- United States

- /

- Oil and Gas

- /

- NYSE:DKL

Delek Logistics Partners (DKL): Evaluating Valuation After Q3 2025 Cash Distribution Announcement

Reviewed by Simply Wall St

Delek Logistics Partners (NYSE:DKL) just announced its third quarter cash distribution of $1.12 per common limited partner unit, which translates to an annualized $4.48 per unit. The payment is scheduled for mid-November and highlights the company’s continued focus on shareholder returns.

See our latest analysis for Delek Logistics Partners.

Following the latest cash distribution announcement, Delek Logistics Partners has seen a modest rise, bringing its shares to $45.88, and positive momentum appears to be building. While the recent share price gain year-to-date sits at 9.1%, the real story lies in the 1-year total shareholder return of 34.2% and a striking 164.3% over five years. This reflects the company’s robust income payouts and growing investor confidence.

If steady income and long-term gains are on your radar, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership.

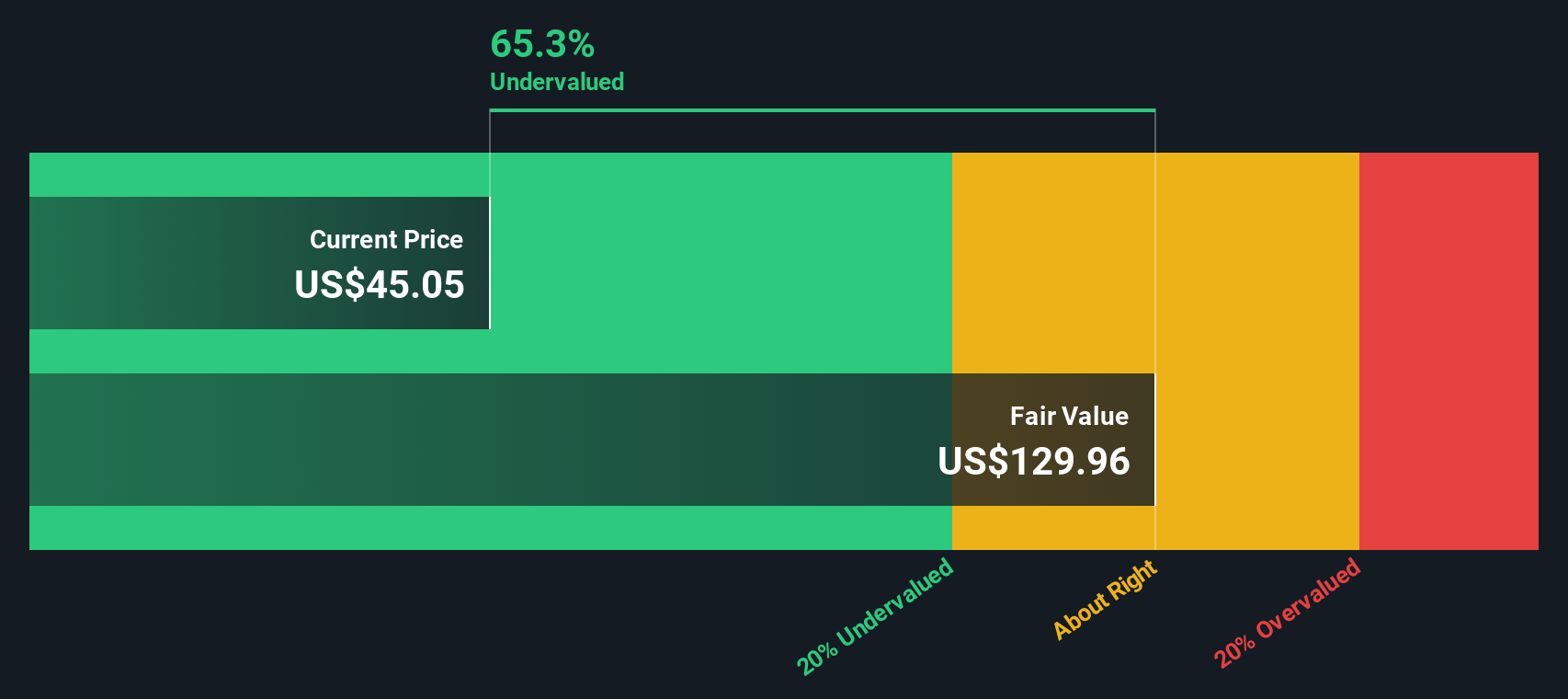

But with shares trading near recent highs and long-term gains already impressive, investors are now asking whether Delek Logistics Partners remains undervalued or if the market has already accounted for its future growth prospects.

Most Popular Narrative: 4.9% Overvalued

Delek Logistics Partners’ last close of $45.88 sits just above the current analyst consensus fair value of $43.75. This puts the stock about 4.9% above where the most widely followed narrative sees it, which creates tension between recent strong returns and what is considered a justifiable price going forward.

*Expanding footprint through the integration of recent water gathering acquisitions (H2O and Gravity) enables operational scale and efficiency gains along key oil and refined product corridors. This should translate to improved net margins and higher distributable cash flow. A robust pipeline for future expansions and M&A, supported by over $1 billion in current liquidity from recent high-yield notes, positions the company to opportunistically grow via acquisitions or asset sales. This contributes to both top-line growth and potential EBITDA uplift.*

What is really pushing the latest fair value? The story is driven by ambitious revenue growth targets, soaring profitability estimates, and a future earnings multiple that only a few companies can justify. Interested in the numbers behind this bold outlook? This narrative contains surprises for anyone who digs deeper.

Result: Fair Value of $43.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a decline in long-term fossil fuel demand or rising leverage could present challenges to the optimistic growth outlook for Delek Logistics Partners.

Find out about the key risks to this Delek Logistics Partners narrative.

Another View: Fair Value by Our DCF Model

Taking a different approach, the SWS DCF model arrives at a much higher fair value for Delek Logistics Partners: $135.70, compared to its recent close of $45.88. This method suggests the stock could be significantly undervalued, raising questions about whether the market is overlooking potential future cash flows. Which valuation will prove right as the outlook changes?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Delek Logistics Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Delek Logistics Partners Narrative

If you want to dive into the numbers yourself or have a different perspective on Delek Logistics Partners, it takes just a few minutes to craft your own view. Do it your way.

A great starting point for your Delek Logistics Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Broaden your horizons with fresh ways to grow your wealth and spot your next standout stock before the crowd.

- Boost your portfolio’s income potential and spot reliable payers by checking out these 21 dividend stocks with yields > 3%.

- Catch the wave of medical innovation and sharpen your edge with insights from these 34 healthcare AI stocks.

- Position yourself for the next tech breakthrough by starting with these 28 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DKL

Delek Logistics Partners

Provides gathering, pipeline, transportation, and other services for crude oil, intermediates, refined products, natural gas, storage, wholesale marketing, terminalling water disposal and recycling customers in the United States.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives