- United States

- /

- Oil and Gas

- /

- NYSE:CQP

Cheniere Energy Partners (CQP): Valuation Insights Following Revenue Growth and Distribution Guidance Update

Reviewed by Simply Wall St

Cheniere Energy Partners (CQP) just rolled out its third-quarter earnings, showing higher revenue year over year while net income declined. In addition, management reaffirmed its full-year distribution guidance for investors.

See our latest analysis for Cheniere Energy Partners.

Cheniere Energy Partners’ reaffirmed distribution outlook and uptick in quarterly revenue have drawn some fresh attention, but the share price remains under modest pressure, with a 1-day decline of 2.07% and a year-to-date dip of 5.86%. Nevertheless, the partnership’s long-term total shareholder returns tell a stronger story. The shares are up 7% over the last year and have delivered nearly 100% total return over five years. This momentum stands out even with recent volatility.

If energy’s strong long-term payouts have you interested, this could be a good moment to expand your search and discover fast growing stocks with high insider ownership

But with shares lagging so far this year despite steady distributions and rising sales, investors now face a familiar dilemma: is Cheniere Energy Partners undervalued with room to run, or has the market already priced in future gains?

Price-to-Earnings of 13.6x: Is it justified?

Cheniere Energy Partners currently trades at a price-to-earnings ratio of 13.6, which places the shares below both the broader US market and its closest industry peers.

The price-to-earnings (P/E) ratio reflects what investors are willing to pay today for a dollar of future earnings. For energy infrastructure partnerships like CQP, this metric offers a snapshot of how the market values current profitability and expected future growth.

CQP’s P/E is not only lower than the US market average of 18.3x, but also undercuts both its peer group average (15.6x) and the US Oil and Gas industry average (14.1x). In comparison, the estimated Fair Price-To-Earnings Ratio is 17.3x, representing a level the market could move towards. The current multiple suggests a margin of safety for those seeking value in this sector.

Explore the SWS fair ratio for Cheniere Energy Partners

Result: Price-to-Earnings of 13.6x (UNDERVALUED)

However, if revenue or net income growth stalls, or if analyst targets are revised downward, the current valuation and outlook could quickly shift.

Find out about the key risks to this Cheniere Energy Partners narrative.

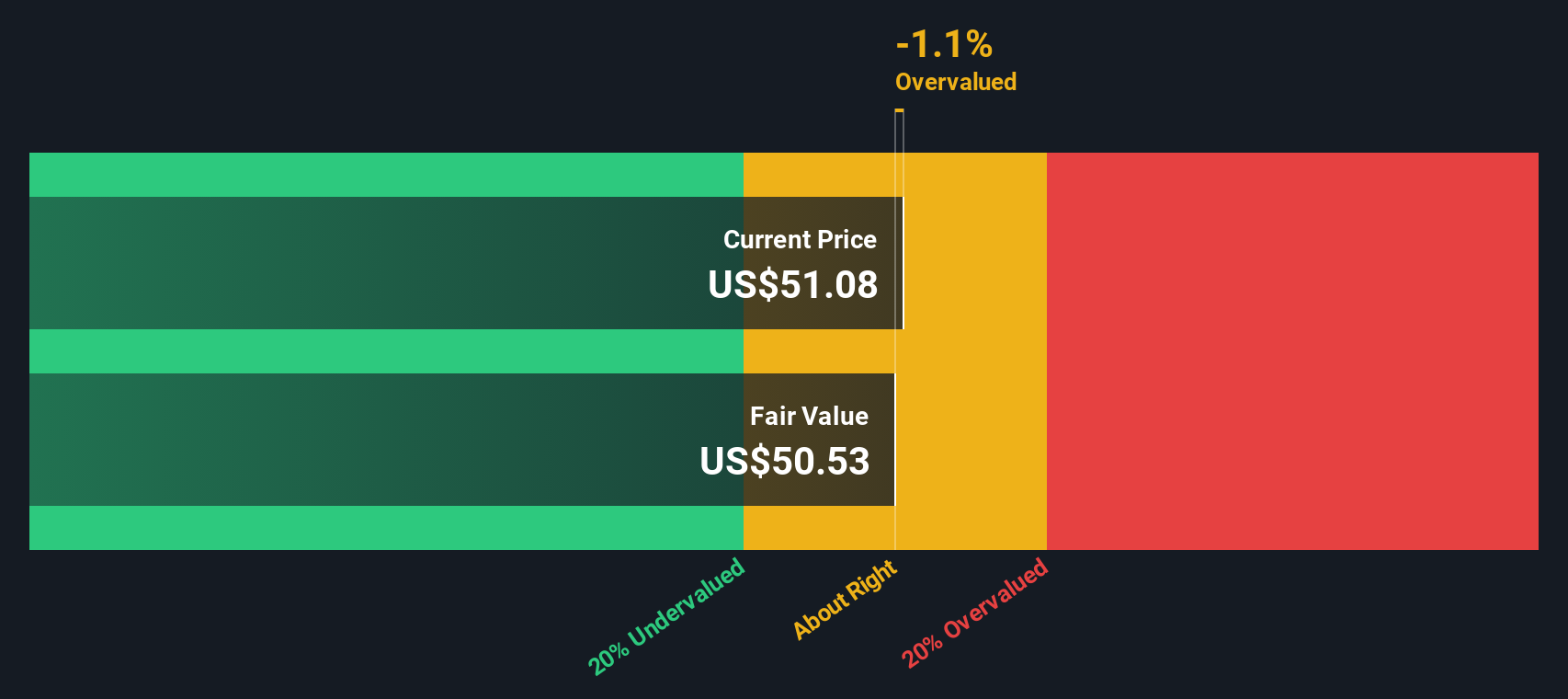

Another View: Discounted Cash Flow Model

Looking from a different perspective, our DCF model suggests Cheniere Energy Partners is actually trading above its estimated fair value, not below it. While earnings-based multiples hint at an undervalued stock, the DCF model raises concern that the market’s pricing could be a bit optimistic at the moment. Which method is closer to reality, and what happens if growth does not accelerate?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cheniere Energy Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cheniere Energy Partners Narrative

Feel free to dig into the numbers yourself and see what story they tell. Your conclusions might differ, and you can easily build your own view in a few minutes. Do it your way

A great starting point for your Cheniere Energy Partners research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

You are missing out if you only focus on one stock. Use the Simply Wall Street Screener now to spot outstanding opportunities others overlook and grow your portfolio smarter.

- Capture rapid gains by targeting these 3589 penny stocks with strong financials with strong financials and real market momentum.

- Get ahead of healthcare breakthroughs by evaluating these 32 healthcare AI stocks leading innovation in diagnostics, patient care, and medical technologies.

- Unlock steady income streams by analyzing these 14 dividend stocks with yields > 3% that offer attractive yields above 3% for income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CQP

Cheniere Energy Partners

Through its subsidiaries, provides liquefied natural gas (LNG) to integrated energy companies, utilities, and energy trading companies in the United States and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives