- United States

- /

- Oil and Gas

- /

- NYSE:CQP

Cheniere Energy Partners (CQP): Assessing Valuation After $1 Billion Fixed-Income Exchange Offer

Reviewed by Simply Wall St

Cheniere Energy Partners (CQP) has launched a $1 billion fixed-income exchange offer tied to its 5.550% senior unsecured notes maturing in 2035. This move gives investors fresh insight into the company’s evolving capital structure and financial strategy.

See our latest analysis for Cheniere Energy Partners.

After a strong pop this week, with a 5.31% 7-day share price return, Cheniere Energy Partners is quietly building momentum. This comes after a fairly flat period; however, the latest exchange offer has renewed market attention. Over the long run, shareholders have enjoyed a hefty 106% total return over five years, though the one-year total return was only slightly below unchanged. It seems like sentiment is improving as investors weigh both stability and growth potential.

If you want to see what else is picking up steam, now's a good moment to broaden your horizons and discover fast growing stocks with high insider ownership

With strong long-term returns but only a modest discount to analyst targets, the question remains: is Cheniere Energy Partners undervalued at current levels, or has the market already priced in its next phase of growth?

Price-to-Earnings of 14.3x: Is it justified?

Cheniere Energy Partners trades at a price-to-earnings ratio of 14.3x, which makes it look attractively valued compared to its peers even after the recent price rally.

The price-to-earnings (P/E) ratio tells investors how much they are paying for each dollar of the company’s current earnings. For an energy exporter and infrastructure owner like Cheniere, the P/E ratio is a key metric because it reflects both its growth prospects and the market’s expectations for profitability over the long run.

Compared to its peer group average of 16x, Cheniere Energy Partners is trading at a discount. The company's fair price-to-earnings ratio is estimated at 18.4x, which may indicate that the market is underestimating future profit growth or the stability of its cash generation. This difference could decrease as investors reconsider the company’s growth strategy and solid earnings profile.

Explore the SWS fair ratio for Cheniere Energy Partners

Result: Price-to-Earnings of 14.3x (UNDERVALUED)

However, slowing annual revenue growth and modest year-to-date returns could challenge the bullish outlook if market conditions shift or if LNG demand softens.

Find out about the key risks to this Cheniere Energy Partners narrative.

Another View: What Does Our DCF Model Say?

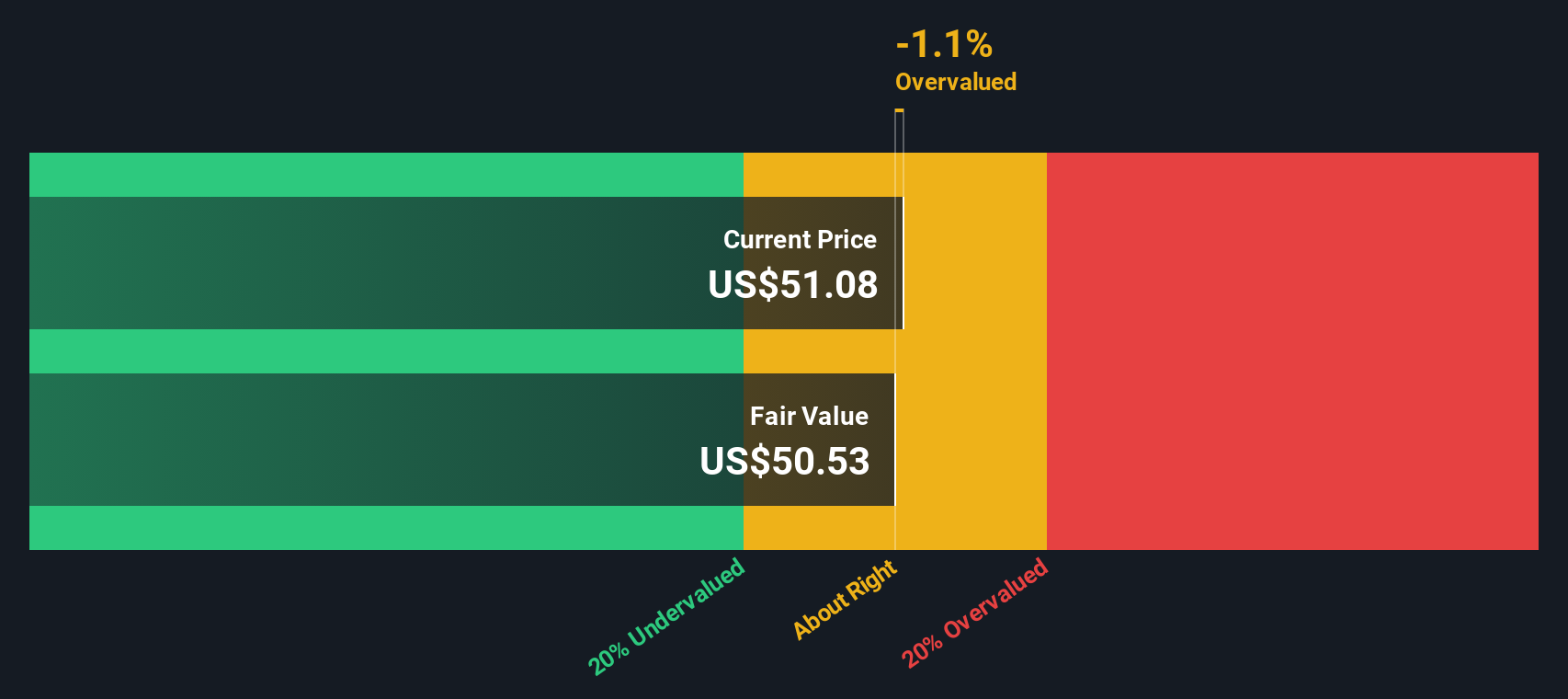

While the P/E ratio suggests Cheniere Energy Partners may be undervalued, our SWS DCF model presents a different perspective. The discounted cash flow analysis puts the fair value at $50.40, which is below the current share price of $54.77. This could indicate that the market is already factoring in more future growth than the actual cash flows support.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cheniere Energy Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cheniere Energy Partners Narrative

If you’re after a different perspective or want to look beneath the surface yourself, assembling your own view is quick and straightforward. You can shape your own narrative in just a few minutes Do it your way

A great starting point for your Cheniere Energy Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on emerging opportunities across different themes. Broaden your perspective and seize the next big move by checking out these handpicked stock ideas:

- Target steady returns and strengthen your portfolio by reviewing these 14 dividend stocks with yields > 3% which offers robust yields and proven income reliability.

- Tap into the explosive potential of artificial intelligence by starting with these 25 AI penny stocks that are set to disrupt industries and accelerate innovation.

- Upgrade your watchlist with these 927 undervalued stocks based on cash flows since these may offer attractive entry points based on strong cash flow potential that could be overlooked by the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CQP

Cheniere Energy Partners

Through its subsidiaries, provides liquefied natural gas (LNG) to integrated energy companies, utilities, and energy trading companies in the United States and internationally.

Established dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026