- United States

- /

- Oil and Gas

- /

- NasdaqGS:PAGP

Plains GP Holdings (PAGP): Evaluating Valuation After Earnings Miss, EPIC Crude Acquisition, and Strategic Reshuffle

Reviewed by Simply Wall St

Plains GP Holdings (PAGP) just reported its third-quarter earnings, coming in below Wall Street expectations on both revenue and earnings per share. At the same time, the company wrapped up its acquisition of EPIC Crude Holdings and revealed plans to streamline its business with targeted divestitures.

See our latest analysis for Plains GP Holdings.

Following its recent earnings miss and the major acquisition of EPIC Crude Holdings, Plains GP Holdings has seen its share price trend lower in recent months as investors digest the company's evolving strategy and mixed results. Momentum has faded a bit, but thanks to solid payouts and transformative moves, Plains GP’s longer-term total shareholder returns stand out. The stock is up over 225% in five years and has posted a 3.8% gain over the last year.

If you're looking to broaden your investing horizons beyond energy, now's a good time to discover fast growing stocks with high insider ownership.

With revenue growth lagging but key strategic shifts underway, investors now face the central question: is Plains GP Holdings undervalued after its recent pullback, or is the market already pricing in the company's next phase of growth?

Most Popular Narrative: 15% Undervalued

With the narrative's fair value at $20.62 and Plains GP Holdings last closing at $17.52, analysts are betting the stock deserves a higher price if their assumptions hold true. The narrative’s calculation hinges on ambitious growth and sustained cash flows as management pivots to a streamlined, crude-focused operation.

The planned divestiture of the NGL segment and redeployment of approximately $3 billion in proceeds into core crude oil operations and bolt-on acquisitions are expected to streamline operations, reduce commodity price exposure, and enhance financial flexibility. These steps should support growth in core revenue and improve net margins via higher-return investments and potential buybacks.

Curious about the financial logic driving this bullish take? The valuation argument includes optimistic moves and projected increases in future profits. Find out what bold projections for earnings and revenue, plus a profit multiple rarely seen in the sector, are embedded in that fair value call. Ready to dig into the story behind the numbers?

Result: Fair Value of $20.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharp drop in oil demand or regulatory shifts could quickly undermine the bull case and challenge Plains GP Holdings’ long-term profitability.

Find out about the key risks to this Plains GP Holdings narrative.

Another View: Multiples Suggest a Different Story

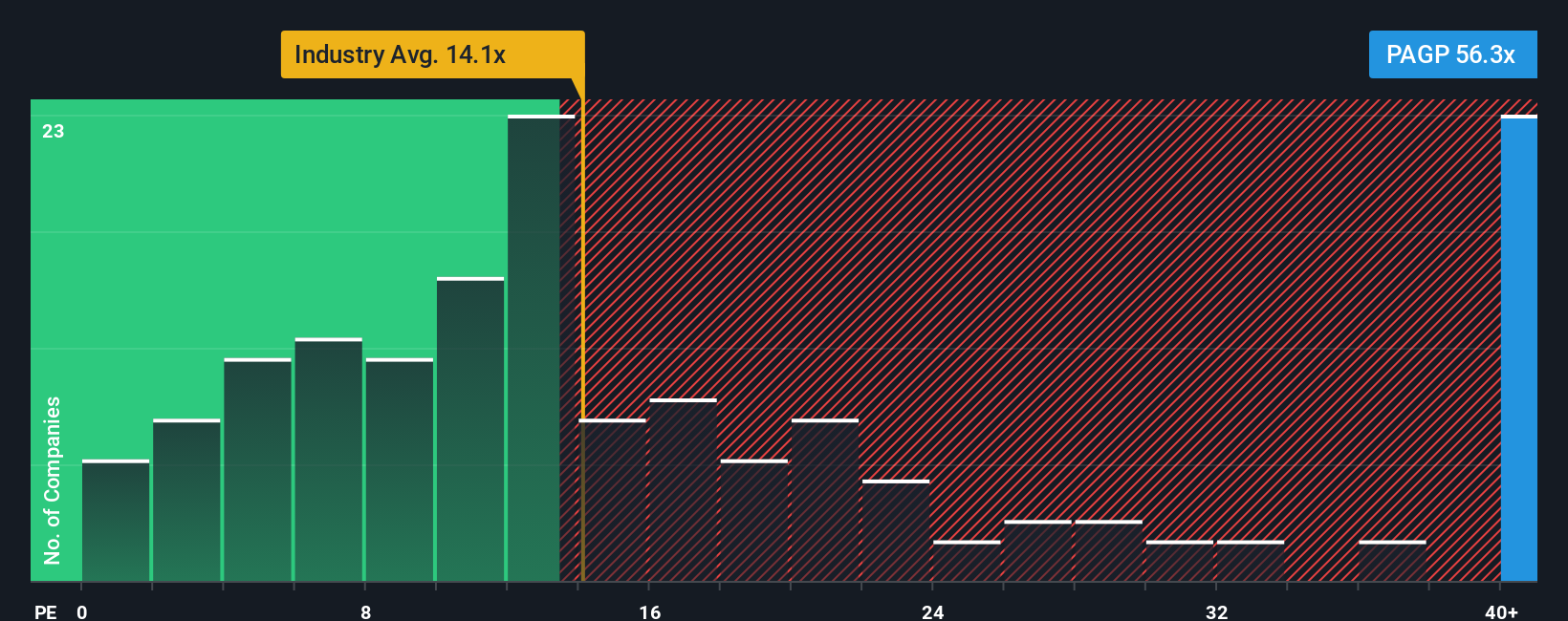

While the fair value approach paints Plains GP Holdings as undervalued, a look at the price-to-earnings ratio tells another story. Currently, the company trades at 55.9 times earnings, which is sharply higher than both the US Oil and Gas industry average of 13.4x and the peer group average of 26x. The market’s current valuation is also far above the fair ratio of 21.6x. This raises the risk that investors are paying a high price for future growth that may not fully materialize. If market sentiment shifts, could today's premium multiple come under pressure?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Plains GP Holdings Narrative

If you think the numbers tell a different story or want to try your own analysis, you can shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Plains GP Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your next big step as an investor by expanding beyond the obvious and targeting smarter opportunities, not just familiar names. The Simply Wall Street Screener puts powerful strategies at your fingertips; don’t pass up the chance to find your next great investment while others are missing out.

- Unlock the potential for steady income by browsing these 16 dividend stocks with yields > 3% that consistently deliver yields over 3%, perfect for building a resilient portfolio.

- Catch the next big trend with these 24 AI penny stocks reshaping industries with machine learning, automation, and disruptive innovation.

- Jump on overlooked value plays with these 870 undervalued stocks based on cash flows to spot stocks the market may be underestimating right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAGP

Plains GP Holdings

Through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives