- United States

- /

- Oil and Gas

- /

- NYSE:BSM

A Fresh Look at Black Stone Minerals (BSM) Valuation Ahead of Q3 2025 Earnings and Shifting Analyst Estimates

Reviewed by Simply Wall St

Black Stone Minerals (BSM) is drawing fresh attention as it gears up to release its Q3 2025 earnings on November 3. Investors are watching closely, considering recent shifts in both revenue and earnings estimates.

See our latest analysis for Black Stone Minerals.

Black Stone Minerals’ latest share price of $13.19 reflects a market that is still weighing its prospects, especially after a strong profit beat last quarter and some recent adjustments to revenue forecasts. Despite short-term ups and downs, the company’s one-year total return of -1.8% trails the market. However, its five-year total shareholder return of over 225% highlights substantial long-term value creation.

If you’re interested in what else is gaining market attention, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With mixed analyst signals and a proven record of long-term returns, the real question is whether Black Stone Minerals is now undervalued and primed for upside, or if the market has already priced in its growth prospects.

Most Popular Narrative: Fairly Valued

At $13.19, Black Stone Minerals’ share price is nearly in line with the most widely followed narrative fair value estimate of $13.00. This suggests a balanced consensus between current market valuations and analyst expectations.

Ongoing operator diversification through the onboarding of multiple top-tier operators (transitioning from a single operator to several with over 20 well obligations per year each) reduces concentration risk and sets up a pipeline of increased drilling activity through the end of the decade. This development underpins long-term revenue growth.

Curious what backs this seemingly steady price target? Explore the bold projections that could propel revenues, margins, and scale to new heights. Uncover the critical levers shaping future growth and see why analysts believe current market expectations may be just scratching the surface.

Result: Fair Value of $13.00 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stalled production growth or disappointing drilling activity in core regions could quickly challenge the consensus view and put pressure on future returns.

Find out about the key risks to this Black Stone Minerals narrative.

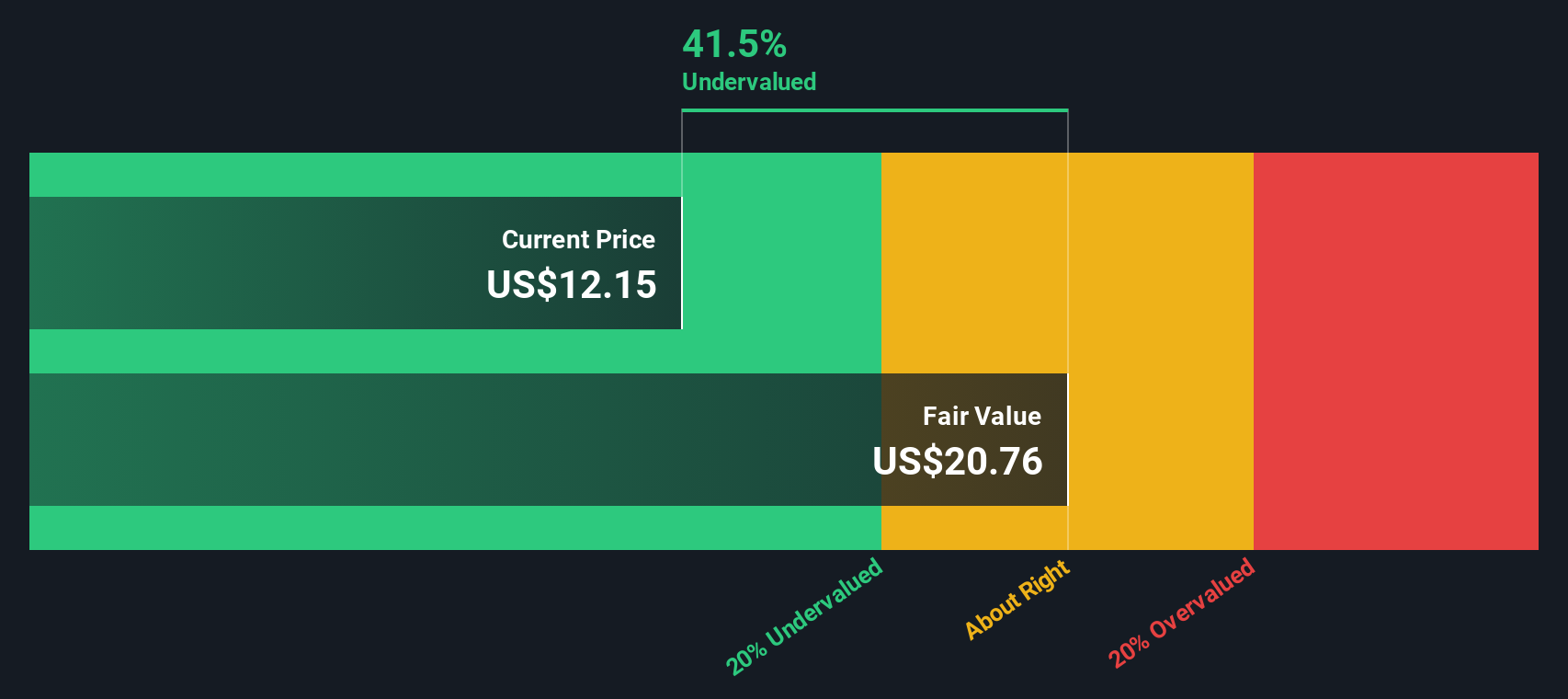

Another View: Discounted Cash Flow Model

While analyst consensus suggests Black Stone Minerals is fairly valued near $13.00, our SWS DCF model paints a more bullish picture. It values the company at $20.76, implying the stock trades roughly 36% below what future cash flows could justify. Is the market missing something, or are the risks not fully accounted for?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Black Stone Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Black Stone Minerals Narrative

If you have a different perspective or want to dive deeper into the numbers, you can quickly craft your own story in just a few minutes. Do it your way

A great starting point for your Black Stone Minerals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their edge by seeking out unique opportunities across sectors and trends. Don’t let these standout stock ideas pass you by.

- Capture the momentum of powerful growth trends by checking out these 26 AI penny stocks poised to transform entire industries with artificial intelligence innovation.

- Stay ahead of the income curve by finding these 22 dividend stocks with yields > 3% offering yields above 3% and a history of reliable payouts.

- Tap into emerging financial technologies with these 81 cryptocurrency and blockchain stocks, where blockchain and crypto-focused companies are rewriting the rules of the digital economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Stone Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BSM

Black Stone Minerals

Owns and manages oil and natural gas mineral interests.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives