- United States

- /

- Oil and Gas

- /

- NYSE:CVX

Chevron (CVX): Assessing Valuation After Modest Pullback and Recent Sector Moves

Reviewed by Simply Wall St

Chevron (CVX) shares have slipped slightly over the past day, down about 2% as broader energy sector trends and market sentiment weigh in. Even so, the stock remains up almost 5% so far this year. Investors are watching closely as Chevron navigates shifting oil prices and sector dynamics.

See our latest analysis for Chevron.

While Chevron's share price dipped 2.33% over the past day, this comes after a generally positive stretch, with a 5% year-to-date share price return and a 4.6% total return over the past year. Momentum has been modest but still points to steady gains, especially considering the market's renewed focus on energy stocks and rising oil price volatility.

If this shift in energy stocks has you thinking bigger, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

The key question now is whether Chevron's current price reflects its fundamental value, or if there is still an edge for investors to capture before markets fully account for future growth.

Most Popular Narrative: 10.5% Undervalued

Chevron’s most widely followed valuation narrative implies a fair value that is meaningfully above the last close of $154.04. This suggests room for further upside according to consensus fair value estimates. Here is a direct look into the analyst assumptions fueling this perspective.

“Record production growth, especially in the Permian and from the Hess acquisition (Guyana, Bakken), positions Chevron to meet the rising energy demand from global population growth and emerging markets, supporting higher baseline revenues and longer-term cash generation.”

Want to know the math behind this upside? The foundation is built on ambitious forecasts about profitability and margins. What bold assumptions are making analysts raise their targets and sustain confidence? Dive in to uncover the narrative’s pivotal projections and the decisive variable driving fair value.

Result: Fair Value of $172.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower progress in renewables and potential volatility from large project execution could weaken Chevron's bullish outlook and future earnings momentum.

Find out about the key risks to this Chevron narrative.

Another View: What Do Market Ratios Say?

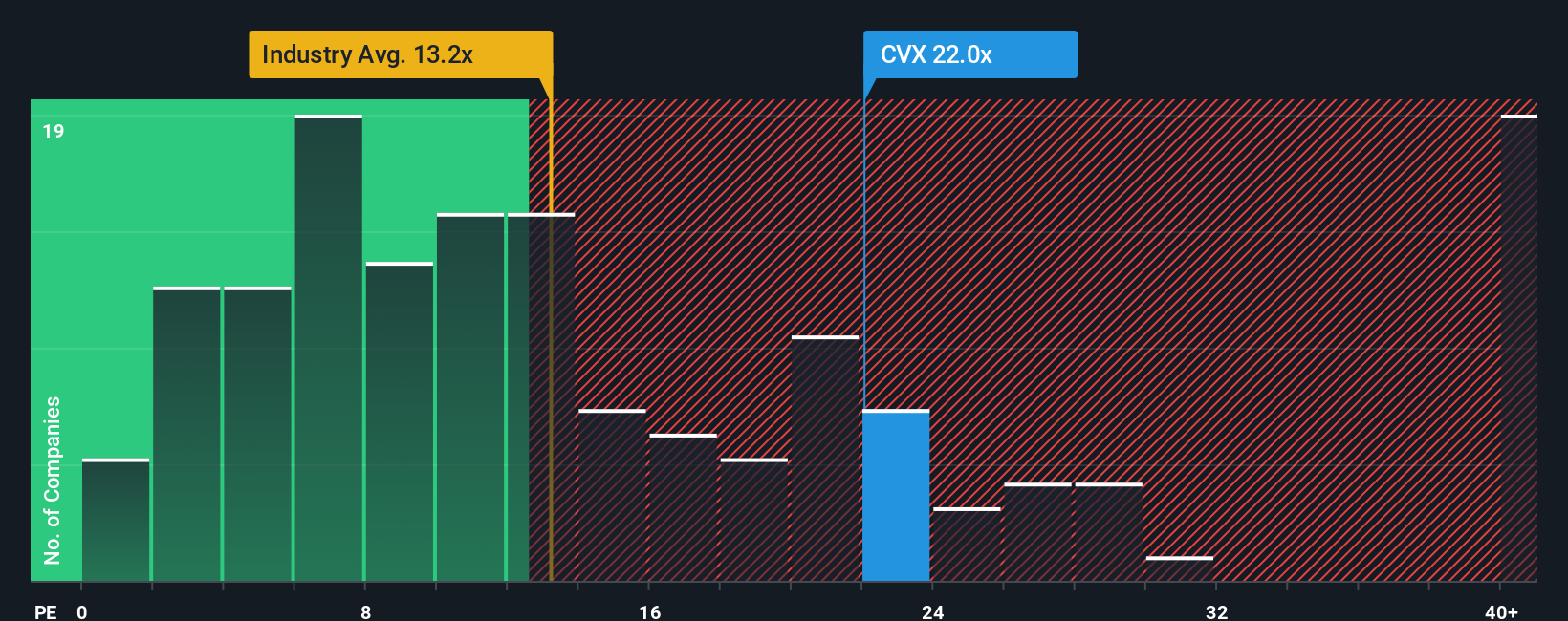

Taking a different approach, Chevron's price-to-earnings ratio stands well above both its industry peers and its own fair ratio. The stock is trading at 24.5 times earnings compared to an industry average of 12.8 and a fair ratio of 23.6. This suggests investors are paying a premium today. Could this premium signal risk if expectations shift, or does it reflect lasting confidence?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chevron Narrative

If this viewpoint does not match your own or you'd rather dive into the numbers yourself, you can quickly craft your own Chevron story. Start now and Do it your way.

A great starting point for your Chevron research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means always having fresh opportunities on your radar. Don’t let market-shaking ideas pass you by. Use these tools to spot what others miss and stay ahead:

- Capture tomorrow’s upside by scanning these 841 undervalued stocks based on cash flows with solid fundamentals priced below fair value, before the rest of the market catches on.

- Unleash your portfolio’s income potential with these 18 dividend stocks with yields > 3% known for reliable yields above 3% that can boost your returns year after year.

- Snap up innovation leaders riding the artificial intelligence wave when you scan these 26 AI penny stocks making breakthroughs in data, automation, and future tech.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVX

Chevron

Through its subsidiaries, engages in the integrated energy and chemicals operations in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives