- United States

- /

- Diversified Financial

- /

- NYSE:WEX

WEX (WEX): Evaluating Valuation After Expanding Tesla Supercharger Access for EV Drivers

Reviewed by Simply Wall St

WEX has just rolled out integration with more than 20,000 Tesla Supercharger points, giving its customers a broader and faster charging network across 1,500 locations. For drivers, this means easier access to high-speed charging and streamlined payment options through the WEX platform.

See our latest analysis for WEX.

WEX’s latest Tesla Supercharger integration follows on the heels of upbeat Q3 earnings and recent executive commentary about the company's evolving embedded payments strategy. Despite these growth signals, the 1-year total shareholder return has dropped by 21%, and the shares are trading at $148.36, which is well below earlier highs. The sharp year-to-date decline suggests momentum has faded for now, but strategic moves like the Supercharger deal could help reset the narrative if customer adoption picks up.

If these kinds of shifts in tech-driven platforms interest you, now’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

After a tough year for WEX shares, the company now trades at a discount relative to analyst targets and historical highs. Is this a window for value investors, or is the market already factoring in further growth?

Most Popular Narrative: 16.4% Undervalued

With WEX shares last closing at $148.36, the prevailing narrative sees fair value at $177.44, significantly higher than current levels. This narrative emphasizes long-term catalysts and major business changes that could reshape where shares are headed next.

The recent signing of a long-term agreement with BP, including both new card sales and the future conversion of BP's existing commercial fleet portfolio, will expand WEX's reach across core fueling segments and is expected to add 0.5% to 1% to company revenue in the first full year post-conversion, catalyzing revenue acceleration in 2026 and beyond, as digital and card-based payments adoption grows across fleet operations.

Want to know the earnings engine behind this surprise valuation gap? The story revolves around future revenue lifts and a profit margin shift that analysts are betting will reshape WEX’s trajectory. Find out exactly which assumptions drive this bullish view and see if the numbers stack up.

Result: Fair Value of $177.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts toward electric vehicles and rising competition from payment platforms could quickly challenge WEX’s growth potential if the company cannot adapt.

Find out about the key risks to this WEX narrative.

Another View: Are Shares Overpriced?

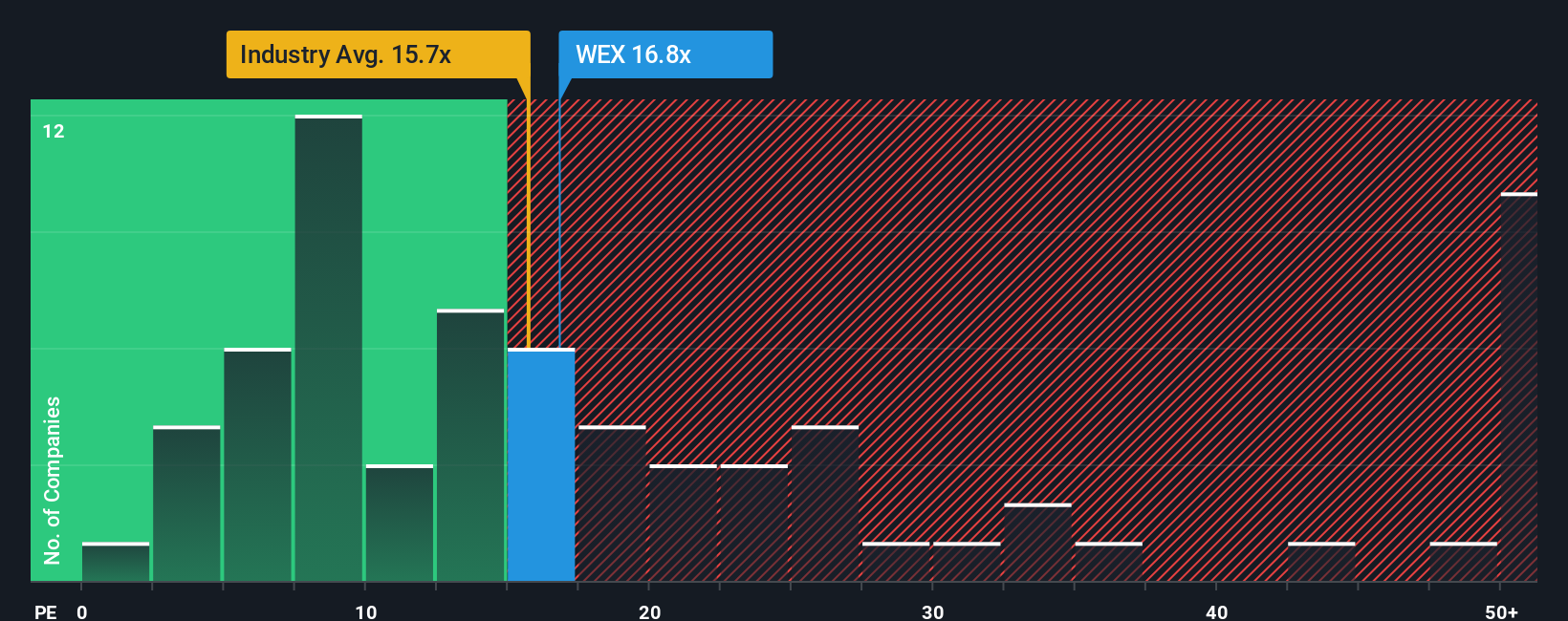

While our estimate sees WEX as deeply undervalued, a look at its price-to-earnings ratio suggests a different story. Right now, WEX trades at 17.9 times earnings, which is higher than both the industry average of 14 and the peer average of 17.2. The market’s fair ratio for WEX is 17.4. This premium could represent confidence or set up disappointment if growth stumbles. Is the stock more vulnerable than it appears?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WEX Narrative

If you want to dig deeper or see the story differently, you have all the tools to craft your perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding WEX.

Looking for more investment ideas?

Unlock your next winning move by using the Simply Wall Street Screener to spot fresh opportunities before the crowd jumps in. Don’t settle for the obvious when new frontiers are just a click away.

- Capture growth in artificial intelligence by spotting the most promising companies among these 25 AI penny stocks, which are advancing next-generation tech solutions and applications.

- Boost your portfolio’s income potential with these 15 dividend stocks with yields > 3%, a focus on stocks offering robust dividend yields and solid track records for steady returns.

- Get ahead in the rapidly evolving fintech world by exploring these 81 cryptocurrency and blockchain stocks, where cryptocurrency and blockchain leaders are reshaping global finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WEX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WEX

WEX

Operates a commerce platform in the United States and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026