- United States

- /

- Energy Services

- /

- NasdaqCM:NESR

How Investors May Respond To National Energy Services Reunited (NESR) Joining the S&P Global BMI Index

Reviewed by Sasha Jovanovic

- National Energy Services Reunited Corp. (NasdaqCM:NESR) was recently added to the S&P Global BMI Index, highlighting its increased recognition in global equity benchmarks.

- This inclusion can make the company more visible to international investors and may open the door for greater institutional participation in the stock.

- With NESR's index addition raising its profile, we'll consider how this could influence both investor sentiment and the company's growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

National Energy Services Reunited Investment Narrative Recap

To be a National Energy Services Reunited (NESR) shareholder, you need to be confident in the company’s ability to steadily grow its presence in the Middle East oilfield services market by securing new contracts and maintaining long-term partnerships with national oil companies. While NESR’s addition to the S&P Global BMI Index increases visibility and could attract more institutional activity, this change does not immediately impact the company’s most important short-term catalyst, awarding and starting up major tenders, nor does it materially address the continued risk from contract concentration and regional instability.

Among NESR’s recent announcements, its multiple, sizable directional drilling contract wins across Saudi Arabia, Oman, and Kuwait directly relate to steady revenue generation and improved backlog visibility. These wins matter in the context of the company’s focus on expanding project awards, as execution and timely revenue realization from such contracts remain critical drivers for operating results, especially amid the heightened attention following new index inclusions.

In contrast, the company’s exposure to concentrated national oil company contracts poses a risk that investors should understand before...

Read the full narrative on National Energy Services Reunited (it's free!)

National Energy Services Reunited is projected to reach $1.5 billion in revenue and $168.6 million in earnings by 2028. This outlook is based on a 4.0% annual revenue growth rate and an earnings increase of $95.6 million from the current $73.0 million.

Uncover how National Energy Services Reunited's forecasts yield a $13.20 fair value, a 28% upside to its current price.

Exploring Other Perspectives

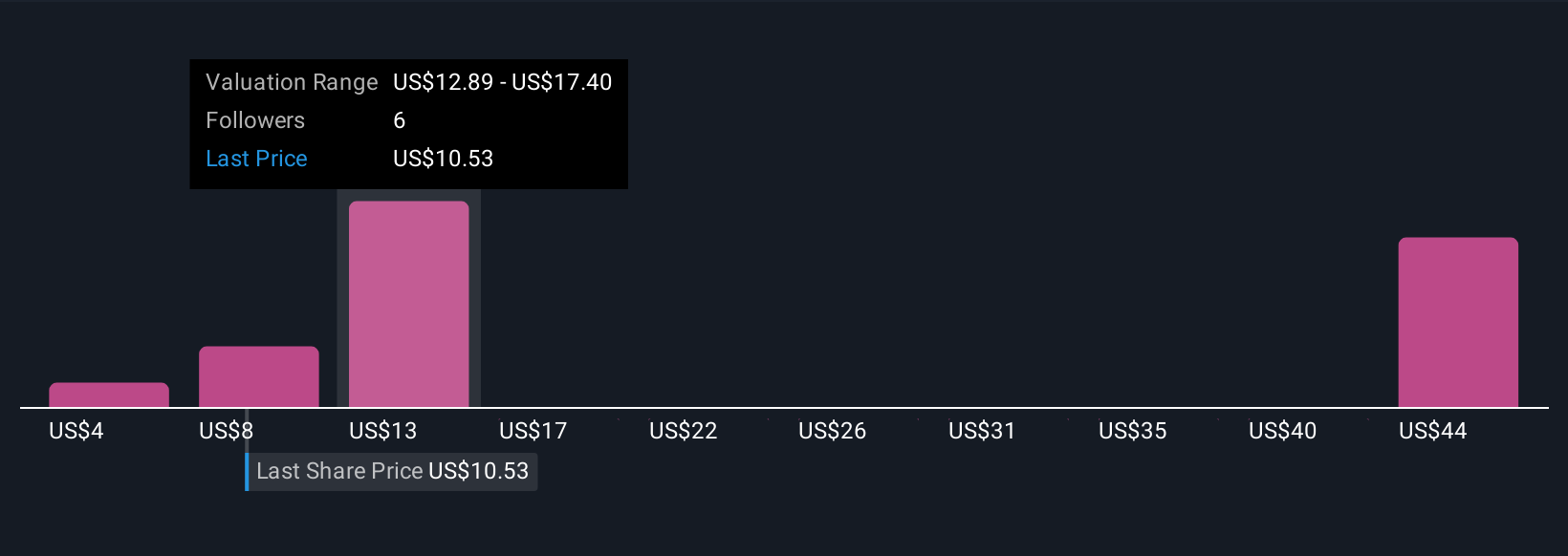

Six individual fair value projections from the Simply Wall St Community range sharply from US$3.87 to US$36.02 per share. Against this backdrop of varied outlooks, NESR’s growth depends heavily on securing and executing large Middle East contracts, inviting readers to compare these perspectives with their own expectations.

Explore 6 other fair value estimates on National Energy Services Reunited - why the stock might be worth over 3x more than the current price!

Build Your Own National Energy Services Reunited Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Energy Services Reunited research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free National Energy Services Reunited research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Energy Services Reunited's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Energy Services Reunited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NESR

National Energy Services Reunited

Provides oilfield services in the Middle East and North Africa region.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives