- United States

- /

- Oil and Gas

- /

- NYSE:CNX

A Fresh Look at CNX Resources (CNX) Valuation After Recent Three-Month Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for CNX Resources.

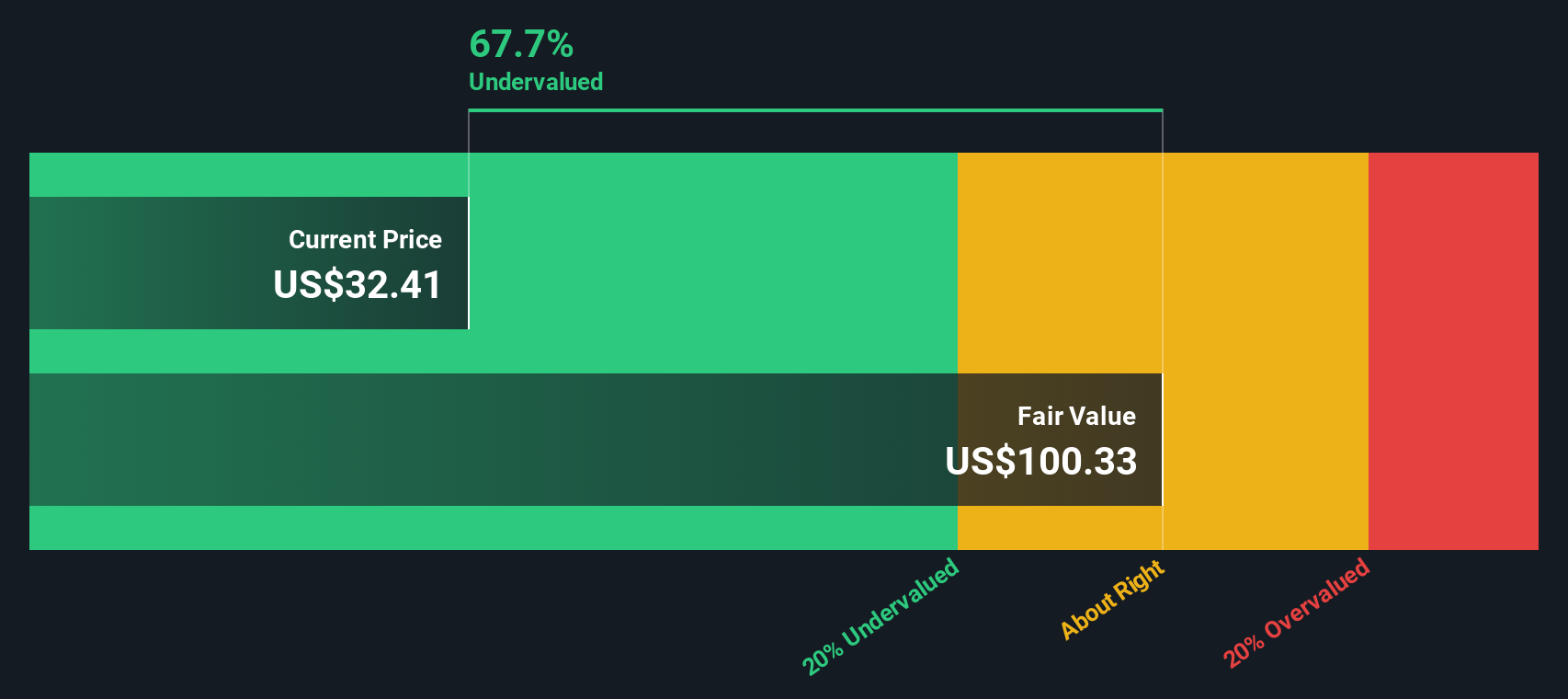

After a solid 16% run-up over the past three months, CNX Resources is starting to capture more attention. While the year-to-date share price return remains negative, the momentum seen recently stands out against the backdrop of a modest one-year total shareholder loss and the stock’s impressive 285% five-year total return. This recent uptick could hint at shifting sentiment, especially as the company continues to deliver steady revenue and net income growth.

If you’re interested in uncovering what other dynamic stocks are building momentum, now is the perfect opportunity to discover fast growing stocks with high insider ownership.

But after this surge and a strong track record, is CNX Resources trading at a bargain that investors should seize? Or is the market already factoring in all the company’s future growth potential?

Most Popular Narrative: 4.5% Overvalued

At $33.66 per share, CNX Resources trades above the most widely followed narrative's fair value of $32.21. This market optimism now faces the test of whether the company can deliver on sizable growth assumptions embedded in the consensus price target.

Favorable policy and regulatory shifts towards cleaner-burning natural gas, including programs like 45Z tax credits and renewable energy attribute markets, are creating new, high-margin revenue streams (e.g., RMG sales, environmental credits). These changes have the potential to enhance both net margins and free cash flow.

Curious how these new revenue streams and environmental credits may fuel future profits? The narrative relies on accelerating margins and regulatory tailwinds. What are the bold projections shaping this potential payday? Dig into the full story to uncover the surprising expectations driving that fair value.

Result: Fair Value of $32.21 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent oversupply in the gas market or regulatory changes could limit the company’s momentum and challenge the optimistic margin outlook.

Find out about the key risks to this CNX Resources narrative.

Another View: What Does the SWS DCF Model Reveal?

While consensus suggests CNX Resources may be a bit overvalued based on analyst targets, our SWS DCF model paints a much different picture, estimating fair value at $152.22, far above the current price. This gap hints at a possible undervalued opportunity or perhaps a disconnect between market consensus and intrinsic value. Which outlook will prove right as market conditions evolve?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CNX Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CNX Resources Narrative

If you see things differently or have your own perspective, you can dive into the numbers and craft your own unique narrative in just a few minutes: Do it your way.

A great starting point for your CNX Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let opportunity slip away. Transform your portfolio by acting now. Our powerful stock screeners make it easy to find your next winner today.

- Tap into tomorrow’s disruptors by targeting these 26 AI penny stocks, which are driving artificial intelligence advances and reshaping key industries.

- Boost your portfolio’s income and stability with these 22 dividend stocks with yields > 3%, offering reliable yields above 3% from proven dividend payers.

- Catalyze your strategy by zeroing in on standout value with these 840 undervalued stocks based on cash flows, selected for strong fundamentals and attractive cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNX

CNX Resources

An independent natural gas and midstream company, engages in the acquisition, exploration, development, and production of natural gas properties in the Appalachian Basin.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives