- United States

- /

- Oil and Gas

- /

- NYSE:AR

Antero Resources (AR): Examining Valuation After Recent Share Price Rally

Reviewed by Simply Wall St

See our latest analysis for Antero Resources.

Antero Resources’ latest run caps off a strong rebound for the stock, with a 1-day share price return of 3% and a 7-day rally near 9%. While share price momentum has been positive recently, the longer-term picture is even more impressive. The company has delivered a 15% total shareholder return over the past year and a staggering 743% over five years, reflecting investors’ renewed appetite for the energy sector and shifting expectations for natural gas demand.

If strong momentum in energy stocks has you interested in what else is gaining traction, it’s a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares up sharply, but trading nearly 25% below the average analyst price target, the question is whether Antero Resources remains undervalued or if the market has already accounted for the company’s future growth prospects.

Most Popular Narrative: 19.9% Undervalued

The most popular narrative sees Antero Resources trading well below its suggested fair value, with the last close price at $33.65 and an estimated fair value of $42. This gap has market watchers probing the assumptions driving such optimism and questioning whether Antero’s fundamentals can sustain these forecasts.

Ongoing capital efficiency gains, including declining maintenance capital requirements, longer well laterals, and falling well costs year over year, are reducing per-unit operating costs. This is boosting net margins and freeing up additional cash for debt reduction and shareholder returns.

Want to see what is fueling this bullish outlook? The narrative hinges on bold financial projections and a strategic shift in cost management. Discover which surprising business moves and future earnings assumptions set the stage for this elevated valuation. Dig into the numbers that could send Antero into a new league.

Result: Fair Value of $42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a global shift toward clean energy or persistent pipeline constraints could quickly challenge this optimistic outlook for Antero Resources.

Find out about the key risks to this Antero Resources narrative.

Another View: Is the Market Price Justified by Multiples?

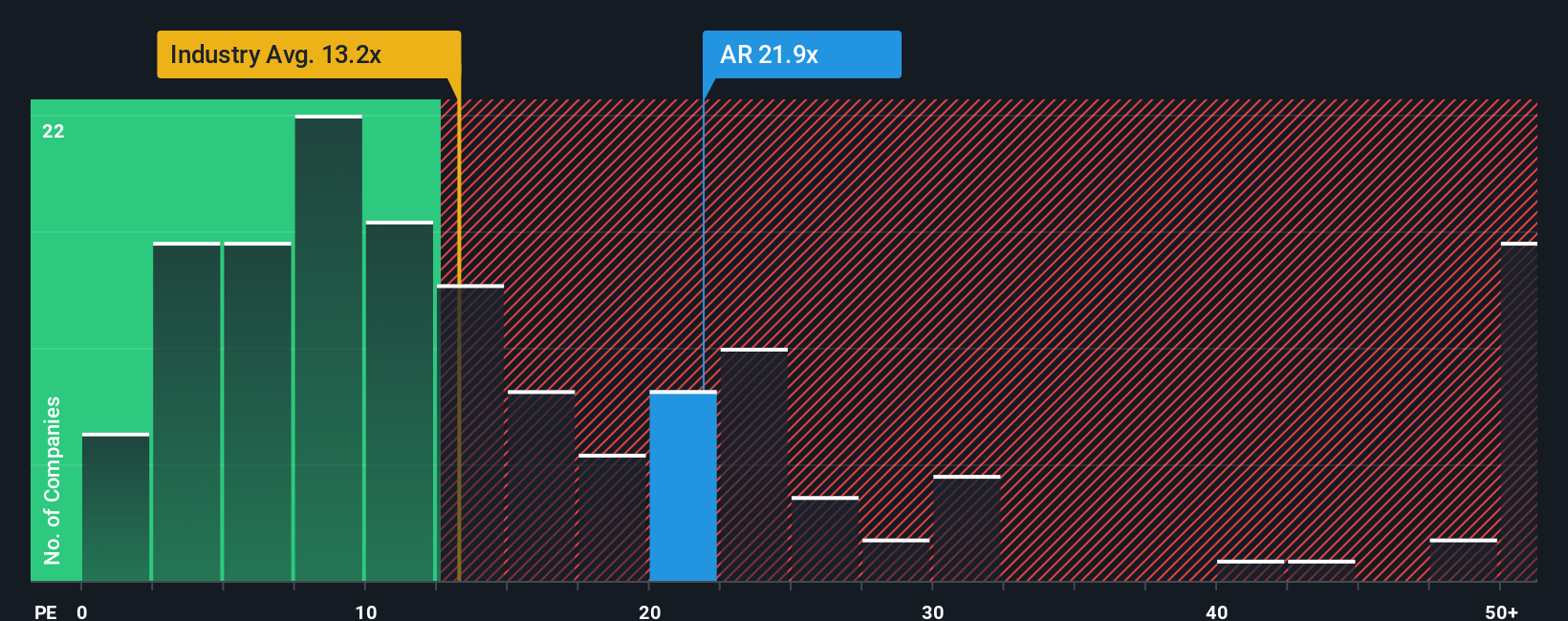

When looking at Antero Resources through the lens of its price-to-earnings ratio, the story shifts. Shares trade at 17.6x earnings, which is a little higher than both the US Oil and Gas industry average of 13.5x and the fair ratio of 17.1x. This suggests the market might be pricing in greater expectations, raising the bar for future results. Could this mean the shares carry more risk at current levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Antero Resources Narrative

If you see the numbers differently or want to explore the facts yourself, it only takes a few minutes to build your own story. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Antero Resources.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Give yourself an edge and see what other standout investments are catching attention right now. You could easily find your next winning idea.

- Tap into real income potential by checking out these 16 dividend stocks with yields > 3% with consistently strong dividend yields and reliable cash flows.

- Unlock upside in technology by scouting these 25 AI penny stocks innovating with artificial intelligence and reshaping tomorrow’s markets.

- Boost your returns by tracking these 878 undervalued stocks based on cash flows that the market may be overlooking, offering value where others aren’t looking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AR

Antero Resources

An independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives