- United States

- /

- Oil and Gas

- /

- NYSE:CIVI

Has Civitas Resources' (CIVI) Efficiency Drive Unlocked a New Competitive Edge?

Reviewed by Sasha Jovanovic

- Earlier this week, Civitas Resources reported a 6% increase in third-quarter production to approximately 336,000 barrels of oil equivalent per day while also reducing its cash operating costs by 5%.

- This operational improvement highlights the company's ongoing efforts to optimize resources and control costs in its core U.S. basins, such as the Permian and DJ Basins.

- We'll examine how Civitas Resources' improved cost efficiency and production may shape its investment narrative moving forward.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Civitas Resources Investment Narrative Recap

To be a shareholder in Civitas Resources, you need confidence in the company's ability to maintain production growth and cost efficiency in the face of shifting market dynamics and regulatory pressures. The latest operational update, highlighting increased production and reduced costs, supports the near-term focus on efficiency, which may help stabilize margins, though it doesn’t materially change the largest risk: region-specific regulatory and environmental challenges in the Permian and DJ Basins that could restrict future volumes. Among recent company announcements, Civitas’s merger agreement with SM Energy stands out, as it is the single most relevant development for investors following these production updates. While operational improvements are positive, the pending merger’s terms, timeline, and required approvals now represent the primary catalyst and overhang for the stock, with the integration process likely to shape outcomes more than incremental quarterly results in the coming months. Yet, investors should keep in mind that unforeseen local regulatory hurdles faced by Civitas in its core basins could…

Read the full narrative on Civitas Resources (it's free!)

Civitas Resources' narrative projects $4.9 billion in revenue and $790.4 million in earnings by 2028. This requires a 0.6% annual revenue decline and a $33.7 million increase in earnings from $756.7 million today.

Uncover how Civitas Resources' forecasts yield a $37.31 fair value, a 27% upside to its current price.

Exploring Other Perspectives

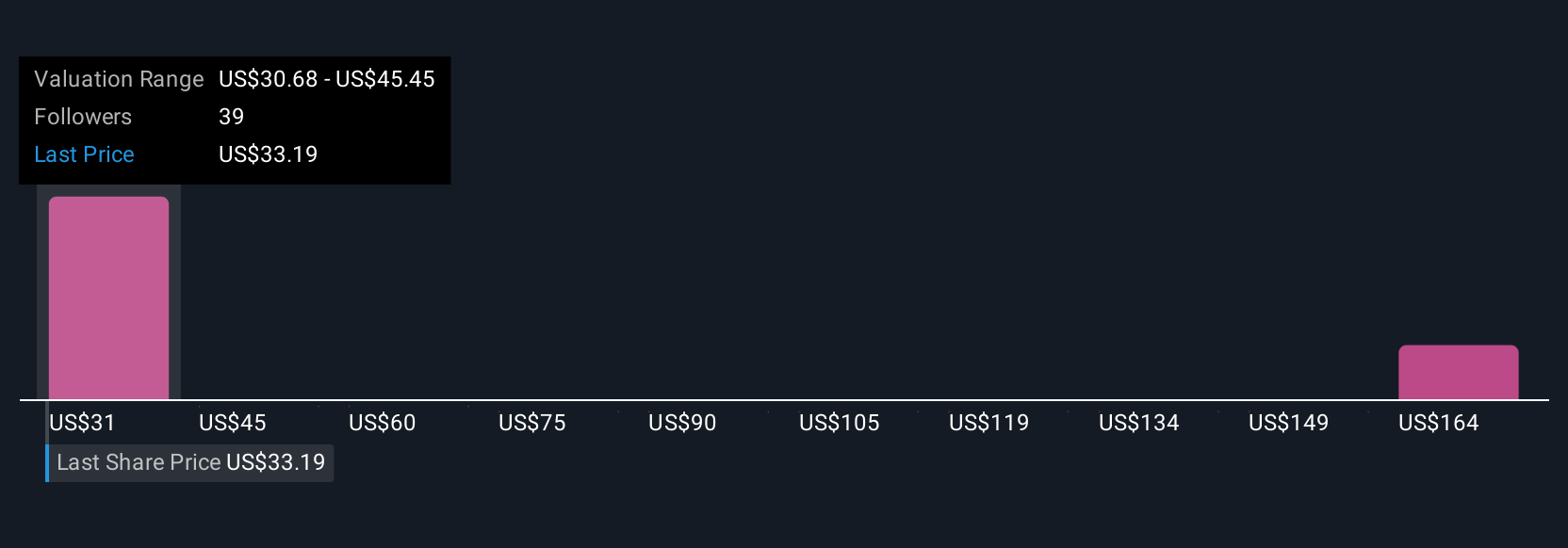

Seven Simply Wall St Community members put Civitas’s fair value between US$30 and an outlier high of US$322, showing a wide spread of outlooks. As you weigh these diverse perspectives, remember that future production depends closely on ongoing cost efficiency gains and local regulatory conditions.

Explore 7 other fair value estimates on Civitas Resources - why the stock might be worth just $30.00!

Build Your Own Civitas Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Civitas Resources research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Civitas Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Civitas Resources' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CIVI

Civitas Resources

An exploration and production company, focuses on the acquisition, development, and production of crude oil and associated liquids-rich natural gas.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.