- United States

- /

- Energy Services

- /

- NYSE:AESI

Should Investors Revisit Atlas Energy Solutions After 51% Drop and Shifting Valuation Signals?

Reviewed by Bailey Pemberton

- Ever wondered if Atlas Energy Solutions stock is a bargain or just another name in the headlines? If you are curious about value—not just price—this could be the stock to watch.

- This year, shares have dropped a steep 51.1%, with a 7-day slide of 6.9% and a 30-day loss of 5.5%. These movements hint at both changing risk perceptions and possible opportunity for bold investors.

- Market chatter has focused on shifting industry dynamics, with headlines highlighting Atlas Energy Solutions’ strategic moves and competitive positioning. These developments are adding both optimism and caution to the mix as investors weigh what comes next.

- On our Value Score framework, Atlas Energy Solutions scores a 3 out of 6. This suggests there is more to this story than just the numbers. Next up, we will explore a range of valuation methods, but stick around for a perspective that might be even more insightful at the end.

Find out why Atlas Energy Solutions's -44.1% return over the last year is lagging behind its peers.

Approach 1: Atlas Energy Solutions Discounted Cash Flow (DCF) Analysis

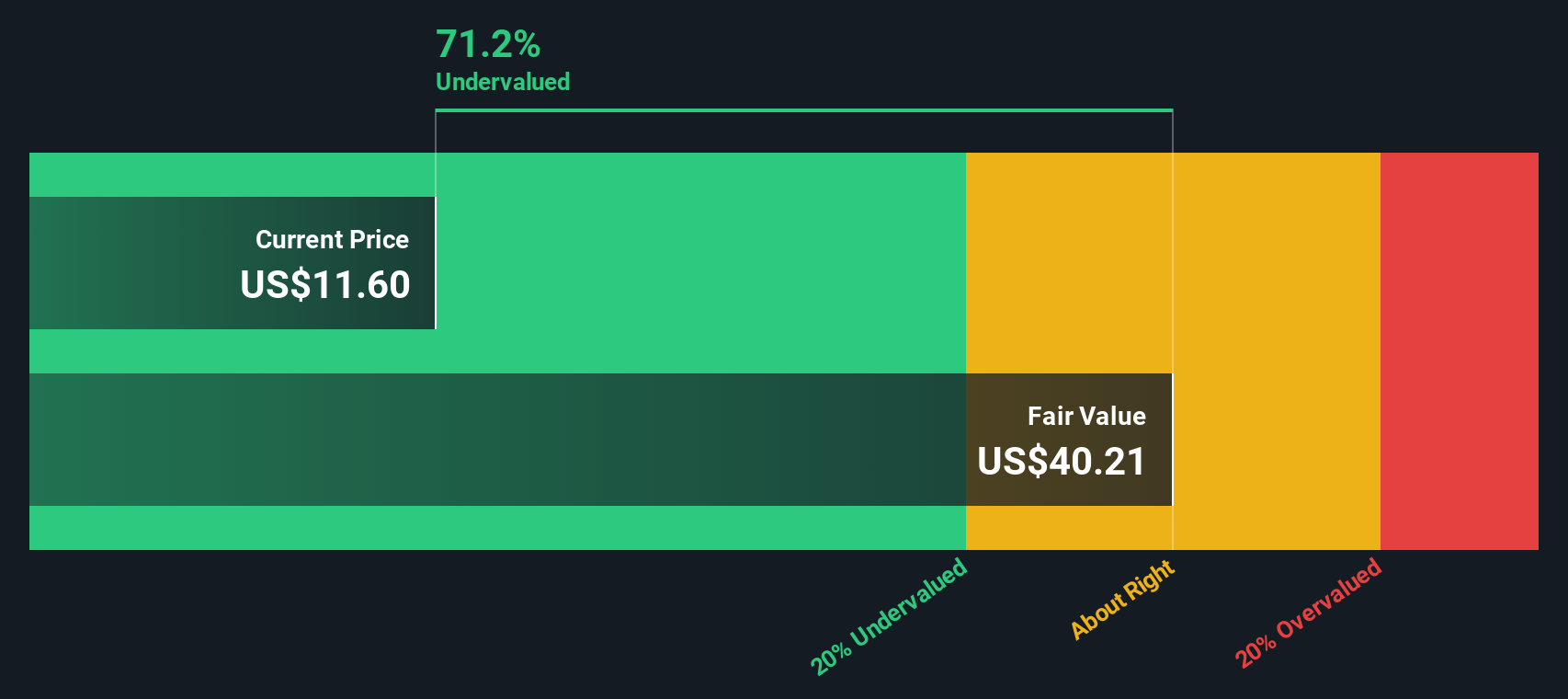

The Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and then discounting them back to their present value. This approach is especially useful for businesses like Atlas Energy Solutions, where future earnings can be projected with some degree of confidence.

Currently, Atlas Energy Solutions has a Free Cash Flow (FCF) of -$193 million. Analyst forecasts estimate FCF to climb steadily, reaching $199 million by 2028. Projections stretching out to 2035, including both analyst estimates and model extrapolations, show FCF continuing to rise. This growth trajectory is crucial because the DCF model aggregates these future values and adjusts them for the time value of money to determine the company’s underlying worth.

According to the 2 Stage Free Cash Flow to Equity model, Atlas Energy Solutions’ estimated intrinsic value is $33.74 per share. Given that the current share price reflects a 66.7% discount to this estimate, the stock appears significantly undervalued based on present projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Atlas Energy Solutions is undervalued by 66.7%. Track this in your watchlist or portfolio, or discover 836 more undervalued stocks based on cash flows.

Approach 2: Atlas Energy Solutions Price vs Sales

The Price-to-Sales (P/S) ratio is often a preferred valuation method for companies where profitability may fluctuate, but underlying revenues can still provide meaningful insights. This metric is especially useful for evaluating companies in sectors like energy services, where profitability can be impacted by industry cycles and revenue growth remains a key sign of ongoing business strength.

Growth expectations and perceived risk both influence what investors consider to be a “normal” or “fair” P/S multiple. Faster-growing, lower-risk companies often command higher P/S ratios, as investors are willing to pay a premium for future potential. Conversely, slower growth or higher risk should yield a lower multiple.

Atlas Energy Solutions is currently trading at a P/S ratio of 1.25x. For context, the industry average stands at 1.00x and peer companies trade around 1.34x. However, Simply Wall St’s proprietary “Fair Ratio” takes this comparison a step further by blending factors like the company’s growth outlook, profit margin, risk profile, industry, and market capitalization to generate a more tailored benchmark. With a Fair Ratio of 0.73x for Atlas Energy Solutions, the company appears to be valued somewhat above what these underlying fundamentals suggest is reasonable.

This Fair Ratio is a better guide than simple peer or industry comparisons because it is specifically calibrated to the unique characteristics of Atlas Energy Solutions rather than broad averages. By weighing growth trends, risk, margins, and competitive position, it provides a more holistic view of true value.

Comparing the current P/S ratio of 1.25x to the Fair Ratio of 0.73x suggests the stock is trading at a premium to its intrinsic worth.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Atlas Energy Solutions Narrative

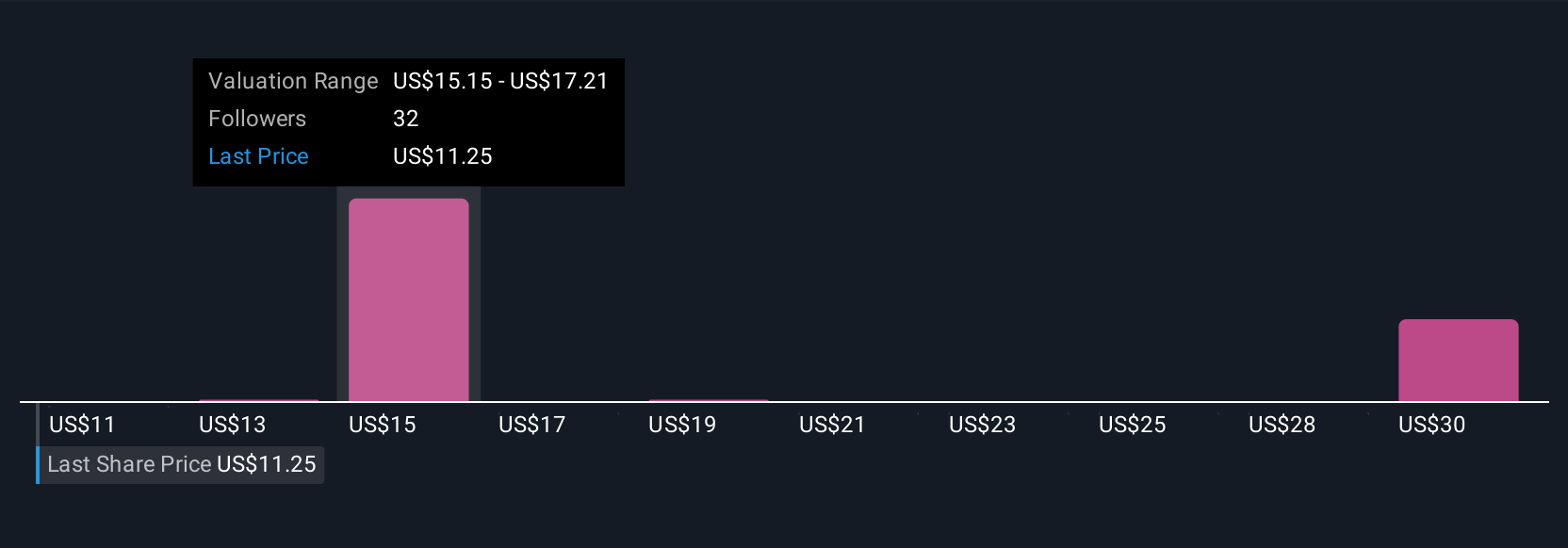

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story or perspective for a company, where you lay out your view on its business model, future growth, margins, and ultimately what you believe is its fair value. Instead of relying solely on traditional metrics or external forecasts, Narratives let you connect the dots between a company’s evolving story, your own financial forecasts, and the price you think the stock should trade at.

Narratives are available within the Community page on Simply Wall St, making it an accessible and popular tool for millions of investors. By creating or exploring Narratives, you can see how others connect events, such as new earnings, changing markets, or strategic moves, to their fair value estimates. This can help you decide whether to buy, hold, or sell. Narratives automatically update as new data rolls in, so your thesis can change dynamically with the market.

For Atlas Energy Solutions, for example, some investors have built bullish Narratives that see the price climbing to $20 based on diversification and improving margins. Others adopt a conservative view, targeting just $12 due to end-market weaknesses and industry risk. This range of perspectives helps you sense-check your own view and see how your convictions line up against real-time insights from the investor community.

Do you think there's more to the story for Atlas Energy Solutions? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AESI

Atlas Energy Solutions

Engages in the production, processing, and sale of mesh and sand used as a proppant during the well completion process in the Permian Basin of West Texas and New Mexico.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives