- United States

- /

- Oil and Gas

- /

- NasdaqCM:NEXT

Is NextDecade's (NEXT) Widening Year-to-Date Loss Shaping Its Long-Term Growth Narrative?

Reviewed by Sasha Jovanovic

- NextDecade Corporation recently reported third quarter 2025 results, showing a US$109.48 million net loss for the quarter, which narrowed from the previous year, while the nine-month net loss widened to US$252.12 million compared to 2024.

- The company’s quarterly basic loss per share improved year-over-year, but the year-to-date figure nearly doubled, highlighting evolving cost pressures or project ramp-ups.

- We’ll explore how the mixed earnings update, especially the growing nine-month losses, impacts the company’s investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is NextDecade's Investment Narrative?

For NextDecade shareholders, the big picture remains centered on whether the company can turn ambitious project plans, including multi-decade LNG supply agreements, into meaningful revenues and ultimately, profitability. The third-quarter results saw a year-over-year improvement in the quarterly net loss, but the substantial widening of year-to-date losses and nearly doubling of basic loss per share underline growing cost pressures, potentially linked to project ramp-ups and financing activity. Short-term catalysts, such as progress on the Rio Grande LNG project and final investment decisions on future trains, remain important, but the latest results reinforce how cash burn and ongoing unprofitability may outweigh positive contract announcements in the near term. Given July's board refresh and the CFO transition in October, plus doubts raised by auditors about NextDecade’s ability to continue as a going concern earlier this year, the most recent update adds weight to liquidity and execution risks, potentially dampening enthusiasm for near-term share recovery despite a recent small bounce. On the other hand, the company’s short cash runway is a red flag that shouldn’t be overlooked.

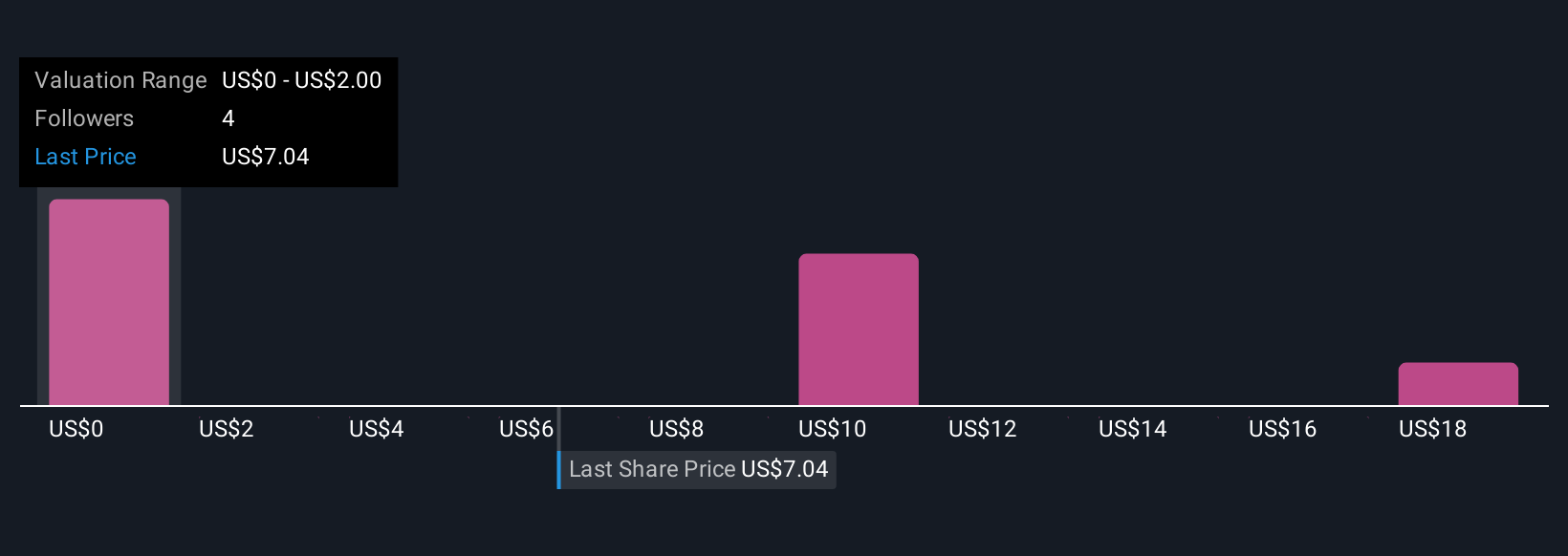

NextDecade's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 4 other fair value estimates on NextDecade - why the stock might be worth less than half the current price!

Build Your Own NextDecade Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NextDecade research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free NextDecade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NextDecade's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NextDecade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NEXT

NextDecade

An energy company, engages in the construction and development activities related to the liquefaction of natural gas in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives