- United States

- /

- Oil and Gas

- /

- NasdaqCM:NEXT

NextDecade (NEXT): Valuation in Focus After Launching Rio Grande LNG Expansion and Securing New Debt Financing

Reviewed by Simply Wall St

NextDecade (NEXT) shares are in focus after the company initiated the federal regulatory process to expand its Rio Grande LNG facility with a sixth train and new marine berth, while also securing additional debt financing.

See our latest analysis for NextDecade.

NextDecade’s recent push to expand its Rio Grande LNG project and secure more flexible debt financing is unfolding against a backdrop of sharp share price swings. Even with promising news, the stock is down nearly 43% in the last three months, and year-to-date share price return is still deeply negative. Longer term, however, the company’s story is more resilient. Total shareholder return stands at over 21% for the past three years and 125% for five years, showing that volatility has not erased significant multi-year gains. Momentum has faded recently, but these strategic moves could shift sentiment if they translate to tangible project milestones and revenue growth.

If you’re watching how energy project expansions ripple through markets, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With the stock trading well below analyst price targets, but weighed down by recent volatility, investors are left to wonder if NextDecade is now undervalued or if the market has already priced in prospects for future growth.

Price-to-Book of 10.2x: Is it justified?

NextDecade trades at a price-to-book ratio of 10.2x, which is significantly higher than both its industry peers and the broader market. This makes the valuation appear stretched at the current share price of $5.97.

The price-to-book ratio compares a company’s market value to its book value and gives investors a sense of how much they are paying for each dollar of net assets. For energy infrastructure companies like NextDecade, this multiple is commonly used to evaluate growth prospects versus asset risk, especially for businesses still in the development phase.

With NextDecade’s ratio standing at 10.2x, the market is pricing in high expectations for future returns even though the company is currently generating minimal revenue and remains unprofitable. This premium is notable when compared to the US Oil and Gas industry average of 1.4x and a peer average of 1.8x. Until project milestones convert into revenue and profits, the justification for such a high multiple relies mainly on future growth potential rather than current fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 10.2x (OVERVALUED)

However, persistent revenue shortfalls or delays in project execution could undermine investor confidence and challenge the case for sustained premium valuation.

Find out about the key risks to this NextDecade narrative.

Another View: Discounted Cash Flow Signals Even Less Value

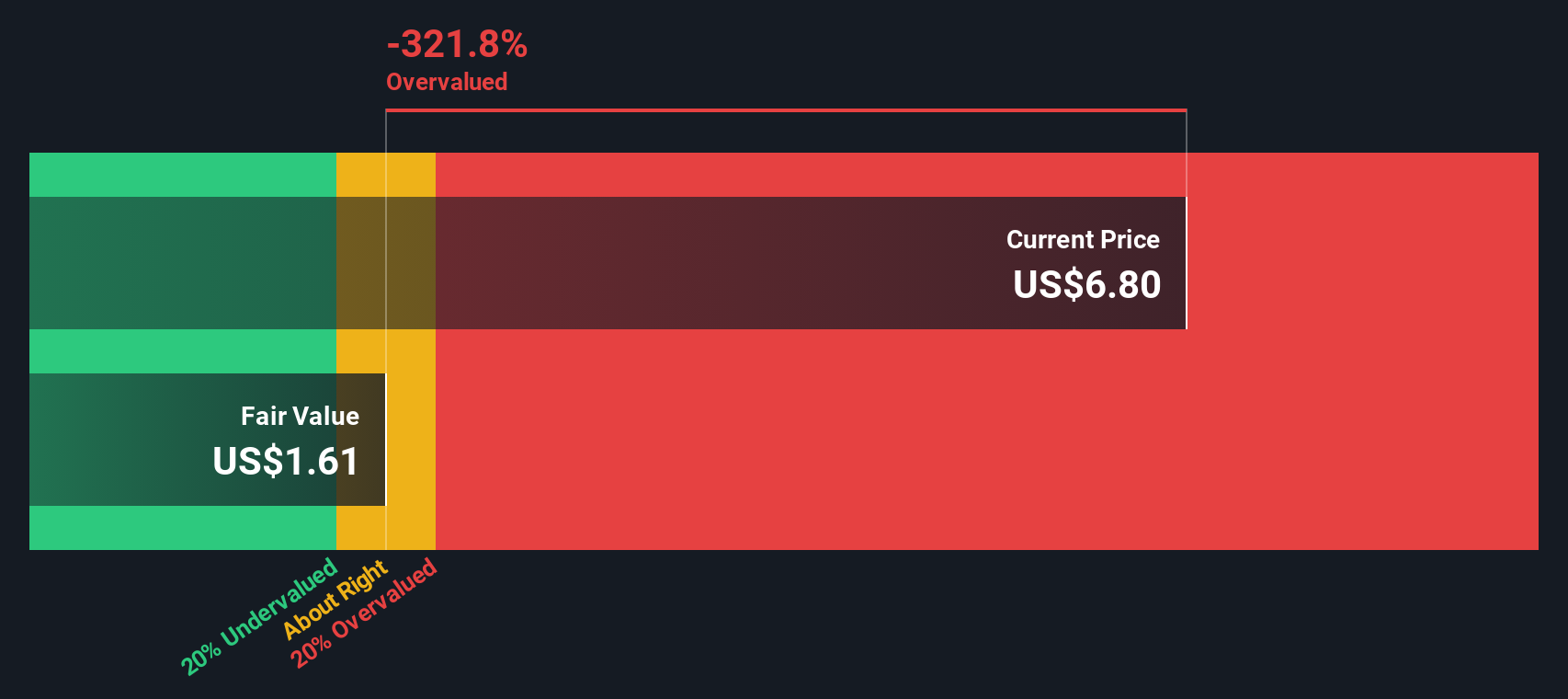

While the price-to-book ratio points to a stretched valuation, our SWS DCF model takes a different angle and suggests an even less optimistic stance. It estimates NextDecade’s fair value at $1.62 compared to the market price of $5.97, indicating the shares are trading well above intrinsic value.

Look into how the SWS DCF model arrives at its fair value.

This raises the question: Is the market too hopeful about future growth, or could there be catalysts ahead to close this gap?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NextDecade for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NextDecade Narrative

If you see the story differently or believe your own research leads elsewhere, you can quickly build your perspective in just a few minutes using our tools. Do it your way

A great starting point for your NextDecade research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by searching beyond the obvious. Don’t miss your chance to find stocks with overlooked value, hidden growth stories, or powerful industry trends using our favorite screeners below.

- Uncover high potential by reviewing these 923 undervalued stocks based on cash flows with robust fundamentals and compelling upside that others might be missing.

- Boost your portfolio’s yield by scouting these 14 dividend stocks with yields > 3% that consistently reward shareholders with healthy, above-average dividends.

- Get a head start in the rapidly evolving AI landscape with these 25 AI penny stocks leading innovation in cloud intelligence, automation, and data analytics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextDecade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEXT

NextDecade

An energy company, engages in the construction and development activities related to the liquefaction of natural gas in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026