- United States

- /

- Oil and Gas

- /

- NasdaqCM:USEG

U.S. Energy Corp.'s (NASDAQ:USEG) 29% Share Price Surge Not Quite Adding Up

U.S. Energy Corp. (NASDAQ:USEG) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 35% in the last year.

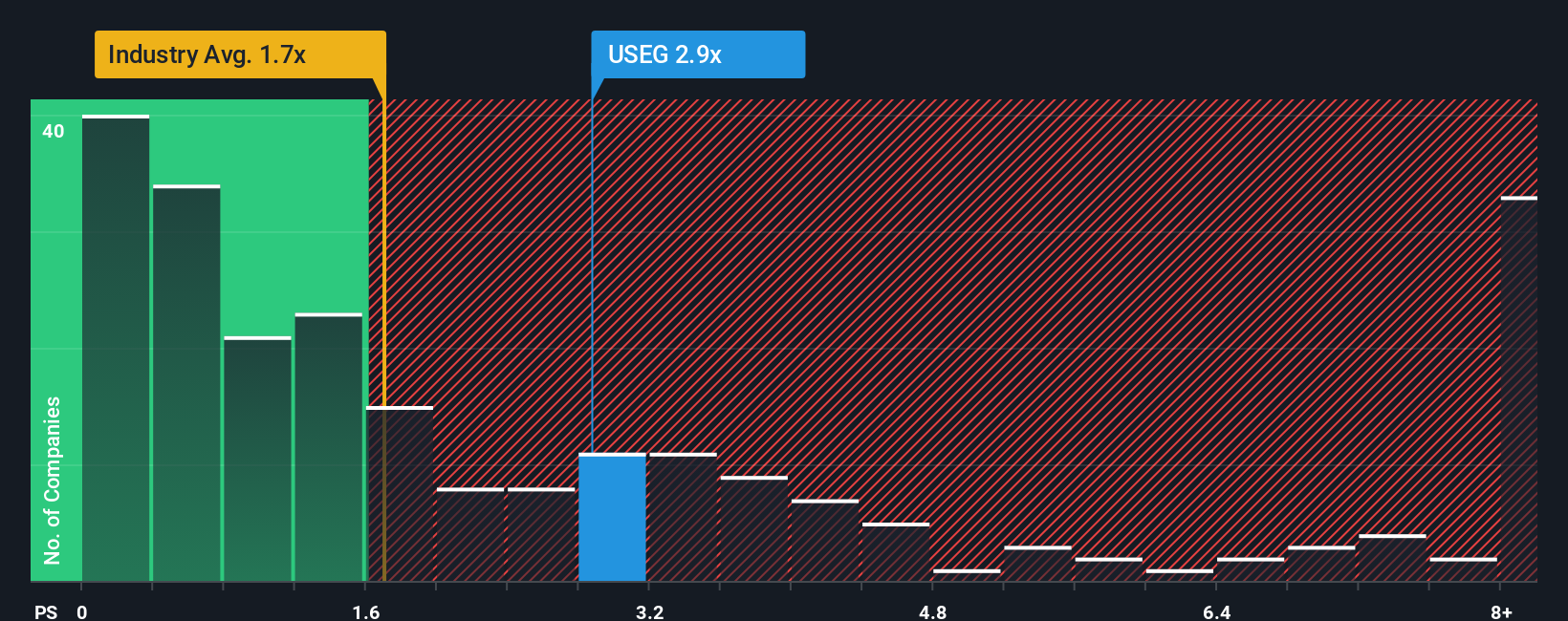

Following the firm bounce in price, given close to half the companies operating in the United States' Oil and Gas industry have price-to-sales ratios (or "P/S") below 1.7x, you may consider U.S. Energy as a stock to potentially avoid with its 2.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for U.S. Energy

How U.S. Energy Has Been Performing

While the industry has experienced revenue growth lately, U.S. Energy's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on U.S. Energy will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as U.S. Energy's is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 41%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 22% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 24% over the next year. With the industry predicted to deliver 6.7% growth, that's a disappointing outcome.

In light of this, it's alarming that U.S. Energy's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On U.S. Energy's P/S

U.S. Energy's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of U.S. Energy's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for U.S. Energy (1 is potentially serious) you should be aware of.

If these risks are making you reconsider your opinion on U.S. Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:USEG

U.S. Energy

An independent energy company, focuses on the acquisition, exploration, and development of industrial gas, and oil and natural gas properties in the continental United States.

Slight risk and fair value.

Market Insights

Community Narratives