- United States

- /

- Oil and Gas

- /

- NYSE:AM

Will Data Center-Driven Gas Demand Shift Antero Midstream's (AM) Long-Term Cash Flow Outlook?

Reviewed by Sasha Jovanovic

- In recent news, Antero Midstream announced that it operates under long-term fixed-rate contracts with Antero Resources, securing predictable cash flows and minimum volume commitments through 2038.

- An interesting aspect is the company’s potential to benefit from surging natural gas demand tied to the rapid development of data centers in the Appalachian Basin, particularly in Northern Virginia.

- We'll now examine how the anticipated rise in data center-driven natural gas demand could impact Antero Midstream's broader investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Antero Midstream Investment Narrative Recap

To be an Antero Midstream shareholder, you need to believe in the resilience of fee-based revenue streams underpinned by long-term, fixed-rate contracts, and in the sustained demand for Appalachian natural gas, especially from data centers and industrial users. The new contract extensions and visibility through 2038 reinforce cash flow reliability, but in the short term, this news does not materially change the biggest catalyst for stable volumes, nor does it offset the ongoing risk of exposure to a single region and anchor customer.

Among the recent company announcements, the October 2025 decision to maintain the dividend at US$0.225 per share directly reflects management's confidence in the continued cash generation signaled by fixed-rate contracts. As natural gas demand from new data center investments builds, dividend sustainability remains closely tied to Antero Resources' production activity and the regulatory climate in Appalachia.

On the flip side, investors should also be aware of the concentration risk tied to Antero Resources and Appalachian Basin activity...

Read the full narrative on Antero Midstream (it's free!)

Antero Midstream's outlook anticipates $1.3 billion in revenue and $655.5 million in earnings by 2028. This scenario is based on a 1.3% annual revenue growth rate and a $199.9 million increase in earnings from the current $455.6 million.

Uncover how Antero Midstream's forecasts yield a $18.64 fair value, a 3% upside to its current price.

Exploring Other Perspectives

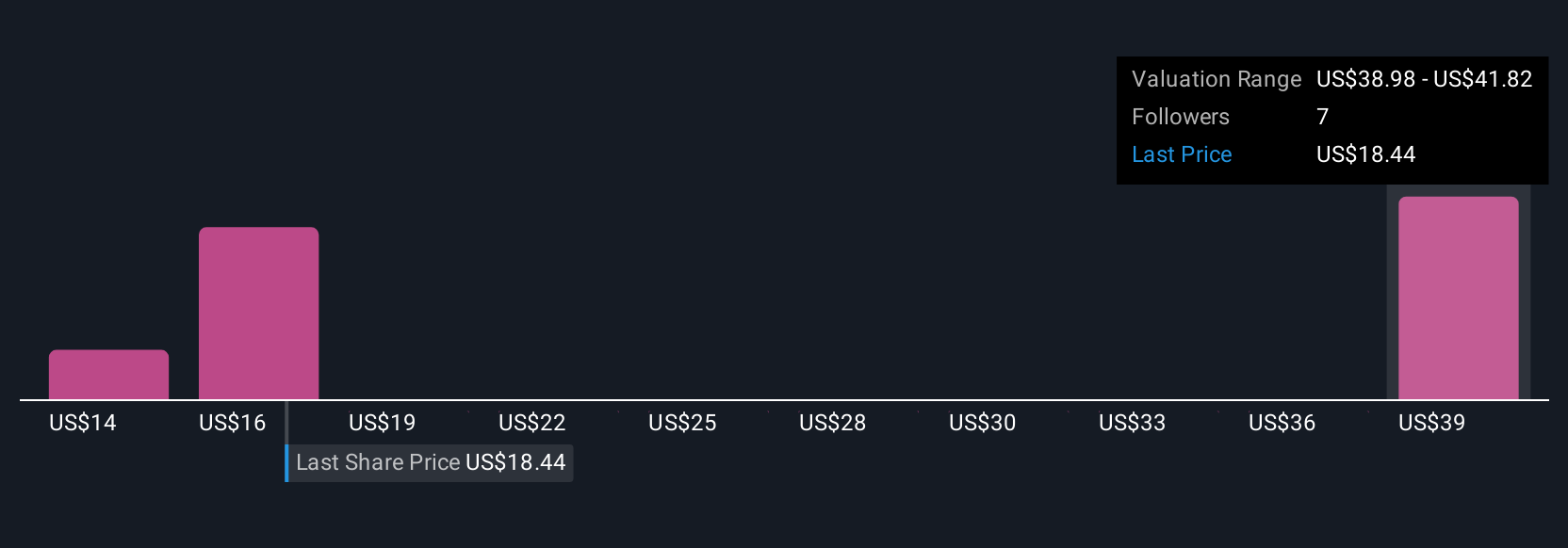

Simply Wall St Community members shared four different fair value estimates for Antero Midstream, from US$14.20 to an outlier of US$31,000.86. While some see immense upside, many will be weighing this optimism against the company's heavy reliance on the stability and expansion plans of Antero Resources, reminding you to question how regional risks could impact future results.

Explore 4 other fair value estimates on Antero Midstream - why the stock might be a potential multi-bagger!

Build Your Own Antero Midstream Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Antero Midstream research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Antero Midstream research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Antero Midstream's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AM

Antero Midstream

Owns, operates, and develops midstream energy assets in the Appalachian Basin.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026