- United States

- /

- Oil and Gas

- /

- NYSE:CVX

Chevron (CVX) Valuation Check as 2026 Capex Plan and $2 Billion Gorgon LNG Expansion Take Shape

Reviewed by Simply Wall St

Chevron (CVX) just laid out its 2026 spending game plan, pairing a leaner capital budget with a fresh $2 billion green light for its Gorgon LNG expansion, and the stock is reacting to that strategy mix.

See our latest analysis for Chevron.

Those capital plans and the Gorgon expansion come on top of governance tweaks to modernize Chevron’s officer structure and ongoing Venezuelan operations. Even so, the stock’s 1 year total shareholder return of 1.10% and 5 year total shareholder return of 100.67% suggest longer term momentum remains intact despite softer recent share price returns.

If Chevron’s measured capex shift has you rethinking your energy exposure, this could be a good moment to explore fast growing stocks with high insider ownership for other potential long term compounders.

With shares down modestly in recent months yet still trading at a hefty intrinsic discount and below analyst targets, is Chevron quietly setting up a value entry point, or is the market already baking in that future growth?

Most Popular Narrative Narrative: 13.3% Undervalued

With Chevron last closing at $150 and the most followed narrative implying a higher fair value, the spread reflects sizable embedded cash flow expectations.

The integration of Hess synergies, new low-cost assets, and share buybacks will be cash flow accretive and boost EPS, even as Chevron sustains high shareholder returns regardless of commodity price cycles.

Want to see what powers that confidence in future payouts and buybacks, even with modest top line growth and a richer earnings multiple than the sector, unlock the full narrative.

Result: Fair Value of $172.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower renewable diversification and execution risks on large upstream projects could challenge Chevron’s cash flow story and temper that undervaluation thesis.

Find out about the key risks to this Chevron narrative.

Another Angle on Valuation

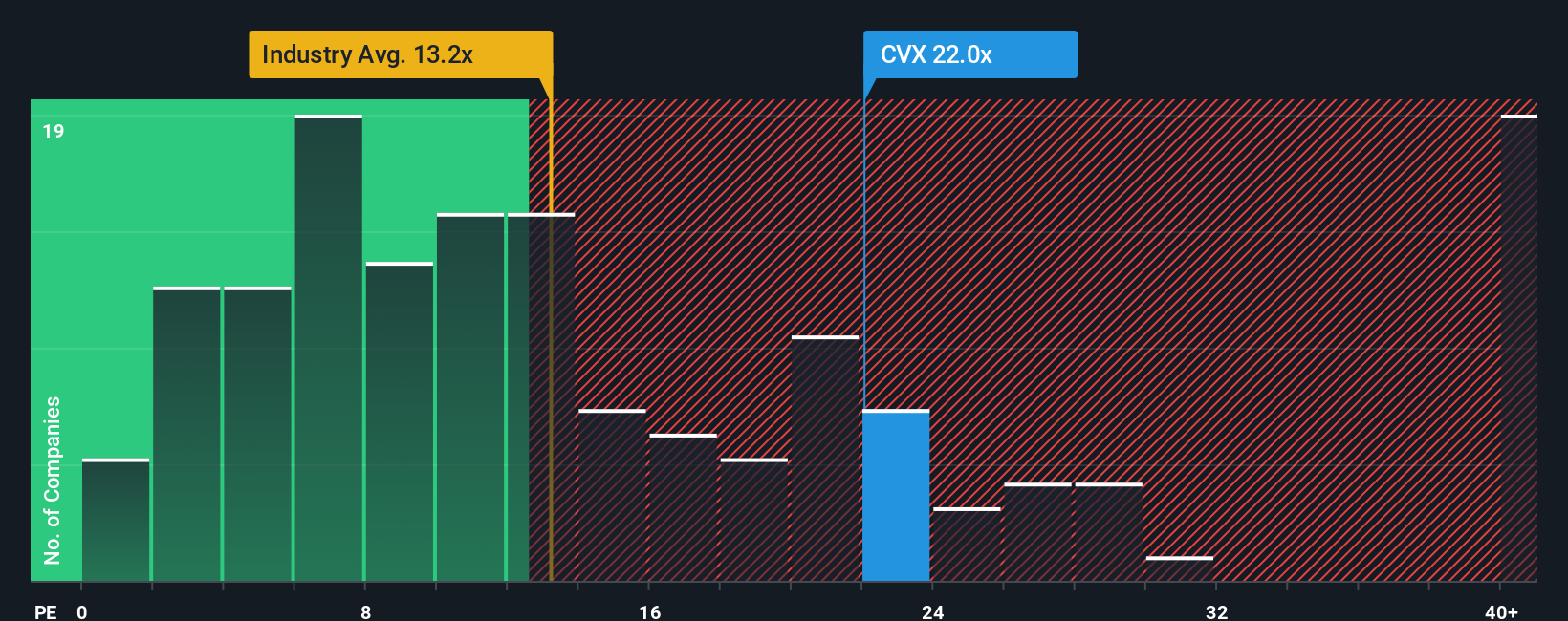

Even if narratives and fair value estimates suggest upside, Chevron’s 23.7x price to earnings ratio looks demanding beside the US Oil and Gas industry at 13.8x and the peer average at 22.6x. With a fair ratio of 25.3x, is the market underpricing quality or simply incorporating additional risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chevron Narrative

If you see the story differently or want to dig into the numbers yourself, craft a personalized Chevron thesis in minutes, Do it your way.

A great starting point for your Chevron research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More High Conviction Ideas

Before the next opportunity moves out of reach, use the Simply Wall Street Screener to uncover focused stock ideas tailored to your style and performance goals.

- Capture potential bargains early by hunting for mispriced cash generators using these 908 undervalued stocks based on cash flows that may have been overlooked by the broader market.

- Position yourself at the frontier of innovation by targeting companies involved in intelligent automation through these 26 AI penny stocks before their growth is fully recognized.

- Strengthen your income stream by focusing on reliable yield opportunities with these 15 dividend stocks with yields > 3% that can support long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026