- United States

- /

- Oil and Gas

- /

- NasdaqCM:NXXT

Will NextNRG's (NXXT) Project Pipeline Growth Redefine Its Long-Term Competitive Advantage?

Reviewed by Sasha Jovanovic

- NextNRG Inc. announced it would report its third quarter 2025 earnings on November 14, 2025, giving investors a key update on operational progress and financial performance.

- This scheduled release comes as market participants seek more insight into the company's expanding integrated energy offerings and increasing project pipeline.

- With the Q3 results now released, we'll examine how expectations for improved operational metrics and business scale could influence NextNRG's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

NextNRG Investment Narrative Recap

To back NextNRG, a shareholder needs to believe that its integrated energy solutions and expanding project pipeline can eventually overcome ongoing operating losses and win long-term contracts, especially as the company pivots toward recurring revenue from resilient microgrids and EV charging infrastructure. The Q3 earnings release is a timely check-in but does not materially change the key short-term catalyst, NextNRG's need to accelerate margin improvement amid rising capital needs, nor does it ease the ongoing risk from continued net losses and possible shareholder dilution if growth investments underdeliver. Among the recent company milestones, the Gulfstream Development Corporation partnership stands out, directly reinforcing NextNRG’s push into commercial contracts and advanced technology deployment for logistics infrastructure. This aligns closely with the critical catalyst of locking in large institutional clients and expanding multiyear contracts, both essential for supporting revenue growth and counterbalancing high fixed costs as new projects scale. Yet, despite these advances, it remains essential for investors to keep in mind that if key margin improvement targets are missed...

Read the full narrative on NextNRG (it's free!)

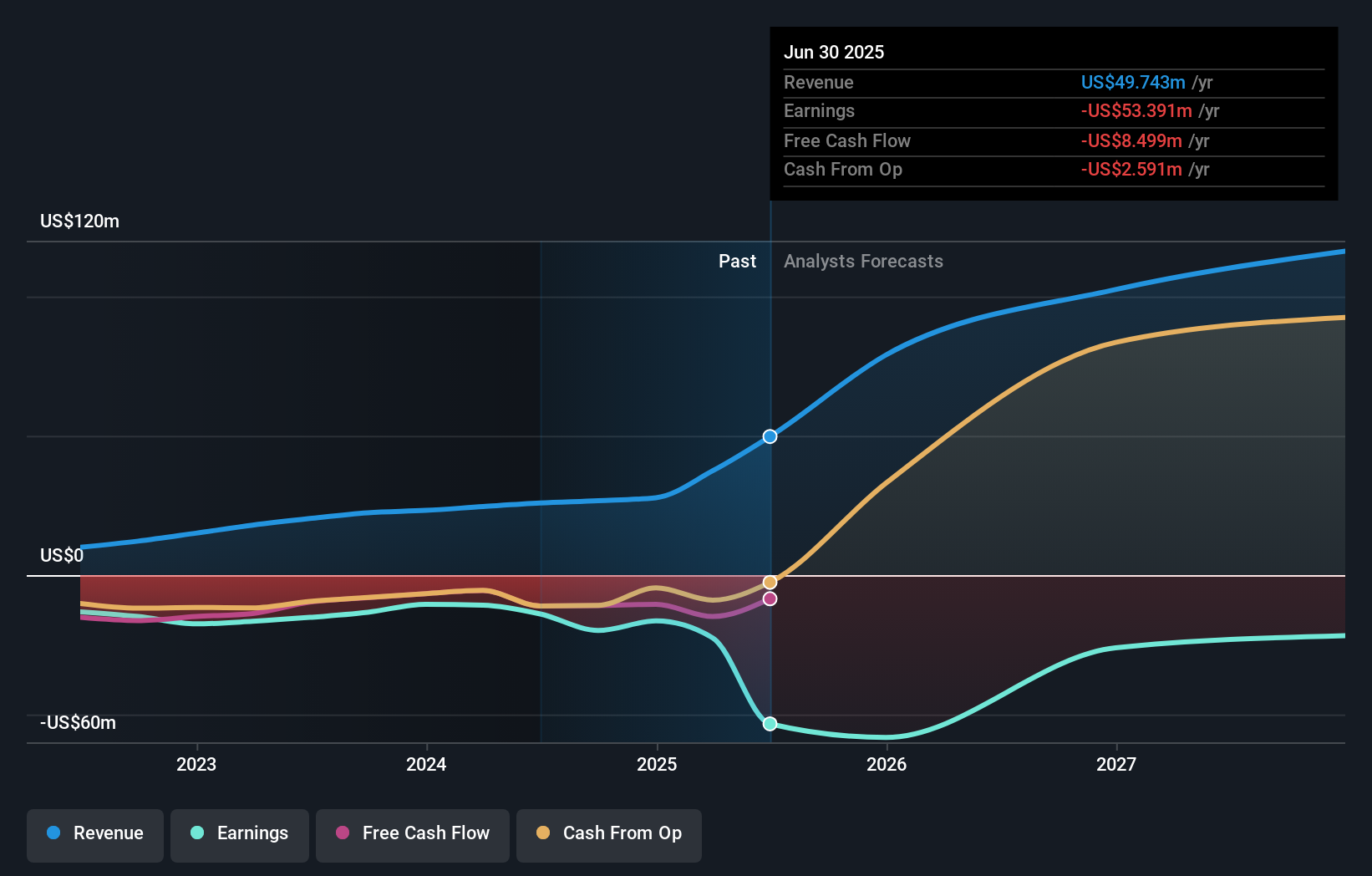

NextNRG's narrative projects $124.8 million revenue and $18.6 million earnings by 2028. This requires 35.9% yearly revenue growth and a $72 million increase in earnings from -$53.4 million today.

Uncover how NextNRG's forecasts yield a $5.50 fair value, a 174% upside to its current price.

Exploring Other Perspectives

With only one fair value estimate from the Simply Wall St Community at US$5.50, diversity of opinion on NextNRG appears limited. Persistent net losses and recurring capital raises cited in recent earnings may weigh heavily on future shareholder outcomes, so explore other viewpoints on what could drive sustained value or volatility.

Explore another fair value estimate on NextNRG - why the stock might be worth just $5.50!

Build Your Own NextNRG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextNRG research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free NextNRG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextNRG's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextNRG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NXXT

Slight risk with imperfect balance sheet.

Market Insights

Community Narratives