- United States

- /

- Diversified Financial

- /

- NYSE:XYZ

Is Block (XYZ) Signaling a New Phase of Growth with Its Buyback and Rising Profits?

Reviewed by Sasha Jovanovic

- Block, Inc. reported its third quarter 2025 results on November 6, posting revenue of US$6.11 billion and net income of US$461.54 million, both increasing from the previous year, along with an active buyback that saw 5.34 million shares repurchased for US$403.03 million during the quarter.

- This combination of higher earnings and a substantial share buyback highlights management's confidence and a focus on delivering increased value to shareholders.

- We'll explore how Block's strong quarterly net income and share repurchases could impact its future growth expectations and market position.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Block Investment Narrative Recap

To be a Block shareholder right now, you need to believe in the continued momentum of Cash App’s ecosystem, expanding product adoption, and the platform’s ability to drive lasting engagement despite new competition. The latest quarterly results highlight growing earnings and a substantial share buyback, but they don’t materially change the most important near-term catalyst: growing user adoption of Cash App’s financial services. However, ongoing dependence on cryptocurrency-related revenue introduces continued earnings volatility as a top risk for the business.

Among recent announcements, Block’s completion of a significant share buyback program stands out alongside strong quarterly profits. This move directly supports shareholder value and underscores management’s focus on capital return, especially while the company invests in innovations like expanded AI-powered features and embedded banking, key for future growth but not without execution risk around adoption and margin expansion.

Yet, despite this strong quarter, looming regulatory changes affecting Bitcoin and crypto-related activity remain a risk investors should watch closely, especially if...

Read the full narrative on Block (it's free!)

Block's outlook anticipates $32.8 billion in revenue and $2.4 billion in earnings by 2028. This is based on an assumed annual revenue growth rate of 11.3%, but a decrease in earnings of $0.6 billion from the current $3.0 billion.

Uncover how Block's forecasts yield a $88.51 fair value, a 35% upside to its current price.

Exploring Other Perspectives

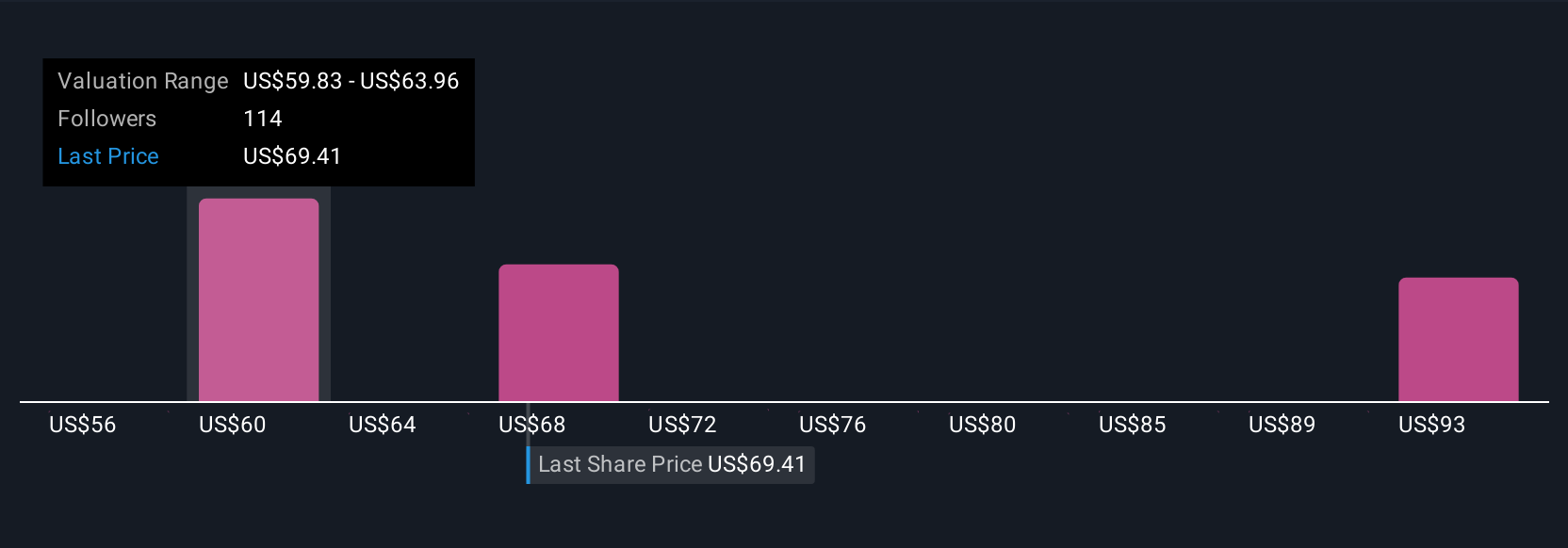

Seventeen fair value estimates from the Simply Wall St Community range from US$60.37 to US$104. While these views vary, potential regulatory and crypto adoption risks could weigh heavily on future outcomes, so consider different viewpoints before deciding.

Explore 17 other fair value estimates on Block - why the stock might be worth 8% less than the current price!

Build Your Own Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Block research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Block's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Block might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYZ

Block

Block, Inc., together with its subsidiaries, builds ecosystems focused on commerce and financial products and services in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives