- United States

- /

- Oil and Gas

- /

- NasdaqGS:CLMT

A Look at Calumet (CLMT) Valuation Following its Sharp Profitability Turnaround

Reviewed by Simply Wall St

Calumet (CLMT) just released earnings showing a sharp turnaround in profitability for the third quarter and first nine months of 2025. While sales were largely flat, the company posted positive net income after last year's losses.

See our latest analysis for Calumet.

Calumet’s recent pivot to profitability and rising production have drawn new investor interest, reflected in its share price rallying 41% over the past 90 days. While momentum is building in the short term, the one-year total shareholder return remains down 11%, indicating there is still ground to recover for long-term holders.

If growing momentum like this has you searching for dynamic opportunities, now is the perfect moment to broaden your search and uncover fast growing stocks with high insider ownership

With shares still trading at a discount to analyst targets despite recent gains, the key question for investors is whether Calumet’s turnaround leaves room for more upside or if the market has already factored in future growth.

Most Popular Narrative: 7.8% Undervalued

Calumet’s fair value estimate from the most widely followed narrative comes in higher than the last close, suggesting there may still be room for upside. The fair value is set at $20.25, while shares finished the latest session at $18.67. This sets the stage for significant drivers under the surface that could impact future returns.

The MaxSAF 150 project is on track to start up in the first half of 2026, enabling Calumet to produce 120-150 million annual gallons of sustainable aviation fuel (SAF) at relatively low capital costs. The project is expected to capture premiums of $1-$2/gallon over renewable diesel and tap into surging mandated and voluntary SAF demand globally. This is likely to drive a material step-up in revenues and EBITDA margin expansion once operational.

Curious how Calumet’s big value call is built? The future fair value rides on ambitious profit leaps and a profit multiple that will raise eyebrows. Want to know what bold forecasts make the math work? The blueprint is hiding beyond the headline numbers. Discover what’s fueling the narrative’s ambitious target.

Result: Fair Value of $20.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, future gains could stall if regulatory tailwinds fade or if Calumet’s heavy debt limits its ability to invest and weather downturns.

Find out about the key risks to this Calumet narrative.

Another View: What Do the Numbers Say?

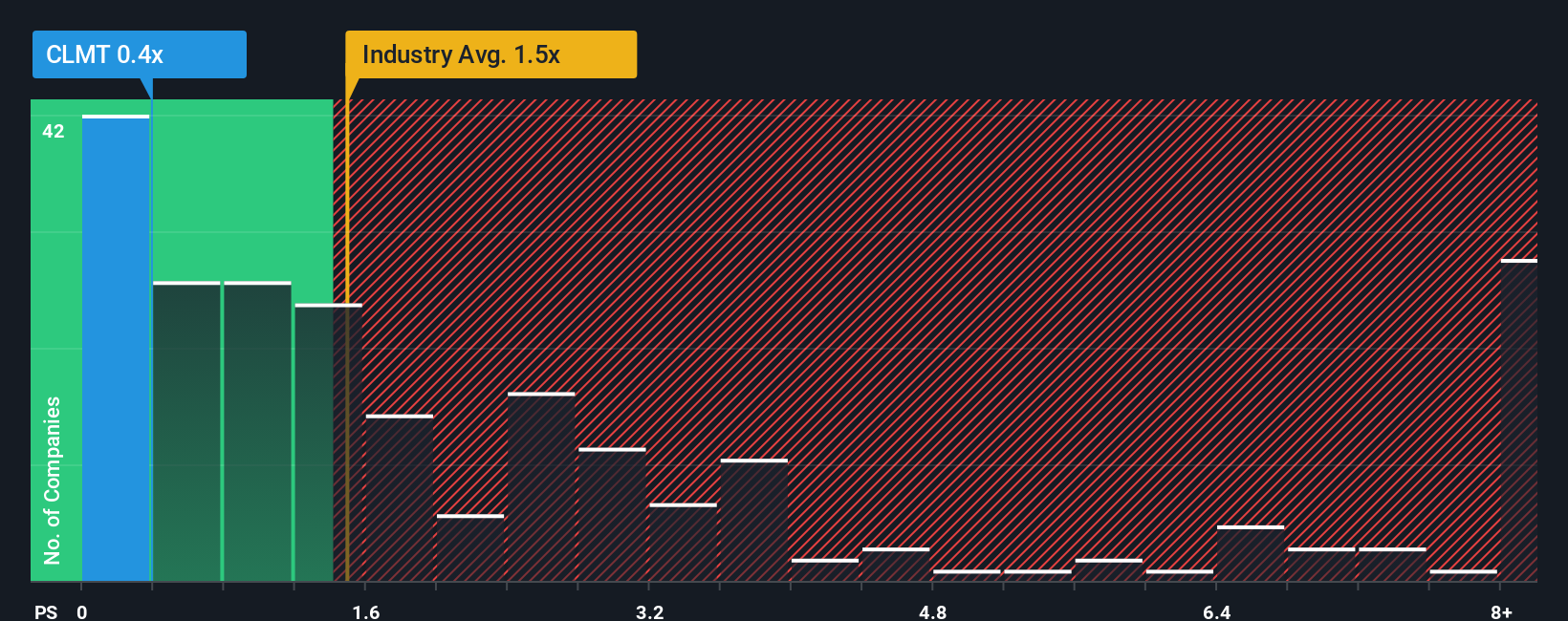

While the fair value narrative points to Calumet being undervalued, the price-to-sales ratio offers a more nuanced perspective. Calumet trades at 0.4x sales, which is twice its peer average of 0.2x, but still well below the U.S. Oil and Gas industry norm of 1.6x. Notably, the fair ratio for Calumet is 0.6x, suggesting the current price is below where the market could move. Does this gap highlight a hidden opportunity, or signal that investors are ignoring real risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Calumet Narrative

If you see the story unfolding differently or want to dig into the numbers firsthand, you can shape your own outlook in just a few minutes. Do it your way

A great starting point for your Calumet research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Smart Opportunities?

Expand your investment toolkit beyond Calumet and get ahead of the curve by checking out strategies other savvy investors are using for tomorrow’s winners.

- Unlock high growth potential by targeting these 3585 penny stocks with strong financials, which are packed with strong fundamentals and untapped value for rapid upward moves.

- Harvest reliable cash flow by seeking out these 16 dividend stocks with yields > 3%, which consistently deliver yields above 3% and help strengthen your portfolio’s income stream.

- Ride the technological revolution and transform your holdings by tapping into these 25 AI penny stocks, shaping the next era with innovations in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLMT

Calumet

Manufactures, formulates, and markets a diversified slate of specialty branded products and renewable fuels to various consumer-facing and industrial markets in North America and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives