- United States

- /

- Oil and Gas

- /

- NYSE:CNR

Does the Latest 12% Drop Make Core Natural Resources a Bargain in 2025?

Reviewed by Bailey Pemberton

- Wondering if Core Natural Resources could be a hidden gem or just another overhyped stock? You are not alone in trying to figure out if its current price really matches its underlying value.

- The stock has seen dramatic ups and downs, including a recent decline of 12.2% over the past month and a year-to-date dip of 28.1%. However, the five-year return of 1698.3% is notable.

- Recent headlines have shed light on regulatory changes and shifting energy market dynamics, which have driven much of the share price action. Industry analysts are debating whether these developments signal an opportunity or a warning for long-term investors.

- On the numbers alone, Core Natural Resources passes 5 out of 6 key valuation checks according to our valuation score. In the next sections, we will explore the methods that lead to this score and suggest a smarter way to interpret all the data that you will not want to miss by the end.

Find out why Core Natural Resources's -38.5% return over the last year is lagging behind its peers.

Approach 1: Core Natural Resources Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them to today's value. This approach helps investors gauge whether the current share price represents fair value considering the company's financial outlook.

For Core Natural Resources, the DCF analysis utilizes recent and projected Free Cash Flow (FCF) figures in USD. The company's latest twelve months (LTM) FCF is $149 million. While analysts have provided detailed estimates for the next five years, projections out to 2035 are extrapolated to provide a fuller picture of potential value. By 2028, FCF is expected to climb to $660 million, with the model forecasting steady growth through 2035.

Bringing all those future cash flows back to the present uses the 2 Stage Free Cash Flow to Equity model. The resulting estimated intrinsic value is $283.17 per share. Given the stock currently trades at a price that is 72.6% below this intrinsic value, Core Natural Resources is evaluated as significantly undervalued by the DCF framework.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Core Natural Resources is undervalued by 72.6%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

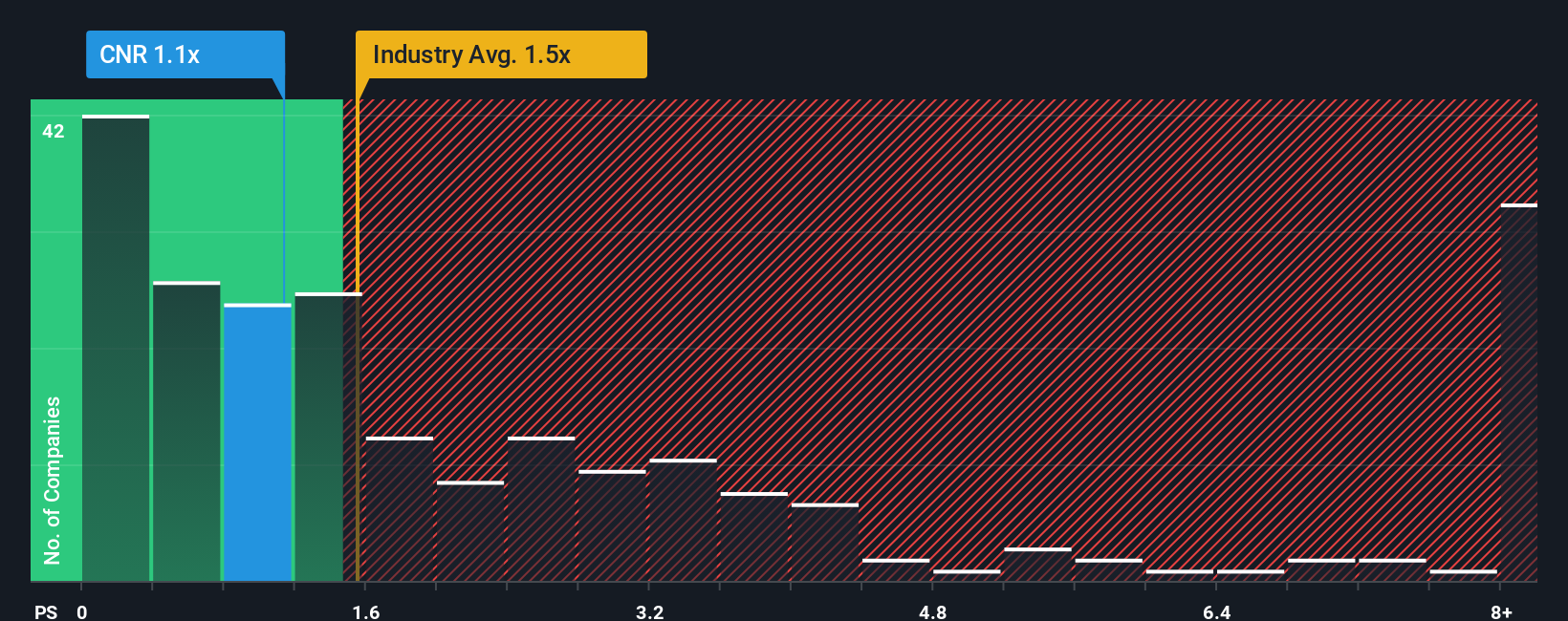

Approach 2: Core Natural Resources Price vs Sales

For companies like Core Natural Resources that generate revenue but may have volatile earnings, the Price-to-Sales (P/S) ratio is often the preferred metric for valuation. This ratio is simple to calculate and especially relevant when comparing firms within the same industry, as it smooths out the effects of short-term profit swings and provides a clearer sense of how the market values each dollar of revenue.

The P/S ratio is influenced by how quickly investors expect revenue to grow and by the perceived risks in the business. When growth prospects are strong and the risk profile is low, the market is generally willing to pay a higher P/S multiple. Conversely, headwinds for the company or the industry tend to pull the ratio down toward or even below average levels.

Core Natural Resources is currently trading at a P/S ratio of 1.22x, which is lower than its industry average of 1.45x and far below the peer average of 5.66x. However, instead of only relying on these rough comparisons, we look at the Simply Wall St "Fair Ratio" for a more tailored view. The Fair Ratio, calculated at 0.92x for Core Natural Resources, accounts for its specific traits such as expected revenue growth, industry trends, profit margin, market cap, and risk factors. This holistic approach gives a fairer baseline for valuation. With Core Natural Resources’ P/S ratio just 0.30x above the Fair Ratio, the stock appears to be trading close to fair value rather than being clearly undervalued or overvalued.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Core Natural Resources Narrative

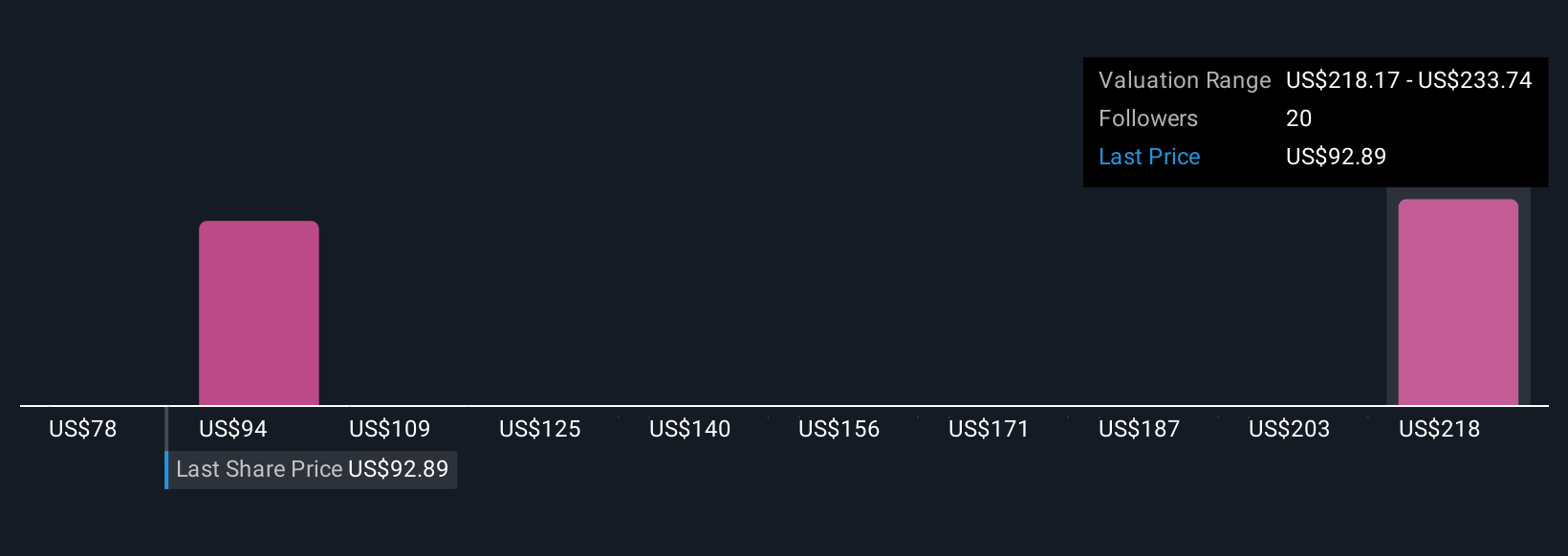

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter and more dynamic approach to investing that lets you connect the company’s story to real numbers.

A Narrative is your personal perspective or “story” about Core Natural Resources, backed by your own assumptions about its future revenue, earnings, margins, and ultimately its fair value, not just the latest statistics or analyst targets.

This tool, available right in the Simply Wall St Community page (and used by millions of investors), makes it easy for anyone to combine recent news or changing forecasts with their financial view so you can make decisions when data changes.

With Narratives, you choose your forecast based on what you believe about Core’s business. For example, you might think regulatory changes or energy demand will drive sharp growth, or you may be concerned about coal risks hampering future results. Then you can see your Fair Value compared to the current Price, helping you decide if you want to buy or sell.

Narratives automatically update with new earnings reports, news, or economic trends, so your view stays current and actionable.

For example, some investors are optimistic, seeing a fair value as high as $110.00 if strong revenue and margin gains play out, while the most cautious might see a fair value closer to $78.00 based on stricter risk and slower growth assumptions.

Do you think there's more to the story for Core Natural Resources? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CNR

Core Natural Resources

Produces, sells, and exports metallurgical and thermal coals in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives