields with more resilient fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKL

Delek Logistics Partners

Provides gathering, pipeline, transportation, and other services for crude oil, intermediates, refined products, natural gas, storage, wholesale marketing, terminalling water disposal and recycling customers in the United States.

Proven track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026