- United States

- /

- Diversified Financial

- /

- OTCPK:SWRD

Stewards (SWRD) Valuation Check After New CMO Hire and Nasdaq Uplisting Plans

Reviewed by Simply Wall St

Stewards (SWRD) just brought in Scott McGowan as Chief Marketing Officer, a move aimed at sharpening its story with investors as the company gears up for a potential uplisting to the Nasdaq Capital Market.

See our latest analysis for Stewards.

The appointment of a seasoned CMO comes after a powerful run in the stock, with Stewards logging a 90 day share price return of 203 percent and a stunning 1 year total shareholder return of 2,248.84 percent, suggesting bullish momentum is still very much in play.

If Stewards’ surge has your attention, now is a good moment to explore fast growing stocks with high insider ownership and see what other fast moving growth stories might deserve a spot on your watchlist.

Yet with Stewards still loss making and its shares up sharply in recent months, the bigger question now is whether investors are overlooking remaining risks or if the market is already pricing in the company’s next leg of growth.

Price-to-Book of 46.9x: Is it justified?

Stewards last closed at 6.06 dollars, and its current valuation looks stretched when viewed through the lens of its price to book ratio.

The price to book multiple compares a company’s market value to its net assets and is a common yardstick for financials and lenders whose balance sheets are central to their business models. At 46.9 times book value, Stewards is being valued at a huge premium to the accounting value of its equity despite still being unprofitable.

Such a rich multiple suggests investors are baking in very optimistic expectations for future growth, margin expansion, or strategic milestones, even as the company reports negative return on equity and relies entirely on higher risk funding. Relative to the broader US Diversified Financial industry, where the average price to book stands at about 1.4 times, the current market pricing for Stewards looks exceptionally elevated.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 46.9x (OVERVALUED)

However, Stewards remains loss making and dependent on high risk financing. Any slowdown in demand or regulatory tightening could quickly pressure its lofty valuation.

Find out about the key risks to this Stewards narrative.

Another View on Value

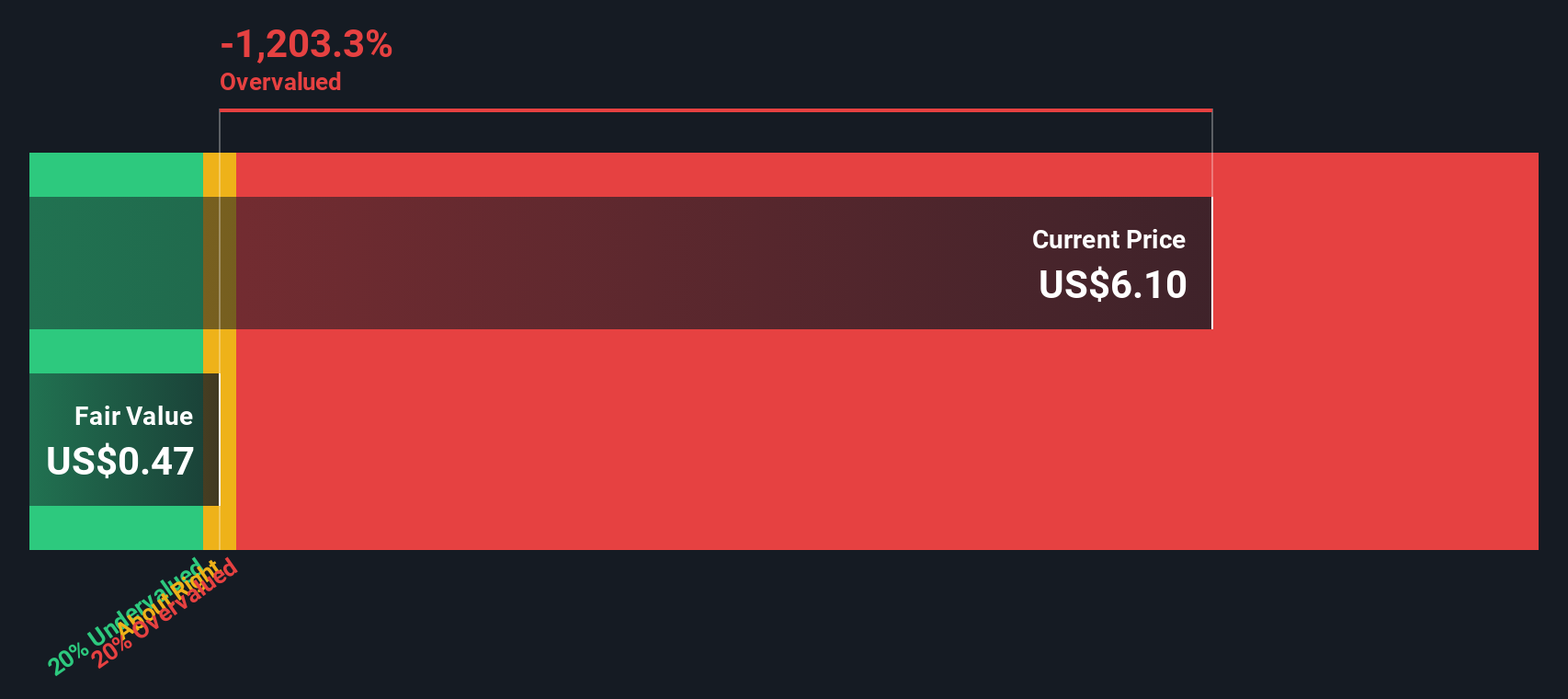

Our DCF model paints an even starker picture, suggesting Stewards’ fair value is closer to 0.47 dollars per share, well below the current 6.06 dollars. If both book value and cash flow point to overvaluation, how long can momentum alone keep the story going?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stewards for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stewards Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Stewards research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for your next smart move?

Do not stop with one story. Put Simply Wall Street’s powerful Screener to work and uncover focused ideas that could sharpen your portfolio’s edge today.

- Capture underappreciated value by targeting companies trading below their estimated worth through these 908 undervalued stocks based on cash flows before the market catches up.

- Harness the momentum of transformative automation and machine learning by zeroing in on potential breakout names across these 26 AI penny stocks.

- Strengthen your income stream by hunting for reliable payers among these 15 dividend stocks with yields > 3% that can support long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:SWRD

Stewards

Offers alternative financing solutions to small and mid-sized businesses in the United States.

Adequate balance sheet with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026