- United States

- /

- Capital Markets

- /

- NYSE:VRTS

Assessing Virtus Investment Partners After a 30% Slide and Strong Excess Returns

Reviewed by Bailey Pemberton

- If you have been wondering whether Virtus Investment Partners at around $161.79 is a bargain or a value trap, you are in the right place to unpack the numbers together.

- The stock has slipped 26.2% year to date and 30.6% over the last year, even though it nudged up 1.4% in the past week while being roughly flat over the last month at -0.3%. This combination often signals shifting views on both risk and opportunity.

- Recent headlines around the asset management space have focused on shifting investor appetite between active and passive strategies, consolidation among mid sized managers, and the hunt for fee resilient product lines. All of these themes directly color how markets see Virtus. At the same time, broader market volatility and rotating sector leadership have put renewed attention on which managers can capture inflows as sentiment turns.

- On our checklist of six valuation tests, Virtus scores a 4 out of 6, pointing to pockets of undervaluation but also some red flags. In the sections that follow we will walk through the classic valuation approaches behind that score before finishing with a more holistic way to think about what the market might really be pricing in.

Approach 1: Virtus Investment Partners Excess Returns Analysis

The Excess Returns model asks whether Virtus can consistently earn more on shareholders equity than the return investors demand, and then capitalizes that gap into an intrinsic value per share.

For Virtus, the starting point is a Book Value of $136.03 per share and a Stable Book Value of $122.29 per share, both grounded in the median levels seen over the past 5 years. On that equity base, the company has delivered an Average Return on Equity of 14.29%, which translates into a Stable EPS of $17.48 per share, based on the historical median.

Investors are assumed to require a Cost of Equity of $11.99 per share. The model therefore estimates an Excess Return of $5.48 per share, the value created above that required return. Capitalizing these excess earnings yields an intrinsic value of about $206.04 per share, implying the stock is roughly 21.5% undervalued compared with the current price around $161.79.

This framework suggests Virtus is being priced as if its solid return profile will fade faster than history implies.

Result: UNDERVALUED

Our Excess Returns analysis suggests Virtus Investment Partners is undervalued by 21.5%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Virtus Investment Partners Price vs Earnings

For a consistently profitable business like Virtus, the price to earnings ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. It captures not only today’s profitability but also what the market expects those earnings to do over time.

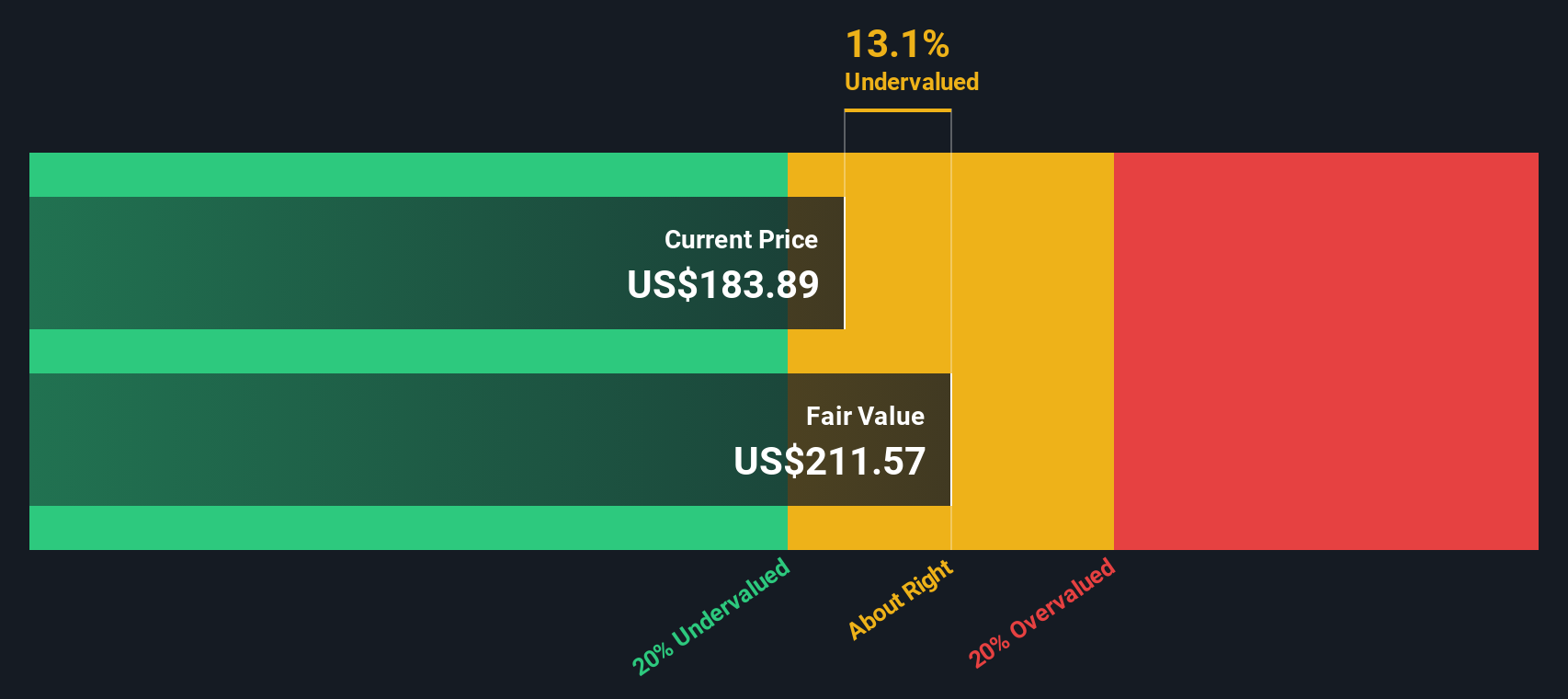

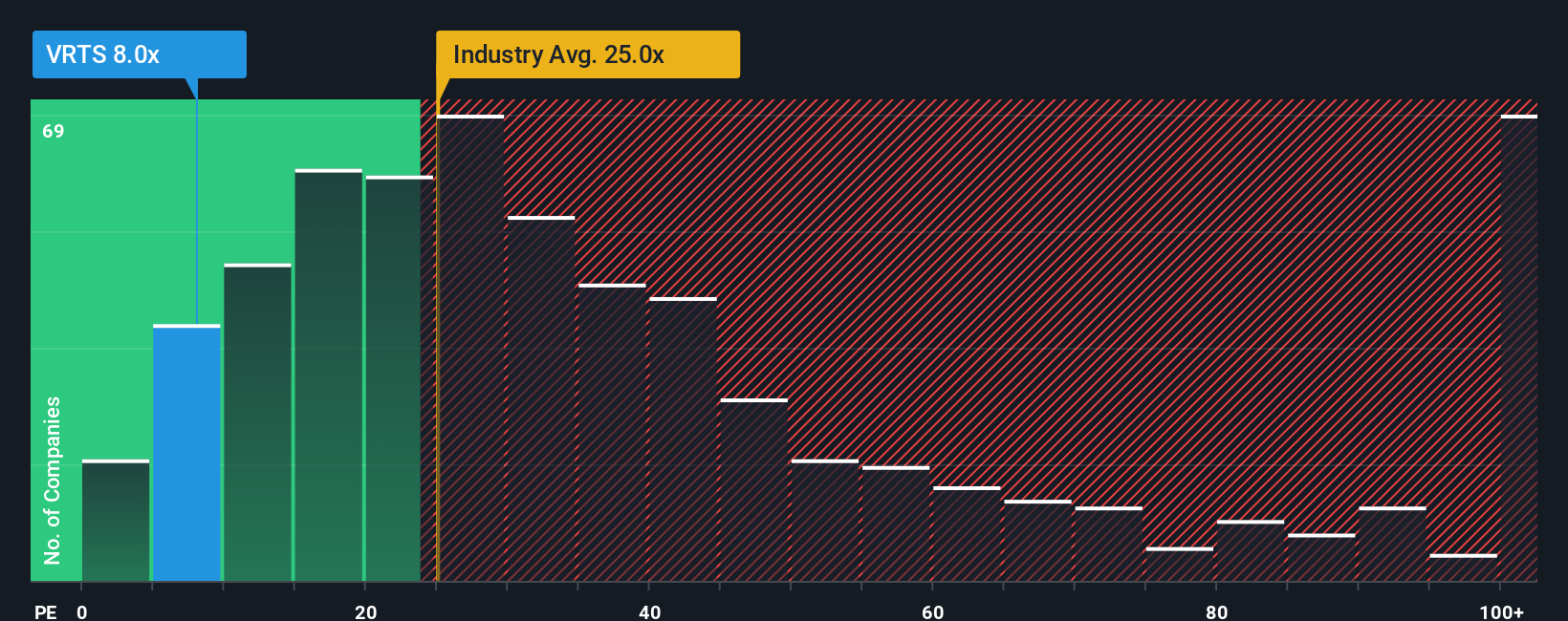

In practice, a higher PE ratio tends to reflect stronger expected growth and lower perceived risk. A lower PE can signal either modest growth prospects, higher risk, or simply an overlooked opportunity. Against that backdrop, Virtus currently trades at about 8.0x earnings, which is far below both the Capital Markets industry average of roughly 24.2x and the broader peer group average of about 22.0x. On simple comparisons, the stock looks inexpensive.

Simply Wall St’s Fair Ratio concept goes a step further by asking what PE multiple Virtus should trade on after adjusting for its specific earnings growth outlook, risk profile, profit margins, industry positioning, and market cap. Because this Fair Ratio incorporates more of the company’s fundamentals than a blunt peer or industry comparison, it offers a more tailored view of value. On that basis, Virtus’ current 8.0x PE sits meaningfully below its Fair Ratio, which suggests a market price that does not fully reflect its earnings power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Virtus Investment Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, translated into numbers such as your assumed fair value, future revenue growth, earnings, and margins. Instead of treating the financials as abstract data, Narratives connect what you believe about Virtus Investment Partners strategy, competitive position, and industry backdrop to a concrete forecast and a resulting fair value estimate. On Simply Wall St’s Community page, used by millions of investors, you can quickly build or explore Narratives as an easy, accessible tool for making buy or sell decisions by comparing each Narrative’s Fair Value with the current market Price. As new information like earnings releases or news emerges, the data behind these Narratives updates dynamically, helping your view stay current without constant manual recalculation. For example, one Virtus Investment Partners Narrative might assume modest revenue growth and assign a conservative fair value well below today’s price, while another Narrative might expect stronger inflows and margin resilience, supporting a materially higher fair value than the current share price.

Do you think there's more to the story for Virtus Investment Partners? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRTS

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026