- United States

- /

- Oil and Gas

- /

- NYSE:AM

Is Antero Midstream a Hidden Value After 24% Surge and Analyst Upgrades in 2025?

Reviewed by Bailey Pemberton

- Curious whether Antero Midstream is a hidden value play or just another stock with a flashy ticker? Here is a breakdown of the story to get to the bottom of what it might be worth.

- Despite recent turbulence, with the share price down 2.4% over the past week and off 10.0% for the month, Antero Midstream is still up an impressive 11.0% year-to-date and has surged 24.1% over the past year.

- A series of positive analyst upgrades and renewed interest in energy infrastructure stocks have fueled recent gains, even as broader market uncertainty persists. These news events help explain both short-term bumps and the longer-term optimism around the company’s prospects.

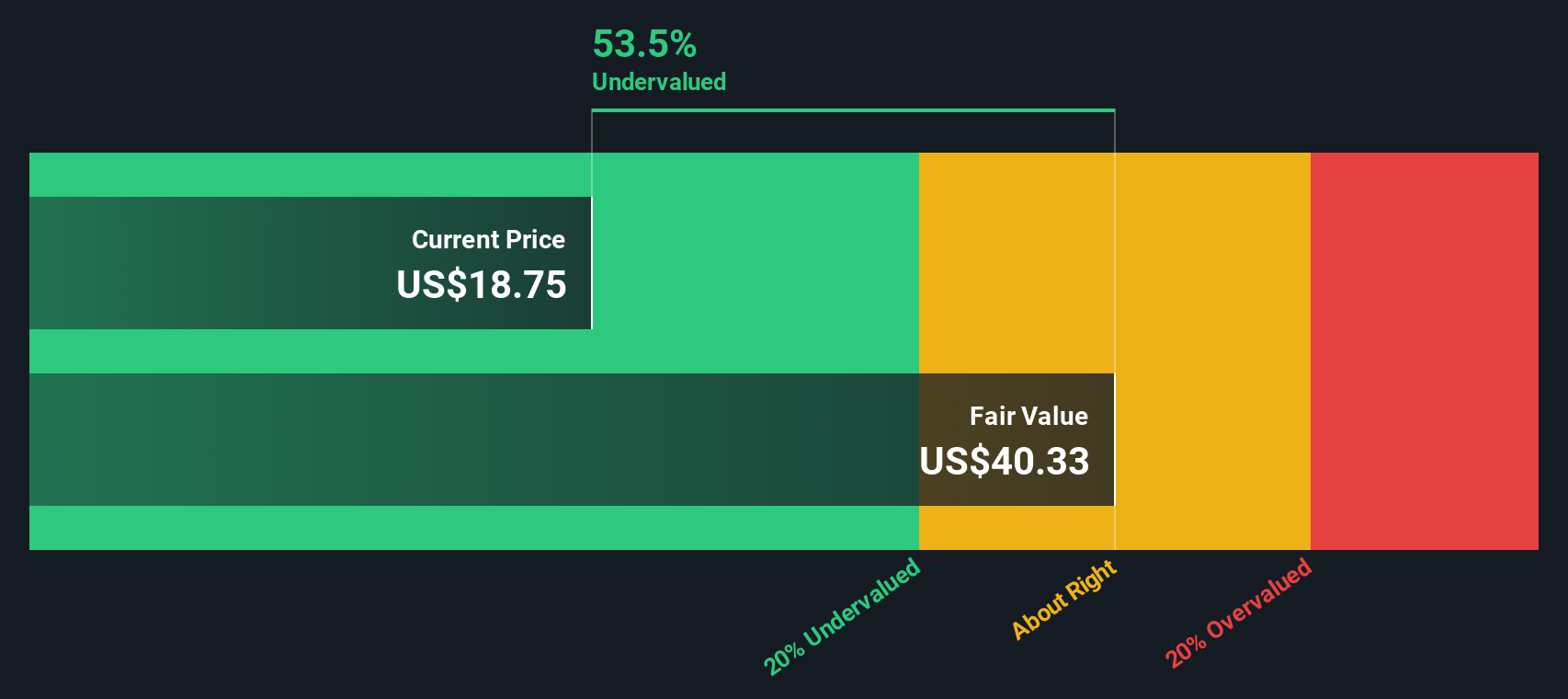

- On the numbers front, Antero Midstream currently holds a valuation score of 4 out of 6, reflecting potential undervaluation in several key measures. In the following sections, we examine how analysts commonly value stocks like this and highlight a smarter, more holistic way to judge whether it is really a bargain.

Approach 1: Antero Midstream Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For Antero Midstream, this approach starts by looking at the company’s current Free Cash Flow, which stood at $616.6 million over the last twelve months. Analysts forecast steady growth in free cash flow, projecting it to rise to $923.5 million by 2029.

The DCF model used here is a 2 Stage Free Cash Flow to Equity approach. Analysts provide estimates for the next five years, and further projections are extrapolated by Simply Wall St to offer a fuller picture of long-term potential. These projections reveal continued increases in free cash flow each year, highlighting the company’s consistent operating performance.

Based on these cash flow projections, the estimated intrinsic value of Antero Midstream’s stock comes out to $48.60 per share. With the DCF model indicating a 64.6% discount to this intrinsic value, the stock currently appears significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Antero Midstream is undervalued by 64.6%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: Antero Midstream Price vs Earnings

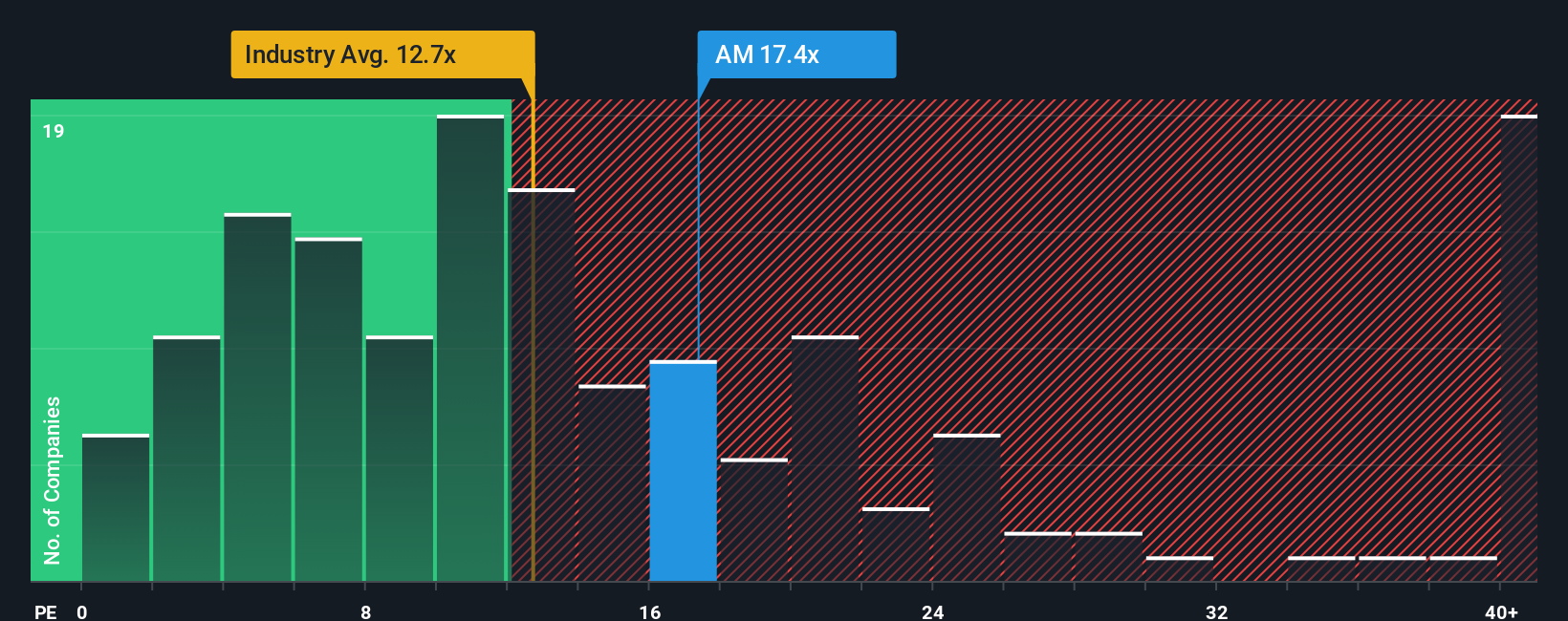

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Antero Midstream, as it measures how much investors are willing to pay today for each dollar of the company’s earnings. For companies with steady profits, the PE ratio offers a quick check of value compared to similar stocks.

It is important to remember that a “normal” or fair PE ratio depends on several factors. Companies with higher expected earnings growth or lower risk profiles generally justify higher PE multiples, while more mature or riskier businesses typically command lower ones.

Currently, Antero Midstream’s PE ratio stands at 17.4x. This places it above the Oil and Gas industry average of 12.8x, but well below its peer average of 28.7x. While comparing these benchmarks is useful, it does not capture all the factors influencing fair value.

This is where Simply Wall St’s proprietary Fair Ratio comes in. The Fair Ratio, calculated based on everything from earnings growth prospects and risk to profit margins, industry category, and company size, offers a more nuanced and company-specific benchmark than peer or industry averages alone. For Antero Midstream, the Fair Ratio is estimated at 18.5x.

With the company trading at 17.4x compared to a Fair Ratio of 18.5x, the stock appears slightly undervalued based on this methodology.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

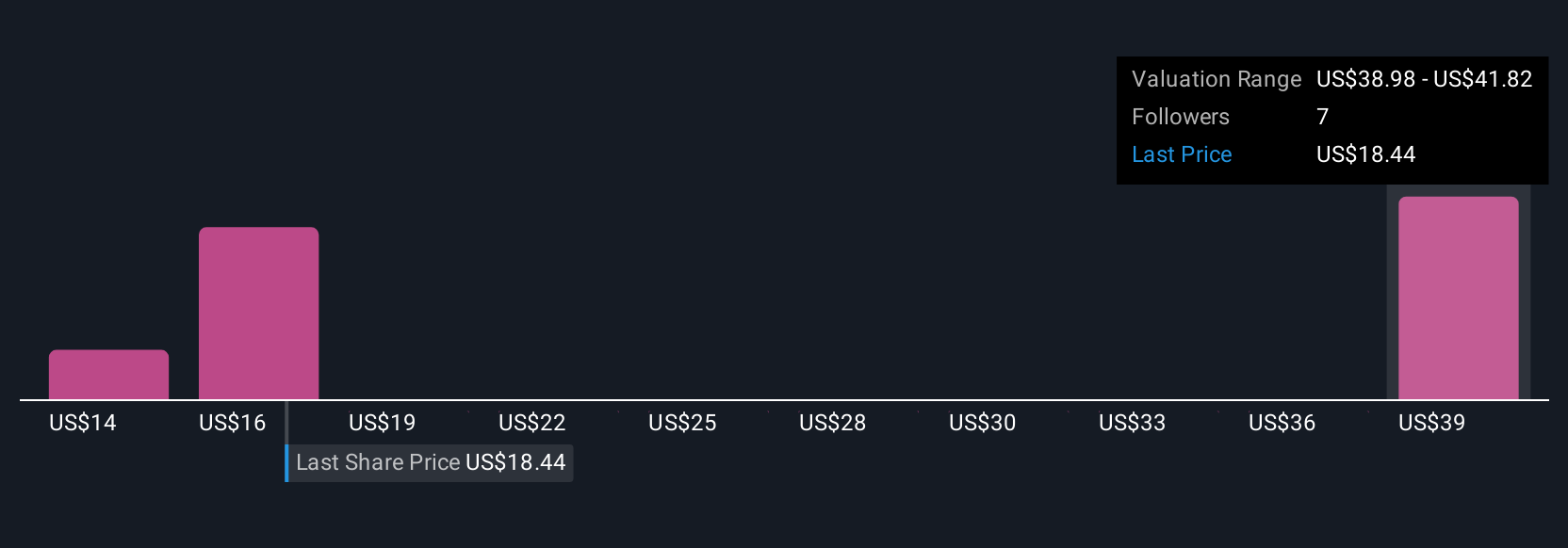

Upgrade Your Decision Making: Choose your Antero Midstream Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple, user-friendly way to tie your perspective about Antero Midstream, including your views on future revenue, earnings, margins, and fair value, into a single story that sits behind the numbers.

Rather than just crunching ratios, Narratives let you express why you think the company is valued as it is, connecting real-world business drivers and risks to your financial estimates and culminating in a personalized fair value for the stock. Narratives are available for anyone to use on the Simply Wall St Community page, where millions of investors contribute their takes.

The real power of Narratives is that they dynamically update when news breaks or earnings are announced. For example, if Antero Midstream strikes a major contract or reports a regulatory setback, your Narrative will automatically reflect these changes.

This tool makes it easier to know when to buy or sell by always showing you how your own fair value compares to the latest market price. For example, some investors currently project strong LNG demand and margin expansion, supporting a bull case fair value as high as $19.00. Others, more cautious about regulatory risks and reliance on one customer, estimate a fair value closer to $16.00.

Do you think there's more to the story for Antero Midstream? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AM

Antero Midstream

Owns, operates, and develops midstream energy assets in the Appalachian Basin.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives