- United States

- /

- Oil and Gas

- /

- NasdaqGS:EXE

A Look at Expand Energy (EXE)'s Valuation After Upbeat Earnings and Raised Production Guidance

Reviewed by Simply Wall St

Expand Energy (EXE) just posted third-quarter earnings that topped Wall Street estimates, supported by increased natural gas production and higher realized prices. The company also announced a boost to its production outlook for the next quarter, reinforcing its growth trajectory.

See our latest analysis for Expand Energy.

Expand Energy’s momentum is picking up, with investors responding to the company’s strong quarterly earnings and upbeat production outlook. Over the last month, a 17.7% share price gain reflects growing confidence, while the 28% total shareholder return over the past year highlights sustained performance. Recent analyst upgrades and improved natural gas prices have strengthened the positive sentiment around the stock.

If you want to discover what else is making waves in the energy sector, explore other fast growing companies with high insider ownership using our screener. This is a great next stop for anyone following operational turnarounds and strong results. fast growing stocks with high insider ownership

With momentum building, the question now is whether Expand Energy’s recent rally leaves the stock undervalued, or if the market has already priced in the company’s accelerating growth and future potential. Is there still a buying opportunity, or has enthusiasm run ahead of fundamentals?

Most Popular Narrative: 6.9% Undervalued

Expand Energy’s latest close at $121.58 sits below the most widely followed narrative’s fair value target of $130.56. This fair value estimate reflects analyst consensus on the company’s earnings potential and production strength, suggesting headroom remains even after recent gains.

Major, recurring operational efficiencies and rapid well productivity gains, driven by advanced digitalization and AI integration, are resulting in reduced drilling and completion costs and increasing net margins. These improvements are expected to compound over time and directly benefit future earnings.

Is relentless efficiency the secret sauce? One forecast for margins, another for earnings, a third for how the market should value those profits. Which bold leap drives the difference between today’s price and this narrative’s target? Unlock the surprising quantitative thesis that has analysts seeing more upside.

Result: Fair Value of $130.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural policy changes or decarbonization trends could weigh on long-term demand. This may potentially challenge the bullish thesis for Expand Energy.

Find out about the key risks to this Expand Energy narrative.

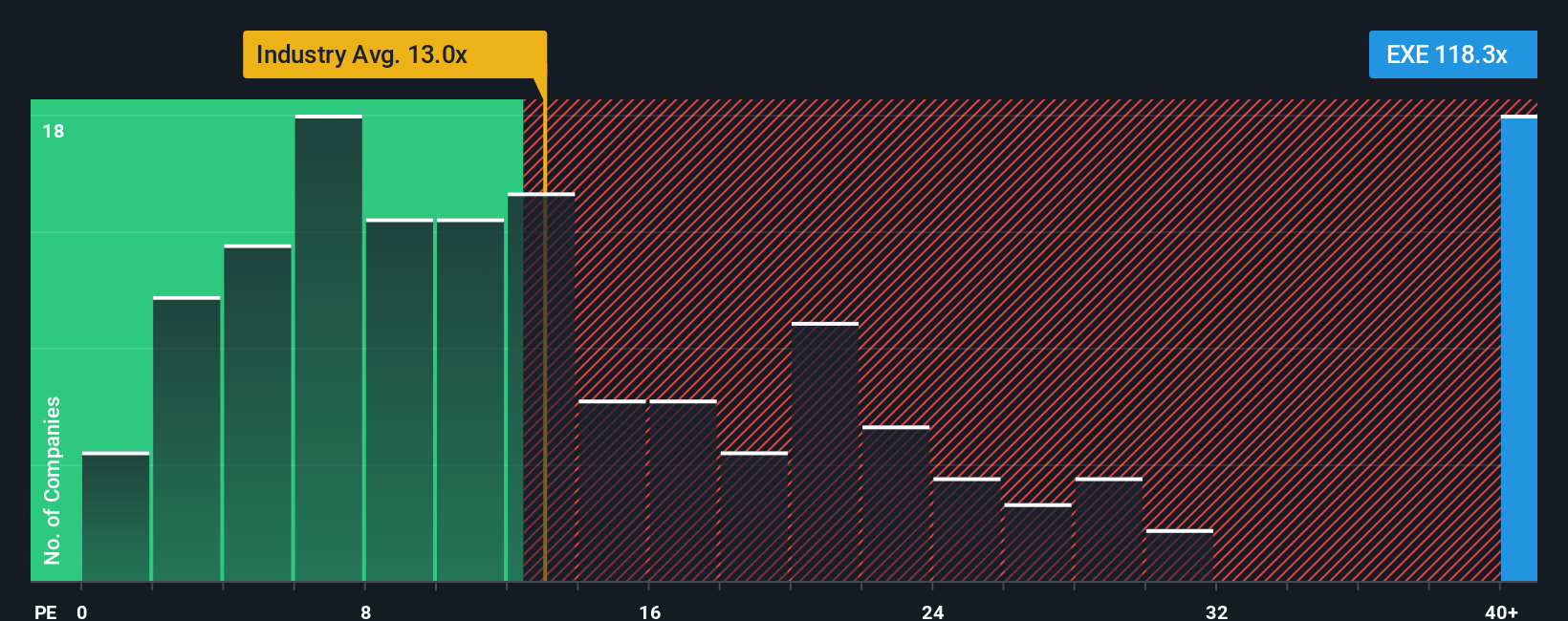

Another View: Market Ratios Signal Caution

While analysts see Expand Energy as undervalued based on projected earnings and growth, current price-to-earnings ratios tell a different story. The P/E stands at 33.4x, which is well above the US Oil and Gas industry average of 13.6x and even higher than the fair ratio of 24.2x. This suggests investors are already paying a premium for future potential. Does this high valuation leave limited room for upside if growth expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Expand Energy Narrative

If you have a different perspective or want to dive into the numbers on your own terms, it only takes a few minutes to generate your personal narrative. Do it your way

A great starting point for your Expand Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock even more opportunities with handpicked stock lists designed to match your ambitions and keep you ahead of the curve. Don’t let today’s market leaders and hidden gems pass you by. Seize the moment now.

- Kickstart your search with these 928 undervalued stocks based on cash flows offering untapped value and stronger upside potential based on robust cash flow analysis.

- Tap into future-defining breakthroughs by checking out these 27 quantum computing stocks, where innovation meets real investment potential in quantum technologies.

- Maximize your income strategy with these 14 dividend stocks with yields > 3% that delivers attractive yields above 3 percent for sustainable long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expand Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EXE

Expand Energy

Operates as an independent natural gas production company in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026